The fund up 20% over past four weeks that Saltydog has bought

Saltydog Investor added to this fund sector in November and has now introduced a new holding.

18th January 2021 14:42

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Saltydog Investor added to this fund sector in November and, after a strong start to 2021, has introduced a new holding.

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Last week, I highlighted a table showing the relative performance of all of the Investment Association sectors during December. The best-performing sector was UK Smaller Companies, which had gone up 7.5%. It has continued to perform well at the start of 2021.

We have held one fund from this sector in our portfolios since November and have just invested in another, the Premier Miton UK Smaller Companies fund.

Since the crash early last year, most of the world’s stock market indices have recovered strongly and many have gone on to set new all-time highs. So far, the UK has struggled to keep up. However, it now looks as though it is starting to make up some of the lost ground.

Each week, we look at how the different sectors are performing. We combine them into our Saltydog groups, based on their historic volatility. The least volatile sectors are in the ‘Safe Haven’ group, then its ‘Slow Ahead’, followed by ‘Steady As She Goes’, and then ‘Full Steam Ahead’ for the most volatile sectors.

- How Saltydog invests: a guide to its momentum approach

- Funds and trusts four professionals are buying and selling: Q1 2021

- Growth fund portfolios pull further ahead of benchmark

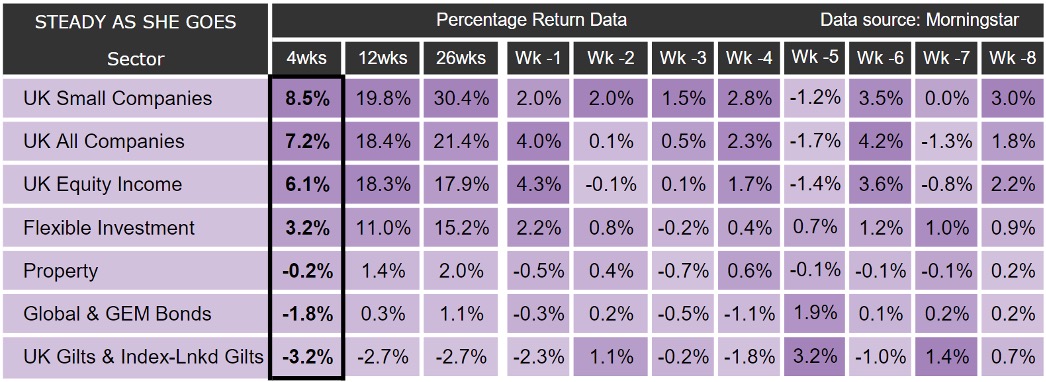

In our latest analysis, the best-performing sector, based on its four-week return, is still UK Smaller Companies. It is in our ‘Steady As She Goes’ group, and here is an extract from our weekly data showing how it compares with other sectors in the group.

Over the last four weeks it has gone up by 8.5%. In 12 weeks, it has gained nearly 20%, and it has risen by more than 30% in the last 26 weeks.

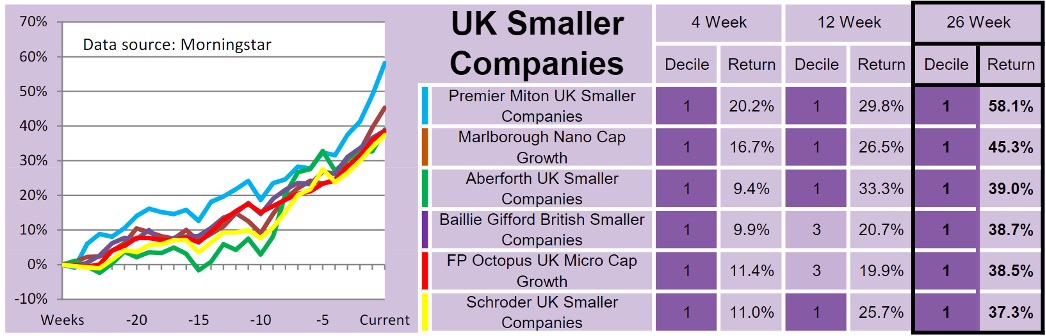

We also show the leading funds in each sector based on their performance over different time periods. We focus on four weeks and 26 weeks. It is particularly encouraging when funds feature in both our shortlists.

This table shows the top-performing funds in the UK Smaller Companies sector, based on their 26-week returns. The top two are also in first and second place in our four-week table.

As well as showing the percentage return, we also provide a decile ranking for each fund based on its performance over four, 12 and 26 weeks. To calculate the decile ranking, we compare all the funds in the group, not just the sector.

So out of all the funds in our ‘Steady as She Goes’ group, the funds at the top of this table have been in the top 10% over four weeks, 12 weeks and 26 weeks.

The sectors investing in UK equities started to appear at the top of our tables in November, and that is when our demonstration portfolios started to invest in them. We selected three funds, one from the UK Smaller Companies sector, one from the UK All Companies Sector, and one from the UK Equity Income sector.

The fund from the UK Smaller Companies sector, Franklin UK Smaller Companies, has done well, but not quite as well as the funds shown in the latest table.

In our Ocean Liner portfolio, we have now invested in the Premier Miton UK Smaller Companies fund.

This is a fund that we have held a couple of times over the years, and it has always made us money.

We first went into it in September 2015 and sold it a few months later. We then went back into it in December 2017 and kept it through until August 2018. During that period, it went up by 8.7%.

It would be nice to think that the UK market could continue to strengthen for some time to come. The FTSE 100 would still have to go up by 17% to get back to the record high that it reached in May 2018. Maybe funds such as the ones listed above could then reap the benefit.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.