FTSE for Friday and Ferrari shares analysed

18th March 2022 07:38

by Alistair Strang from Trends and Targets

As the 2022 Formula One season kicks off at the weekend, independent analyst Alistair Strang takes a look at the stock chart for Ferrari and also the outlook for a resurgent FTSE 100 index.

At time of writing, there are just 62 hours until the start of the 2022 Formula 1 season.

Many folk will be fascinated in this years events, but we're curious about Ferrari (NYSE:RACE), suspecting they may not be outsiders this time.

It feels like the market is now paying some attention to Ferrari's share price, needing only above just $210 to suggest imminent recovery to an initial $220 with our secondary, if exceeded, looking like a very logical $244.

In a normal world, the secondary should prove critical, as closure above this level should enter a region where a longer term cycle to $298 calculates as possible. This will represent a new all-time high for the company, ideally representative of a strong performance in motorsport. Or perhaps strong sales, due to a surge in buyers taking advantage of their cheap Covid support loans.

Hopefully, Sunday in Bahrain provides an insight into what awaits this season.

Source: Trends and Targets. Past performance is not a guide to future performance

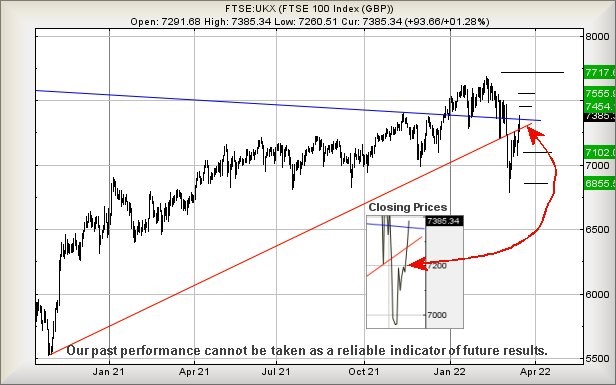

FTSE for Friday

Generally we regard it as quite a big deal when a share price enthusiastically regains a prior trend. This week, the FTSE 100 achieved something quite surprising, regaining an uptrend and also once again breaking through a historical downtrend.

We're inclined to suspect the markets are no longer taking the European conflict quite as seriously. Closing Thursday at 7,385 points, we're inclined to assign a near-term trigger for the FTSE at 7,399 points.

Source: Trends and Targets. Past performance is not a guide to future performance

Movement above this level currently calculates with the potential of 7,454 next. Our secondary, if such a level is exceeded, works out at 7,555 points. In the event the market somehow makes it above this level, something extraordinary happens, as apparently a leap toward 7,717 points becomes viable, signalling the potential of a brand new high for the UK market.

Our alternate scenario requires the FTSE to wobble below 7,260 points as this opens the doors for reversal to 7,102 points with secondary, if broken, at 6,855 points.

Have a good weekend, one where the good weather forecast risks being spoiled by the need to stay indoors watching a car race!

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.