The fund sectors fast out of the blocks in 2025

Saltydog Investor crunches the performance numbers and finds that only four equity-based sectors rose in both January and February. Here are the early winners so far in 2025.

4th March 2025 11:15

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Last month, most global stock markets that we monitor went down. The most notable exception was the Hong Kong Hang Seng, with a one-month return of 13.4%, although it did fall by -2.3% last week.

- Invest with ii: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

| Stock market indices | 2024 | 2025 | ||||

| Index | Q1 | Q2 | Q3 | Q4 | Jan | Feb |

| FTSE 100 | 2.8% | 2.7% | 0.9% | -0.8% | 6.1% | 1.6% |

| FTSE 250 | 1.0% | 2.0% | 3.8% | -2.0% | 1.6% | -3.0% |

| Dow Jones Ind Ave | 5.6% | -1.7% | 8.2% | 0.5% | 4.7% | -1.6% |

| S&P 500 | 10.2% | 3.9% | 5.5% | 2.1% | 2.7% | -1.4% |

| NASDAQ | 9.1% | 8.3% | 2.6% | 6.2% | 1.6% | -4.0% |

| DAX | 10.4% | -1.4% | 6.0% | 3.0% | 9.2% | 3.8% |

| CAC40 | 8.8% | -8.9% | 2.1% | -3.3% | 7.7% | 2.0% |

| Nikkei 225 | 20.6% | -1.9% | -4.2% | 5.2% | -0.8% | -6.1% |

| Hang Seng | -3.0% | 7.1% | 19.3% | -5.1% | 0.8% | 13.4% |

| Shanghai Composite | 2.2% | -2.4% | 12.4% | 0.5% | -3.0% | 2.2% |

| Sensex | 2.0% | 7.3% | 6.7% | -7.3% | -0.8% | -5.6% |

| Ibovespa | -4.5% | -3.3% | 6.4% | -8.7% | 4.9% | -2.6% |

Data source: Morningstar. Past performance is not a guide to future performance.

The European indices have also had a pretty good start to the year. After two months, the Paris CAC 40 has risen by 9.9%, while the German DAX has made a gain of 13.3%.

The best-performing index last week was the FTSE 100. It finished the week up 1.7%, and closed the month at an all-time high. It went up by 1.6% in February, adding to the 6.1% it posted in January.

Unfortunately, the US indices, along with the Brazilian Ibovespa and Indian Sensex, struggled. The Japanese Nikkei 225 had a particularly difficult month, losing 6.1%.

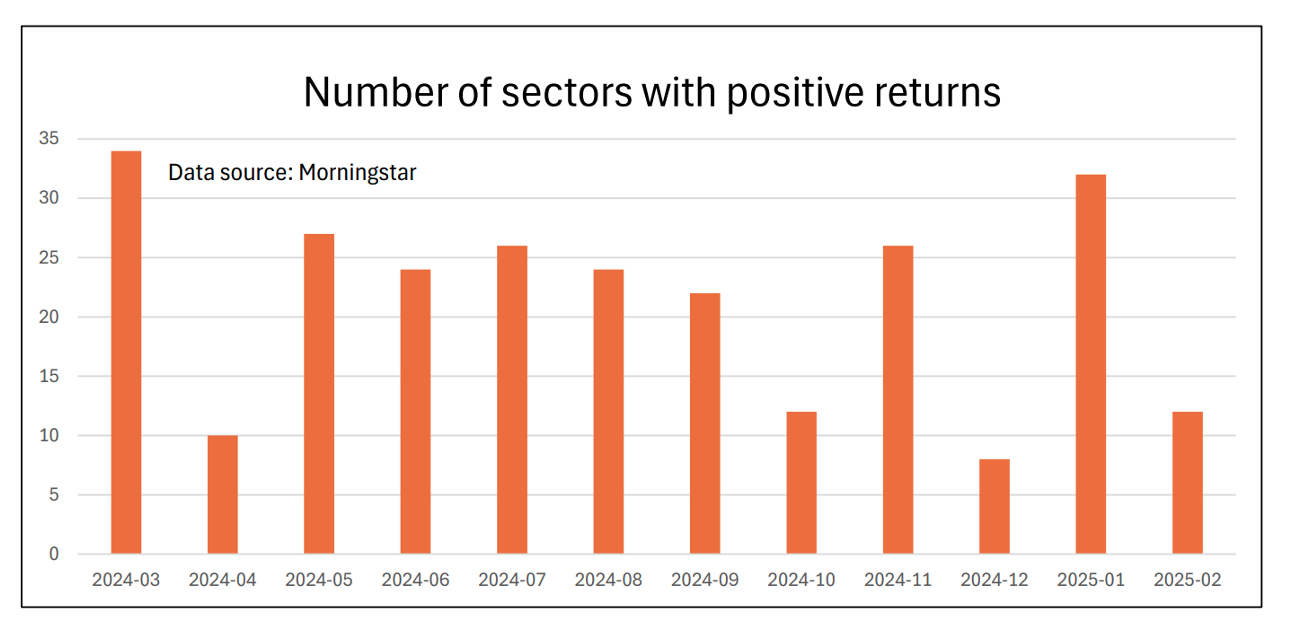

Out of the 34 Investment Association (IA) sectors that we track each week, only 12 went up in February. That was an improvement on the eight that went up in December, but a significant drop from the 32 that made gains in January.

Past performance is not a guide to future performance.

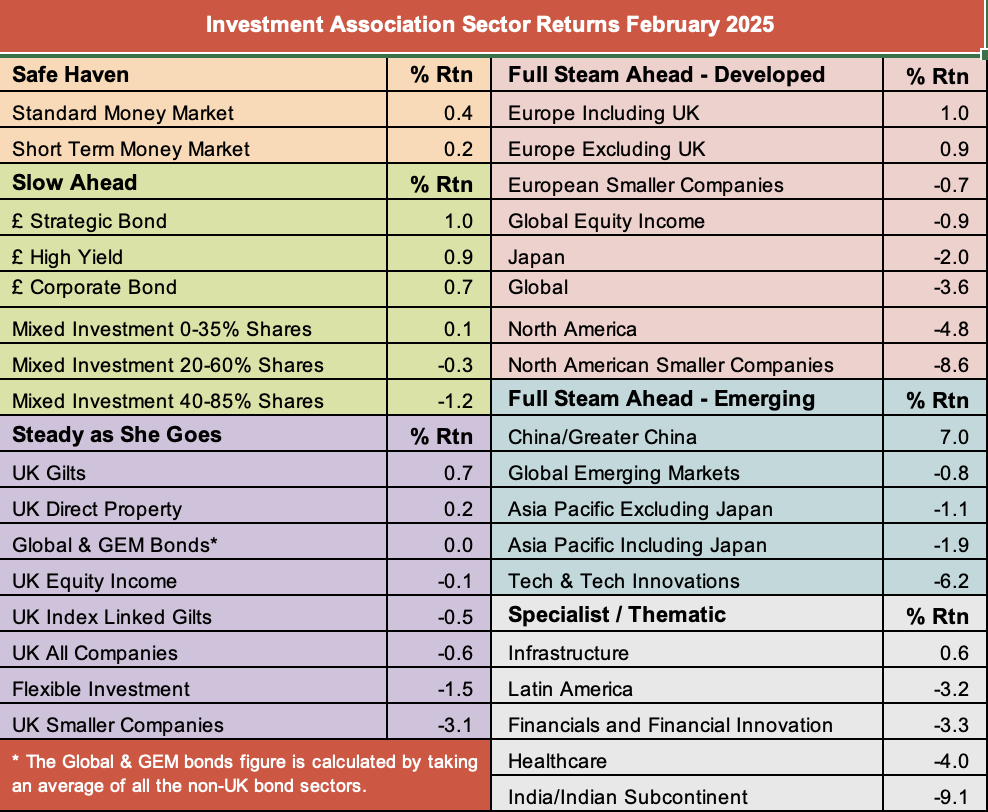

As we would have expected, the two Money Market sectors went up last month, as did most of the sectors investing in bonds. However, the sectors investing in equities did not fare as well.

Data source: Morningstar. Past performance is not a guide to future performance.

The China/Greater China sector rose by 7.0%, but the UK equity, American, Japanese, and Global sectors all went down.

However, the Europe including UK and Europe excluding UK sectors did post gains in February.

Only four equity-based sectors have risen in both January and February. Across the two months, the Europe Excluding UK sector leads the way, with a 8.6% return. Close behind are the Europe Including UK and China/Greater China sectors, which are both showing two-month gains of 8.3%. Finally, the fourth sector is Infrastructure, up 1.7%.

- Top 10 most-bought investment funds: February 2025

- Top 10 most-popular investment trusts: February 2025

Last week we highlighted some of the best-performing funds from the China/Greater China sector.

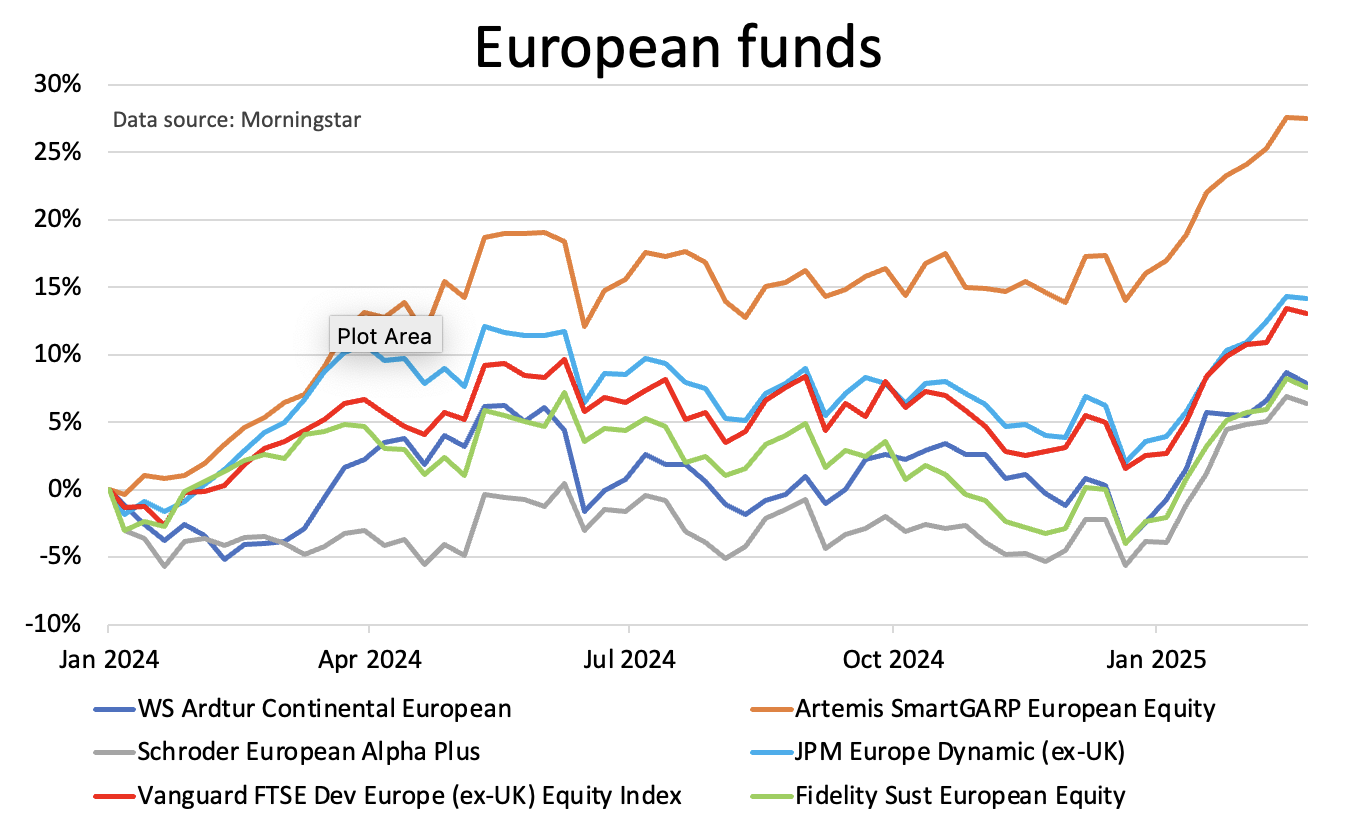

Here are some of the leading European funds, based on their performance so far this year.

Past performance is not a guide to future performance.

It is interesting to see that at the start of last year there was quite a difference in the performance of these funds. By the beginning of June, the Artemis SmartGARP European Eq I Acc GBP fund had gone up by 19.1%, while the Schroder European Alpha Plus Z Acc fund was showing a loss -of 1.2%. All the funds then trended down over the next six months.

However, they started heading back up just before Christmas, and so far this year have all risen by more than 10%.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.