The future of AIM: will company exodus continue?

The number of companies on the AIM market has more than halved since its peak, but recent activity shows there is value to be found there. Award-winning AIM expert Andrew Hore looks at why AIM has shrunk and how it can grow again.

26th April 2024 15:09

by Andrew Hore from interactive investor

On top of the dearth of new admissions there has been a steady stream of companies leaving AIM. Many of those are making a choice to leave because they do not believe it is worth remaining. There could be fewer than 700 companies on AIM by the end of the year, which is around 1,000 lower than the peak.

The cost of being quoted and a lack of liquidity has made some boards question the value of a quotation that takes up additional management time due to work on investor relations. If a share price has slumped it means that there will be significant dilution if money is raised.

- Invest with ii: Open a Stocks & Shares ISA | Top ISA Funds | ISA Offers & Cashback

Some investors prefer to put money into private companies without the spotlight being on the business. It may be that a quoted company is providing information to competitors as well as investors, with the private competitors not required to provide a similar level of transparency.

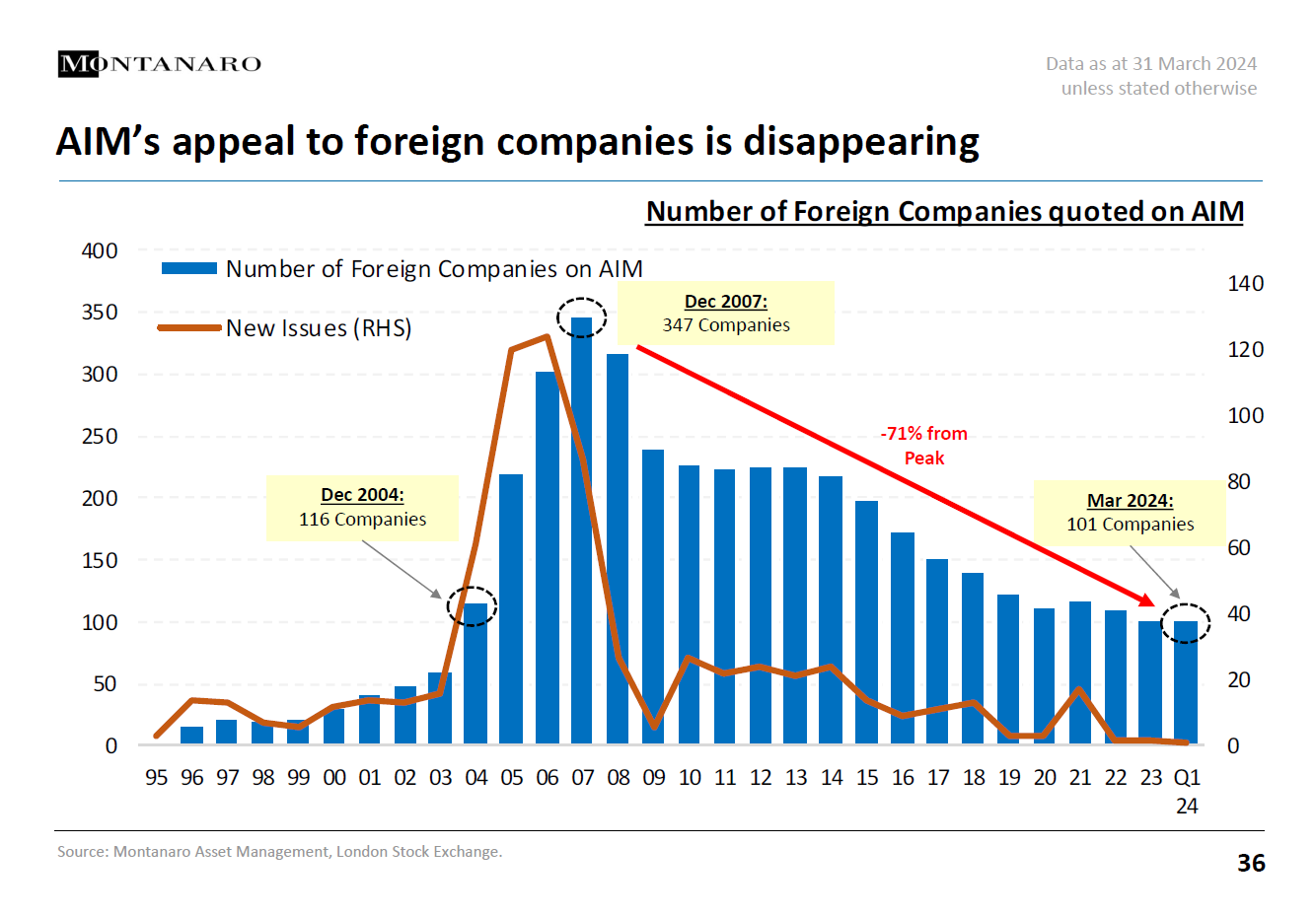

Foreign companies appear to be shunning AIM, according to a graph published by fund manager Montanaro.

This is not necessarily as bad as it might seem. The core problem for most of the foreign companies joining AIM has been a lack of investor interest. The London Stock Exchange did a good job of attracting overseas companies to AIM two decades ago, but it effectively oversold the market. It did not ensure that there was going to be enough interest for there to be liquidity in these shares.

Of course, it is really down to the brokers to generate the interest. However, they saw an opportunity to gain fees for floating the companies that the London Stock Exchange had gone around the world encouraging to come to AIM but did not do a good enough job to ensure that there was a satisfactory aftermarket.

There were also more companies in the past that had a listing on an overseas market and AIM was a secondary quotation. Some of those dropped the AIM quotation because most of the trading was done via the original listing.

There are still companies with other listings. They are mainly mining companies on the Australian exchange ASX and Toronto Stock Exchange.

- How to build an AIM ISA

- Five AIM growth shares for your ISA

- Insider: bosses at this small-cap pair spend over £300k

Some UK-based holding companies have their main interests overseas. For example, Craneware (LSE:CRW) provides billing software to US hospitals and does not have any sales in the UK. The decline in foreign companies on AIM is just a symptom of the overall decline in the overall number, though.

The number of companies on AIM peaked at 1,694 at the end of 2007 and it has been on a downward trend ever since, with the odd year when there was a small rise. There were 738 companies at the end of March 2024, a decline of 56%.

The average value of a company on AIM has gone in the opposite direction from £57.6 million in 2007 to nearly £104 million – even after the decline in share prices over the past three years. In 2007, 14% of AIM market capitalisation was accounted for by companies worth more than £500 million and this has risen to 43.3%. Although more than 50% of the companies are still worth less than £50 million.

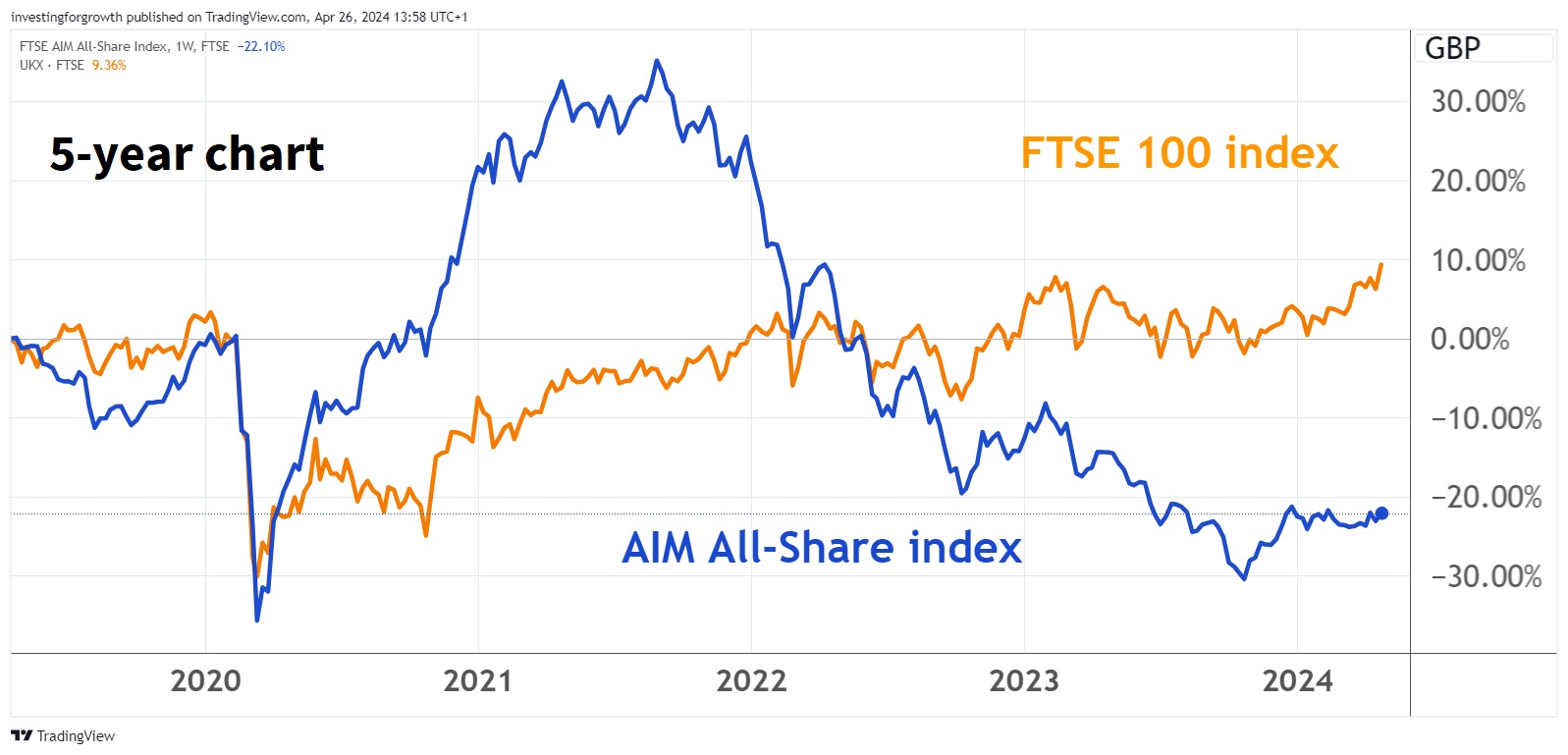

Source: TradingView. Past performance is not a guide to future performance.

What’s behind the recent cancellations?

The decline in numbers of companies on AIM has been going on for many years and, while the reasons tend to be the same, there can be a change in the importance of different reasons. Looking at last year’s cancellations, 30 out of 73 – that does not include reverse takeovers – were due to companies being taken over.

That shows that there is value to be found on AIM if bidders are willing to take a long-term view. In fact, many of the acquirers are foreign companies.

This has carried on into this year, with nine out of the 17 leavers being taken over. Recently announced bids include one for self-storage sites operator Lok'n Store Group (LSE:LOK) from larger European rival Shurgard. The companies taken over tend to be ones with good, profitable track records, so AIM is losing some of its better performers.

The second-largest grouping is those companies choosing to leave. There were 17 last year and, while there have been two in the first quarter of 2024, there are more coming along. It takes around one month to announce a decision, gain shareholder approval and set a leaving date.

In recent weeks, oil and gas company Molecular Energies (LSE:MEN), antimicrobial technology developer Byotrol (LSE:BYOT), drug discovery company C4X Discovery Holdings (LSE:C4XD), Redx Pharma (LSE:REDX), cloud telephony services provider LoopUp (LOOP) and e-Therapeutics (LSE:ETX) have gained or are seeking shareholder approval for their departures from AIM. They all say there is a lack of liquidity, and it is difficult for them to raise cash on AIM – although many previously raised large amounts.

Possibly more worrying is that Molecular Energies is no longer spinning off green technology investment company Green House Capital as a separate AIM company – something it had been planning for months.

Molecular Energies reckons it can save £500,000/year by leaving AIM. Advisers and non-exec directors would account for a big chunk of that. Other companies may not save as much, but it will be in six figures. This is a large amount of cash for a company that could be worth less than £25 million, especially if they are losing money. They will need to raise cash just to keep funding their AIM quotation as well as any other losses.

- Shares for the future: my third-favourite stock to own

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

The departures do not necessarily mean that AIM has failed these companies. LoopUp is an example of a much-hyped company that failed to deliver. In August 2016, the original placing price was 100p when £8.5 million was raised. Including that cash, LoopUp has raised more than £70 million since joining AIM. Prior to the announcement of the proposed cancellation LoopUp was valued at less than £5 million. LoopUp needed to raise a further £9 million and four investors were willing to subscribe £6.2 million if LoopUp went private.

Data-based developer of RNAi medicines e-therapeutics raised £28.9 million at 15p/share – a premium to the market price – from existing shareholders at the same time as announcing its departure from AIM. The management has been considering the cancelation for more than a year and it was disappointed that other investors lacked interest in the latest fundraising.

There are plans to seek a Nasdaq listing because of the greater interest in pharma and biotech companies from US investors. Leaving AIM now means that the future issue price on Nasdaq will not be governed by an AIM share price. AIM companies moving to Nasdaq do not always do well, though.

Financial difficulties are the third most common reason for leaving last year. There were 13 in total and eight of those were in the fourth quarter. Another four companies have gone the same way in the first quarter of 2024, and it could be more significant this year than it was last year. There are always going to be failures, particular in tougher economic conditions.

In 2023, there were also nine companies that left because they were being voluntarily wound up, two moved to the Main Market (Breedon Group (LSE:BREE) and Ceres Power Holdings (LSE:CWR)), one lost its nominated adviser and did not replace it and one was suspended for more than six months.

Does it matter there are fewer companies?

Let’s face it, there were too many companies on AIM back in 2007. There was no way that hundreds of them were going to gain the attention they required.

Even the current number is relatively large. However, there needs to be a steady flow of companies to any market and a large number of companies leaving with barely a replacement is not a good look.

Smaller companies need funding, and it can be difficult to get it from other sources. It is certainly difficult for many companies to raise cash on AIM at the moment, but there will eventually be an upturn – although it could take a while. Private equity has its drawbacks, because there can be greater attention and involvement from one large shareholder than there would be from a group of investors that have a large stake between them.

- Stockwatch: does this spectacular bull run have further to go?

- ISA insights: guides, investment ideas and tax tips

There was a sharp recovery for AIM after the 2019 election, and it may take until the next election before a recovery takes hold. There has been an upward trend since late last year, but it has been inconsistent.

There could be an influx of existing standard list shells to AIM because they have secured reverse takeovers that are not large enough to make them eligible for re-admission to the listing. An example is Electric Guitar (LSE:ELEG), which is moving in May after acquiring 3radical, which has developed a platform to attract individuals to provide data that can be used for marketing by its clients.

Electric Guitar will be valued at £4.7 million at 2.1p/share after the acquisition. That is low, but the idea is to make more acquisitions and that would make the quotation worthwhile. Using the quotation to grow through acquisition is one of the potential reasons that new companies will still consider AIM.

If companies believe that they can obtain an acceptable valuation for themselves and they feel they have a use for a quotation, then they will come to AIM. For there to be a greater flow of companies it will require more confidence in a market recovery. The days of more than 100 new companies in a year are long gone, though.

Andrew Hore is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

AIM stocks tend to be volatile high-risk/high-reward investments and are intended for people with an appropriate degree of equity trading knowledge and experience.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.