GameStop needs a miracle – and steady Eddie L&G keeps plugging away

The Reddit investing saga reinforces an expensive lesson in rationality.

3rd February 2021 08:40

by Alistair Strang from Trends and Targets

The Reddit investing saga reinforces an expensive lesson in rationality.

GameStop (again!) and Legal & General

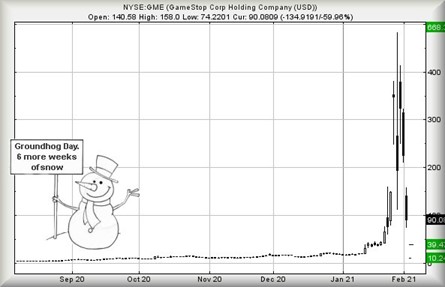

Our throwaway comment yesterday regarding the GameStop (LSE:GEN) frenzy certainly attracted emails, perhaps due to mentioning a share price reversal target below $10 (£7.31).

Once again, the share price received a thrashing, with the low of the day at $74, a rather horrible level for a share challenging $485 a few days ago. Price movements certainly reinforce the expensive lesson: avoid becoming caught up in the excess enthusiasm often displayed by relatively few people in public discussion groups on the internet.

- Chart of the week: FTSE and the GameStop saga – is there a link?

- What the GameStop saga means for markets

We're now able to calculate an ‘ultimate’ bottom of $10.24 against this, a probable return to the price level of November last year before it all went crazy. Near-term weakness below 74 should prove capable of travel down to an initial $39 with secondary, when broken, at $10.24.

We cannot calculate anything below such a level. It now needs a miracle to get out of trouble, visually unlikely.

Legal & General (LSE: LGEN) certainly can rarely be accused of an excess of flamboyance. Plodding and reliable, only the Covid-19 crash of last March provided a similar sized blip to that from the financial crash of 2009.

At present, the share requires exceed 280p to give hope for a slight change of pace, this trigger working out with a pretty tame ambition of 308p. Secondary is a longer term 366p. The important detail comes if Legal & General ever closes a session above 313p at any time in the future.

- Top 10 most-purchased ETFs in January 2021

- L&G Ethical Trust removed from ACE 40 ethical rated list

- Why reading charts can help you become a better investor

This is quite a big deal. While the immediate suggestion allows travel to 308p with secondary, if bettered, at 366p, closure above 313p is something we'd regard as pretty game changing.

This is one of these all-important ‘big picture’ things, launching the price into a zone where a distant 498p is supposed to be irresistibly attractive sometime in the distant future.

For now, the price is bumbling around, requiring to dip below 203p before we'd be alarmed.

Source: Trends and Targets. Past performance is not a guide to future performance

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of interactive investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or interactive investor will be responsible for any losses that may be incurred as a result of following a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.