Four trusts to tap into winning themes

A Kepler analyst considers thematic fund flows and how investors might find opportunities in areas where the outlook is arguably only getting stronger over time.

15th March 2024 14:01

This content is provided by Kepler Trust Intelligence, an investment trust focused website for private and professional investors. Kepler Trust Intelligence is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Material produced by Kepler Trust Intelligence should be considered a marketing communication, and is not independent research.

Thematic investing has become remarkably popular in recent years, as the data we show below indicates. Huge sums of money went into thematic funds in 2020 and 2021, in the technology and green sectors in particular, but also into other themes.

In this note, we analyse “thematic investing”, breaking down what it actually means in practice, and exploring the options in the investment trust space.

- Invest with ii: Invest in Investment Trusts | Top UK Shares| Interactive investor Offers

Next week, in our virtual “Themes for your ISA in 2024” event, we will be hearing from experienced portfolio managers covering four themes that we think could deliver strong returns over the coming years and decades.

Where did it all begin?

Simply put, thematic investing is a strategy that invests in companies that are benefiting from and driving long-term global mega-trends, which are often narratives of the “next big thing” over the coming five, 10, or even 20 years. This type of investing focuses on both anticipated and emerging long-term themes, rather than individual companies or sectors, attempting to benefit from the success and progression of social, technological, and economic themes potentially changing the course of entire industries.

One of the earliest examples of thematic investing can be traced back to just after the Second World War. A Chicago-based company, Television Shares Management Corporation, launched a television fund in 1948 to profit from the burgeoning TV industry. Given roughly one million TV sets were due to roll out, coupled with the fact colour TVs were also set to debut, the fund was launched to capitalise on the expected growth and proliferation to come.

While not a thematic strategy as we know it today, it laid the groundwork, and the following decades, particularly the 1960s, saw its fair share of fund launches. More funds were launched to capture growth from an array of themes/mega-trends, spanning from a Missiles-Rockets-Jets & Automation fund to an Oceanographic fund, which invested in companies aiming to farm and build communities underwater. However, some will claim that the true earliest example of a thematic fund was launched in 1998 and focused on investing in technology companies. This was arguably more akin to the diversified thematic funds we see today.

Whichever side of the debate you fall on, it’s important to look over the past to see the changes and nuances over the years that shaped things into what we know today. It also gives us a chance to decipher the potential benefits and risks, and in the case of thematic investing, there are plenty of both.

Thematic funds offer strong return potential and diversification within a broader theme like technology. For example, a tech-focused fund isn’t constrained to one form of technology, instead, it can capture the many secular themes in the sector by investing in a range of companies driving innovation. Over the last decade, these types of funds have seen strong returns driven by the breadth of impact technology has had across the board ranging from healthcare to retail.

When it comes to the risks, however, there can be much greater volatility and sharp underperformance, particularly if a strategy is driven by shorter-term market movements or if its investment remit becomes too narrow, pinning its success on one theme which lacks backing or appetite from investors – like perhaps the Oceanographic fund...

Given the nature of thematic investing, there are numerous occasions where funds have been launched in a “bubble period”, in the hopes of jumping on the bandwagon of something that’s doing well and enjoying the associated returns. But this strategy can quickly tail off and if so, you’re either stuck with businesses that were at inflated valuations and have now undergone material multiple compression after the “short-term” theme ran its course or left to patiently wait for the strategy to wind up.

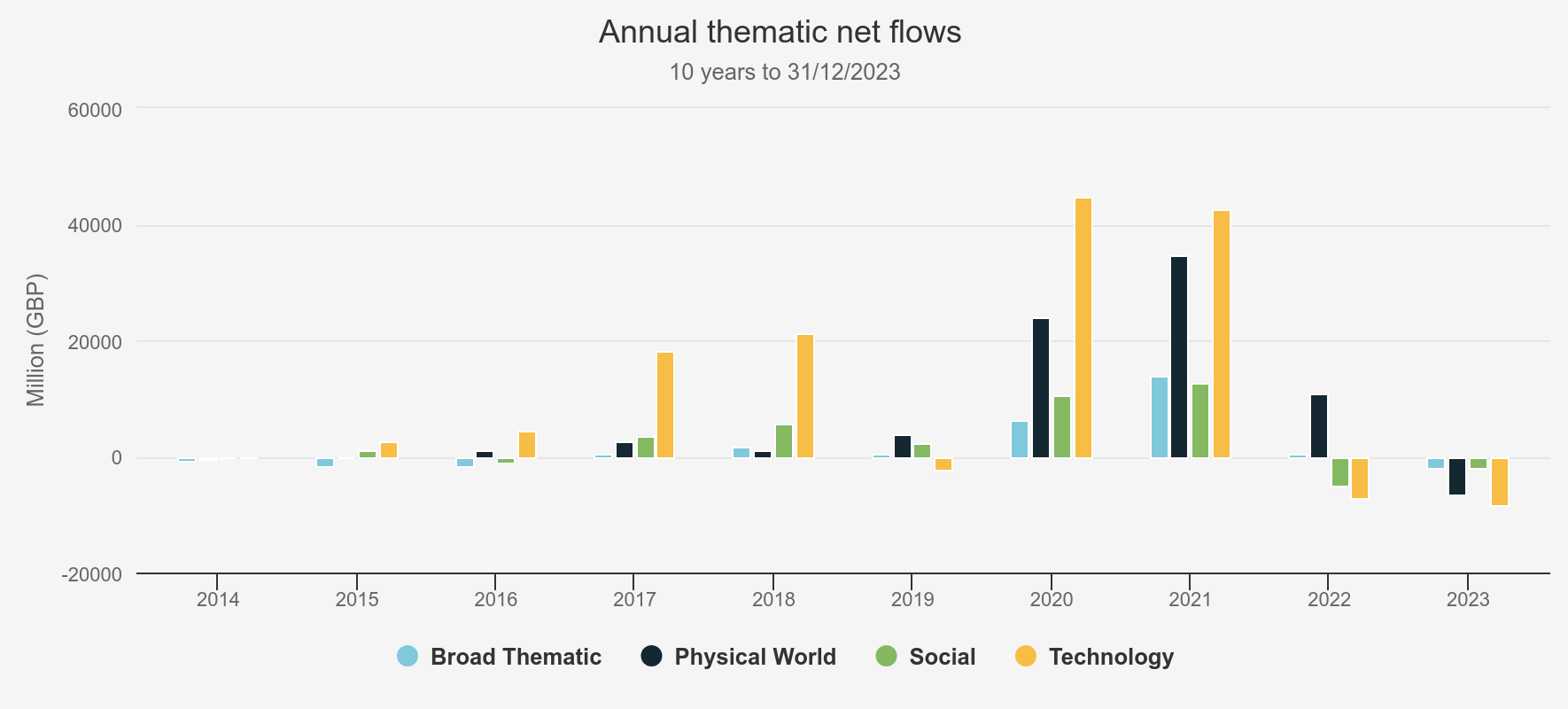

Despite the risks, thematic funds have been popular with investors in recent years, something the chart below highlights. According to Morningstar, the circa 2,000 thematic funds that fit their definition can be split into four segments: broad thematic, which contains funds targeting multiple themes; physical world, containing funds addressing the management of physical resources including energy transition; technology, which contains funds targeting disruptive growth potential of technological change; and social, containing funds looking to capitalise on structural changes in society.

For most of the last decade, flows into thematic funds increased year-on-year, with 2020 and 2021 seeing a huge surge into each theme, as the below chart illustrates. The way in which we did things changed materially over this period from how we work and shop to how we keep tabs on our health and communicate. This led to a number of mainly growth-oriented businesses, technology companies being a prime example, to rally and subsequently attract a flurry of investment. Additionally, the political and social impetus behind green reforms has strengthened dramatically, which boosted flows into the physical world category.

NET FLOWS IN THEMATIC FUNDS

Source: Morningstar

However, as we alluded to earlier, performance and demand can fall off quickly. This is something we’ve seen over the last two years, and, as the chart above highlights, there were significant net outflows in both 2022 and 2023. We think this largely comes down to the change in the global interest rate environment.

First, it saw appetite return for traditional value stocks that don’t typically feature in thematic funds. Second, it led to a significant shift in overall investor behaviour as they dashed for cash, preferring a 5% or so rate of interest on their savings in lower-risk bank accounts or bonds, particularly given the fears of recession that have abounded.

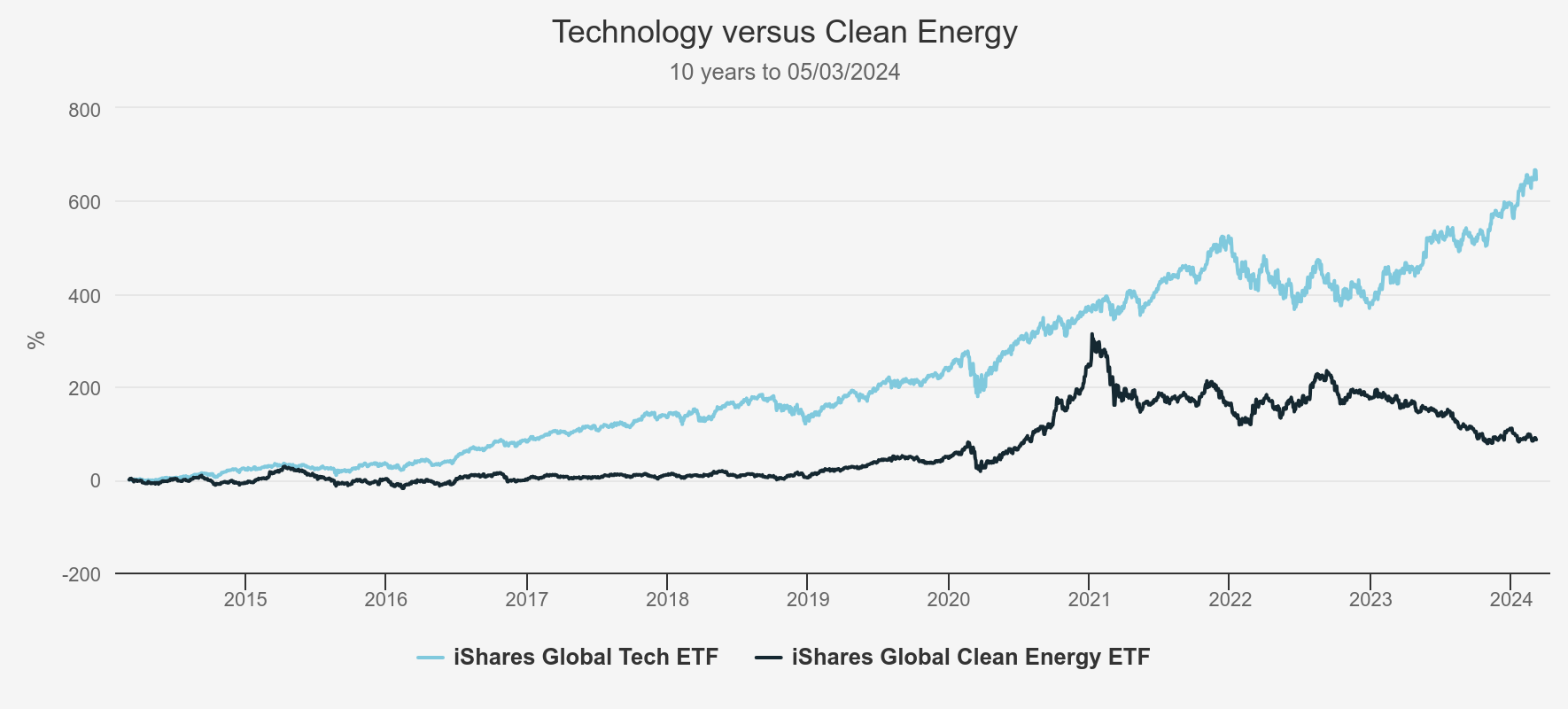

Two areas that saw particularly stark outflows were technology and renewables, although performance has differed greatly. We’ve included a chart below which looks at the returns of technology and clean energy, represented by the iShares Global Tech and iShares Global Clean Energy ETFs, which highlights the performance divergence from the latter part of 2022. And yet, when you look at the investment trusts in each respective sector, discounts are very similar.

For example, Allianz Technology Trust Ord (LSE:ATT) sits at a current discount of 10.7% and Impax Environmental Markets Ord (LSE:IEM) is sitting at 9.9%, which suggests it’s not performance that’s led to outflows, but rather a reflection of a shift to cash and higher-yielding options offering less risk, in our opinion.

When the interest rate picture becomes clearer though, and rates start to fall, we think the higher-yielding options investors are enjoying today will start to look less attractive, meaning a large allocation of cash will need somewhere to go. Both sectors arguably offer opportunities for the years and decades to come. With a strong run of performance, continual increases in demand and wider-than-average discounts, technology might attract more immediate investment, although investing in the sector that has sold off recently might prove the better strategy.

TECHNOLOGY VERSUS CLEAN ENERGY

Source: Morningstar. Past performance is not a reliable indicator of future results

Where is it all heading?

Within technology, we think the outlook for semiconductors is one of particular interest. While the industry faces short-term challenges, the crucial role this sector has to play economically given its resilience and capacity for innovation, means the long-term outlook could see unprecedented growth and opportunities.

This is something that Mike Seidenberg, the lead manager of ATT, is looking to capitalise on. While he aims to capture the many secular themes in the technology sector that have long-term high growth potential, he points out that his bullishness in semiconductors, overall, remains reflected in his above-benchmark allocation to the industry.

However, he does not just simply invest in the giant-cap stocks that dominate the benchmark. With the frothiness of valuations once again starting to enter the conversation, he believes there is also a mosaic of opportunities slightly further down the market-cap spectrum that could benefit and has built up exposure over time in certain mid-cap companies such as Monolithic Power Systems Inc (NASDAQ:MPWR), which designs and develops semiconductor-based power solutions, and Micron Technology Inc (NASDAQ:MU), a producer of memory and storage technology.

Another, yet slightly different way to gain exposure to this theme is via Henderson European Focus Trust Ord (LSE:HEFT). HEFT’s portfolio features leading global, yet European-based, semiconductor equipment manufacturers such as Infineon Technologies AG (XETRA:IFX) and ASM International NV (EURONEXT:ASM) which provide essential equipment to the industry.

Both companies are likely beneficiaries no matter which company ends up manufacturing the end product, including those, like NVIDIA Corp (NASDAQ:NVDA), which are being driven by artificial intelligence (AI) demand. Unlike Nvidia, though, these companies are sitting at a much lower price-to-earnings (P/E) figure, a measure of valuation, and could act as a cheaper proxy for exposure to the theme while still benefiting from the uptick in demand.

Another theme HEFT provides exposure to is electrification, through companies such as Siemens AG (XETRA:SIE) and Schneider Electric SE (XETRA:SND). Both companies are crucial in aiding the transition to a greener and more sustainable energy supply and play a pivotal role in energy efficiency. For example, Microsoft Corp (NASDAQ:MSFT) is planning to build roughly 120 additional data centres to help meet the increase in demand for AI services, necessitating significant numbers of semiconductors.

Given the massive energy requirements that will be needed from these data centres, along with the fact each will need to deliver on renewable energy targets, it sees energy efficiency as a critical component to lowering operating costs. Siemens and Schneider Electric are likely beneficiaries here, given they supply the infrastructure management hardware and software which helps optimise these facilities.

Another structural growth theme with obvious long-term drivers is healthcare, in particular biotechnology. All over the world, the need for better healthcare and the wealth to afford it is growing. However, the sector has been under pressure over the last few years, driven by higher interest rates which has seen less financing for companies in this sector and investors that are less willing to put money into high-risk growth companies, especially ones that are often pre-profitable.

The team behind International Biotechnology Ord (LSE:IBT) point to the cyclicality of the biotech sector as a long-term supporting factor arguing it may be an interesting time to look at the sector. Over 2023, the managers increased exposure to companies further down the market-cap spectrum to take advantage of lower valuations, anticipation of mergers and acquisitions, and what they see as a potential bullish move in the cycle.

The pressures that come with rising interest rates on a rate-sensitive industry such as biotechnology have led to a number of larger entities acquiring smaller firms including targeted therapy company Seagen, which was acquired by pharmaceutical and biotechnology giant Pfizer Inc (NYSE:PFE), and Horizon Therapeutics, a rare disease company acquired by one the world’s largest biotech companies Amgen Inc (NASDAQ:AMGN).

Both acquisitions led to significant upticks in share prices. While short-term expectations changed to anticipate fewer rate cuts in the early part of 2024, we think that once rate cuts become a reality then there is potential for a substantial re-rating of the sector, which, given IBT’s current double-digit discount, could present an attractive entry point for investors.

Conclusion

The themes discussed above, from technology and clean energy to healthcare and electrification, have all come under pressure over the last couple of years. While some areas have experienced more dramatic outflows than others, given investors have sought the shelter of higher and less-risky returns on offer with easy-access bank accounts and bonds, investment trusts investing in these themes have seen discounts widen to above-average levels.

This could present a significant opportunity, in our view, as the underlying fundamentals of these themes haven’t really changed, with an argument to be made that each theme’s outlook is only getting stronger over time. As we illustrate in the table below, each trust now sits at a discount significantly wider than its own five-year average.

TRUST DISCOUNTS AND PERFORMANCE OVER FIVE YEARS

| ONE-YEAR NAV TOTAL RETURNS | CURRENT DISCOUNT | FIVE-YEAR AVERAGE | |

| Allianz Technology Trust (ATT) | 45.8 | -10.7 | -5.8 |

| Morningstar Investment Trust Technology & Media | 21.7 | -11.8 | -7.4 |

| Impax Environmental Markets | -4.7 | -9.9 | 1.0 |

| Morningstar Investment Trust Environmental | 10.3 | -12.6 | -0.3 |

| Henderson European Focus Trust (HEFT) | 10.7 | -11.8 | -10.8 |

| Morningstar Investment Trust Europe | 10.3 | -9.7 | -8.2 |

| International Biotechnology (IBT) | 3.5 | -10.9 | -3.3 |

| Morningstar Investment Trust Biotechnology & Healthcare | 0.2 | -14.5 | -1.4 |

Source: Morningstar, as at 05/03/2024. Past performance is not a reliable indicator of future results

The desire to decode the concept of thematic investing has led us to look back in time to its genesis and identify some interesting opportunities in the investment trust space. In our upcoming virtual “Themes for your ISA in 2024” event, the managers of ATT and IBT will be presenting on their respective trusts, and we will also be joined by two more managers: Evy Hambro who manages the BlackRock World Mining Trust Ord (LSE:BRWM) and Duncan Ball who manages BBGI Global Infrastructure Ord (LSE:BBGI).

The managers of BRWM have long been cognisant of the huge demand for metals that a green economy will produce and are well-positioned to benefit from the increase in demand. BBGI argues the social infrastructure asset class shows promising prospects, driven by the need for decarbonisation, digitalisation, and the upgrade or replacement of ageing infrastructure. While there’s no guarantee that planned infrastructure spending will result in investment opportunities, they also see the potential that governments will seek private sector capital support, something they have done historically, especially considering the significant strain on government balance sheets following the Covid pandemic.

Each manager will present on their strategy covering themes that they believe will matter to your portfolio for the decades to come.

Kepler Partners is a third-party supplier and not part of interactive investor. Neither Kepler Partners or interactive investor will be responsible for any losses that may be incurred as a result of a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important Information

Kepler Partners is not authorised to make recommendations to Retail Clients. This report is based on factual information only, and is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

This report has been issued by Kepler Partners LLP solely for information purposes only and the views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment. If you are unclear about any of the information on this website or its suitability for you, please contact your financial or tax adviser, or an independent financial or tax adviser before making any investment or financial decisions.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. Persons who access this information are required to inform themselves and to comply with any such restrictions. In particular, this website is exclusively for non-US Persons. The information in this website is not for distribution to and does not constitute an offer to sell or the solicitation of any offer to buy any securities in the United States of America to or for the benefit of US Persons.

This is a marketing document, should be considered non-independent research and is subject to the rules in COBS 12.3 relating to such research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research.

No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not to be taken as advice to take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm's internal rules. A copy of the firm's conflict of interest policy is available on request.

Past performance is not necessarily a guide to the future. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is a limited liability partnership registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771.

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority.