General election 2024: stock market reaction

Labour is back in power for the first time in 14 years, but what have share prices done in response? Head of equity strategy Lee Wild rounds up the movers as the result sinks in.

5th July 2024 13:54

by Lee Wild from interactive investor

Well, the country has voted, and predictions of a landslide Labour majority proved correct.

While the result doesn’t change the immediate fiscal outlook, investors are clearly happy with the stability that such a majority brings, and with Labour’s perceived fiscal prudence and likely closer alignment with the EU, which could help unwind some of the Brexit discount. Overseas investors have already begun to show an interest in undervalued UK assets. This result might encourage more.

- Invest with ii: What is a Managed ISA? | Open a Managed ISA | Transfer an ISA

The FTSE 100 enjoyed a three-day winning streak coming into this election – adding 120 points, or 1.5% since Tuesday. Despite having already factored in a Labour victory, the index added a further 30 points in the aftermath of the election result Friday to sit just 200 points from a record high. It remains in positive territory - just - after a late-morning wobble extended into lunchtime.

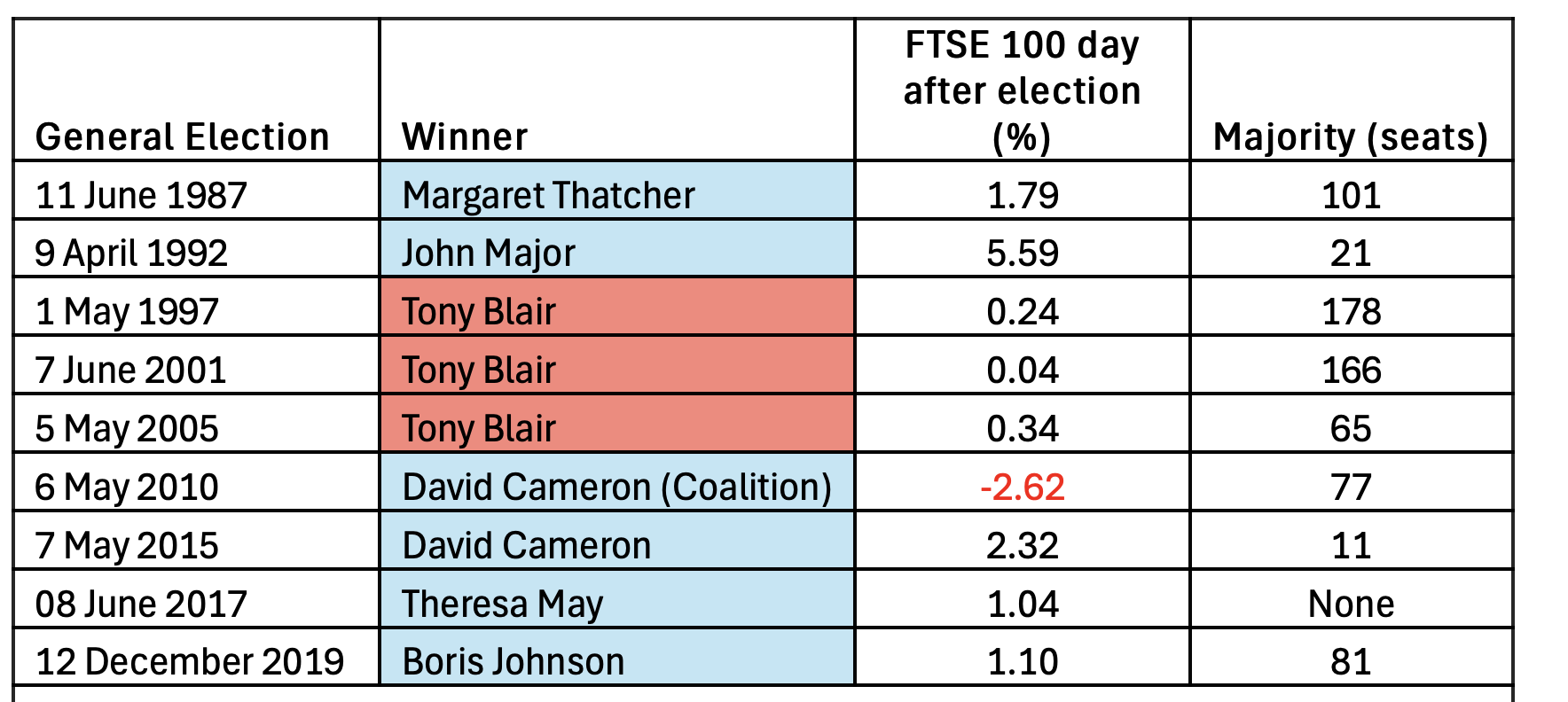

Interestingly, the FTSE 100 has responded positively to every general election result since 1987. Only exception is 2010 when David Cameron formed a coalition government.

Source: Morningstar, UK Election Statistics: 1918-2023, A Long Century of Elections.

It’s all about the housebuilders on Friday, racing higher as they price in the potential benefits of Starmer’s mortgage guarantee scheme to support buyers with small deposits. Labour has also set aggressive targets for housebuilding and will fast-track approval for urban brownfield development.

Persimmon (LSE:PSN), Barratt Developments (LSE:BDEV) and Taylor Wimpey (LSE:TW.) are among the biggest FTSE 100 risers, but a promised focus on affordable housing is also potentially great news for Vistry Group (LSE:VTY).

Source: TradingView. Past performance is not a guide to future performance.

Banks rose too. They’d already had a good couple of days, and optimism around Labour’s economic plans helped NatWest Group (LSE:NWG) and Barclays (LSE:BARC) improve again, although gains for the former are slim lunchtime, while the latter has slipped into the red.

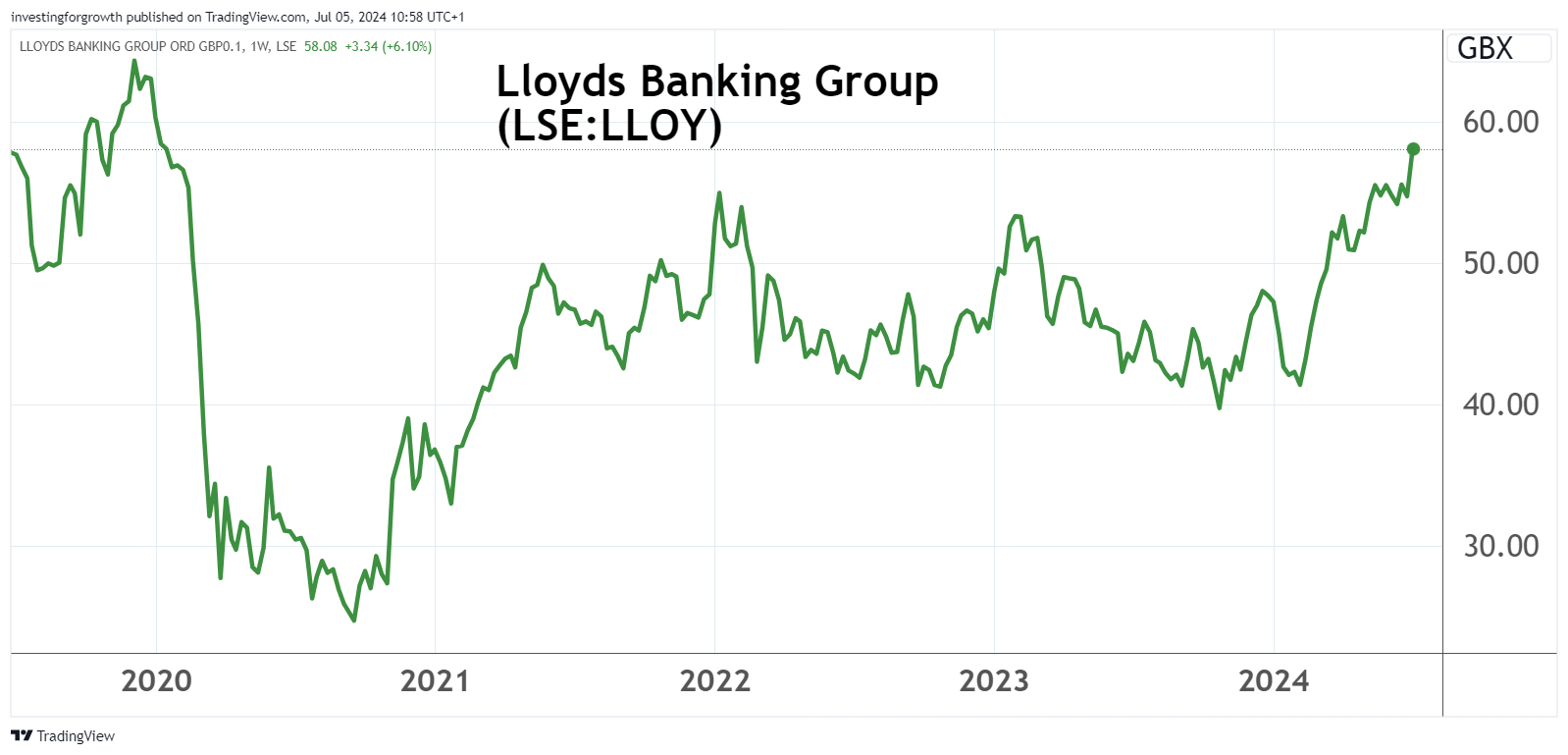

However, shares in Lloyds Banking Group (LSE:LLOY) – often seen as a bellwether for the UK economy – made a four-year high above 58p.

Source: TradingView. Past performance is not a guide to future performance.

Renewable energy stocks and investment trusts such as AFC Energy (LSE:AFC), Ceres Power Holdings (LSE:CWR) and Greencoat UK Wind (LSE:UKW) are on the move too. A clean energy system by 2030 is one of Labour’s missions. There’ll be no licences issued to explore new fields in the North Sea, a windfall tax crackdown and end to fracking.

- 18 FTSE 100 stocks about to return billions in dividend income

- Sign up to our free newsletter for share, fund and trust ideas, and the latest news and analysis

- Brace your income for the self-assessment tax raid

Elsewhere, the pound has had a good week, and sentiment versus the dollar remains positive post-election given the prospect of certainty and stable government.

Gilt yields are steady as markets had already factored in a Labour win and its coherent fiscal plan. But worth watching for the inflation impact of any increased spending on economic growth.

This election outcome appears to bring stability and less risk than might have been the case had Labour won a few years ago. Investors are happier with the party’s approach to the economy and anticipation of interest rate cuts this year. Some analysts also believe consensus earnings expectations are still too cautious. So watch out for upgrades during the upcoming results season.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.