Fundsmith's Terry Smith reveals his seven guiding investment principles

4th January 2019 15:23

Writing exclusively for our sister website Money Observer, the star fund manager explains how investors should approach current market volatility.

Tumult, turbulence and turmoil are just the words beginning with the letter T used by commentators to describe the behaviour of stockmarkets in October. I think it's always good to look at the definition of the words we are being asked to accept.

For example: turmoil, noun: a state of great disturbance, confusion, or uncertainty. synonyms: confusion, upheaval(s), turbulence, tumult, disorder.

That all sounds very dramatic, so what actually happened? In October the MSCI World Index (£net) fell by 5.3%, bringing its return for 2018 to the end of October to +3.4%. In my opinion that falls well short of turmoil.

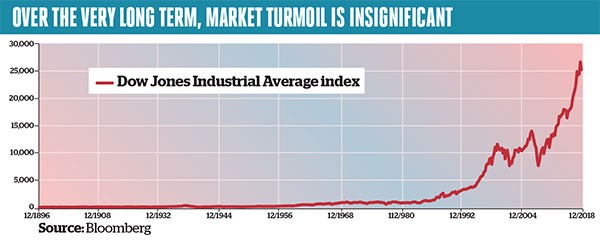

An example of what might more reasonably be described as market turmoil was so-called Black Monday on 19 October 1987, when the Dow Jones index fell 22.6% in a single day. That felt dramatic. I should know, as I was in work that day on the trading floor of the investment bank BZW and when I went home I received a slew of sell orders from a large US client who rang me. I had to be careful writing them down, as I only had candlelight, because the power still had not been restored from the hurricane which had struck on the previous Friday – adding to the dramatic effect.

Full of tumult, turmoil or turbulence Black Monday may have been, but did it really matter? Look at the chart of the Dow Jones index below and see if you can spot Black Monday. You will need good eyesight to do so. In the long term, it was not significant.

However, this does not stop commentators predicting crashes and bear markets and suggesting investors take preventative action, which ranges from reducing their equity holdings or buying lowly rated so-called 'value' stocks, through to selling everything and holding cash to safeguard the value of their assets.

Past performance is not a guide to future performance

My guiding principles are as follows:

1 No one can predict market downturns with any useful level of reliability. Forecasts of what may happen in the market are about as reliable as Michael Fish's infamous denial, in the BBC weather forecast on 15 October 1987, that a hurricane was due to hit the UK.

2 However, when one of the repeated warnings proves to be accurate, the forecasters will ignore the fact that if you had followed their advice you would have foregone gains while you waited, given that no one can predict the timing of a bear market accurately. These could have far outweighed subsequent losses.

3 Bull markets do not die of old age, so ignore warnings that begin: "This bull market has gone on for a long time." They usually die from an event, often but not always rising interest rates.

4 Bull markets climb a wall of worry. The troubling events you can readily see unfolding are rarely the cause of a bear market. For example, Alan Greenspan had already described the market as irrationally exuberant in 1996, and the Asian crisis of 1997 and Russian default and LTCM collapse in 1998 looked scary – but they made the Fed hesitate to raise rates, and that in turn gave the bull market a new leg, which lasted until 2000. Maybe the possible trade war with China could have a similar effect.

5 Bull markets do not broaden with age: they narrow. The current bull market began in 2009, when shares rose indiscriminately. After 2014 emerging markets stopped rising. Then the US took the lead. Then the technology sector in the US. Then just the big-hitting FAANGs. The idea that in the late stages of a bull market investors can make gains or protect themselves by switching into the stocks that have lagged flies in the face of history.

6 As for buying so-called value stocks, this is best done after the bear market has struck, not before. If you approached any of the famous value investors and suggested they buy some of the assorted stocks in the FTSE 100 index on a price/earnings (PE) of 15 times as a value play, they would laugh at you. Real value plays, when they emerge in a bear market, involve buying stocks with a yield almost as high as the PE. For example, at the end of 2000 Imperial Tobacco was on a PE ratio of 8.1 times and had a yield of 6.25%.

7 A bear market will occur at some point, but the best stance is to ignore it, since you can't predict it or position yourself to avoid it.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.