The fund I sold after a 22% rally

Saltydog analyst halved his holding in this star fund while he assesses the current market decline.

15th June 2020 13:25

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Saltydog analyst Douglas Chadwick halved his holding in this star fund while he assesses the market decline.

The stock market rally falters

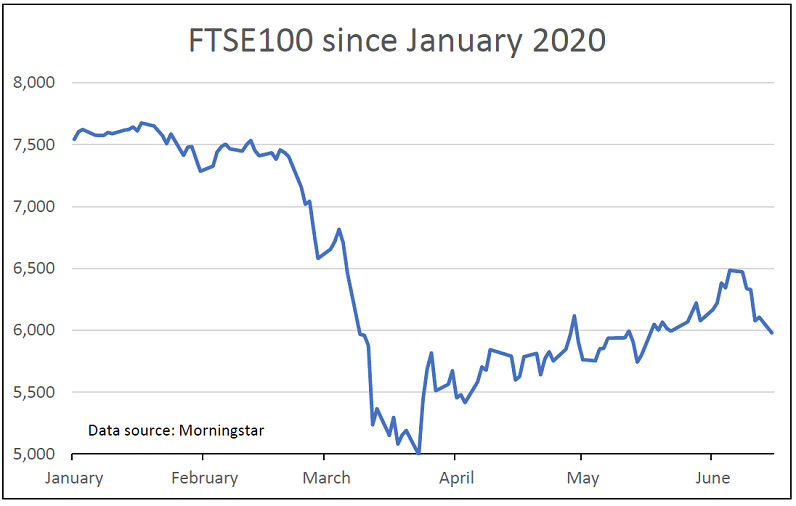

The fall in the value of global socks at the end of February and the beginning of March was spectacular, and by some measures the fastest ever.

On Friday 21 February, the FTSE 100 index ended the week at 7,404. Less than three weeks later, on Thursday 12 March, it closed at 5,237. It had gone down by more than 30% in 14 trading sessions.

On the 23 March it closed below 5,000 for the first time since 2011. It then set off on a remarkable recovery. At the end of April it closed just above 5,900, and during trading last Monday peaked above 6,500. It had gained 30% from the low in March, but hasn’t managed to get any higher.

By the end of last week it had fallen to 6,105 and this morning it opened below 6,000. Had it risen too far too soon?

In the US, the benchmark for its technology stocks, the Nasdaq, has not only recouped the losses that it suffered earlier in the year but gone on to set new all-time highs. Last Wednesday, it closed above 10,000 for the first time ever, but dropped back a bit at the end of the week.

In the Saltydog demonstration portfolios, we dramatically reduced our exposure to equity markets at the end of February/beginning of March and only started to reinvest in April.

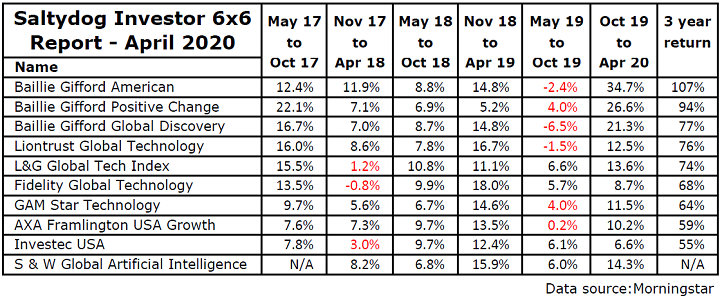

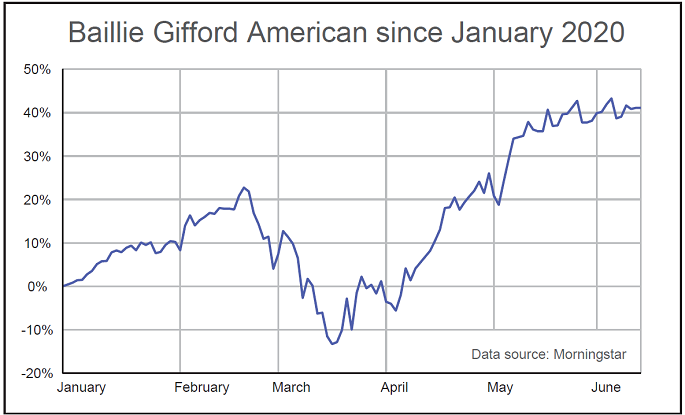

One of our star performers has been the Baillie Gifford American fund. We have been in and out of it many times over the years and it came out top in the recent 6x6 analysis that I wrote about a few weeks ago.

We went back into it in April and almost immediately added to our holding.

When we reviewed our portfolios last week it was showing an overall gain of more than 22%. However, it has levelled off in recent weeks.

We decided to halve our holding and wait and see if this is just a temporary consolidation, or has the recent recovery run out of steam?

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.