FTSE for Friday: end-of week targets for the blue-chip index and bitcoin

19th November 2021 07:28

by Alistair Strang from Trends and Targets

Stocks took a tumble late yesterday afternoon, and independent analyst Alistair Strang is not happy. Here's why.

Watching the FTSE slither off a cliff yesterday afternoon was frustrating, a clear sign something perceived as bad was happening. The Dow Jones also reacted negatively, while the S&P and the Nasdaq somehow or other discovered some strength. It was one of these occasions which invented the need for multiple monitors, a 14 inch table screen utterly failing to provide sufficient information on real time chaos.

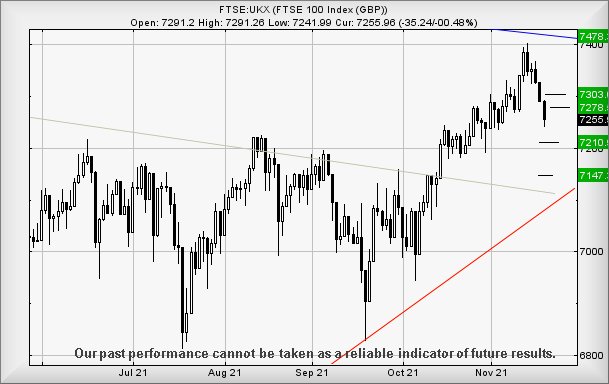

We’re not happy at the level the FTSE closed the day at. The immediate situation suggests weakness below 7,240 risks ongoing reversal to an initial 7,210 points. If broken, our secondary calculates at 7,147 points. If triggered, the tightest stop looks like 7,282 points.

- Subscribe to the ii YouTube channel for interviews with popular investors

- Why reading charts can help you become a better investor

As usual, we advocate caution if the movement triggers in the opening seconds of Friday as it is liable to prove “fake”. To judge by the chart, should our initial drop target of 7,210 make an appearance, the index should bounce a bit.

On the basis such a spike down movement occurs, it will prove interesting if any subsequent bounce manages above 7,263 points, as continued traffic in the direction of a fairly limp 7,278 points. If bettered, our secondary calculates at 7,303 points.

Source: Trends and Targets. Past performance is not a guide to future performance

Bitcoin

With some surprise volatility, bitcoin has managed to launch itself into fairly dangerous territory. The price remains absurd, of course, but there appears some reversal around the corner.

Weakness next below $56,600 calculates with a drop potential at an initial $52,953. If broken, our secondary works out at $47,291, a level at which we’re not convinced to expect a rebound.

Instead, if this secondary target level breaks, there’s a strong argument favouring an eventual bounce down at $38,909. Or so!

Source: Trends and Targets. Past performance is not a guide to future performance

An important caveat with bitcoin is worth remembering. Unless the cryptocurrency manages to actually close a session below our secondary target level, it remains trading in a region where we’re supposed to regard a long term $76,881 as a strong ambition, a level at which some volatility can be anticipated.

Given past behaviour, along with surprising underlying strength, we shall not be surprised if it goes down a bit, only to recover and once again paint a new high.

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.