Five UK stocks in line for US tax windfall

8th December 2017 12:00

by Emil Ahmad from interactive investor

Love him or hate him, Donald Trump can never be accused of lacking ambition. While some describe it as misguided, his improbable election victory and first year in office has been defined by bold statements and political hyperbole.

From repealing Obamacare to the border wall, Trump's vision for America is as incendiary as it is unrealistic. After all, the president must still get approval for such sweeping reform, and the Senate is stoicism incarnate.

Nevertheless, few are betting against the US tax cuts receiving Senate backing. Wall Street briefly hit record intraday highs in early trading Monday as investors bought into an emphatic resurrection of the Trump Bump. Predictably, biggest winners from the biggest package of tax cuts since Reagan's 1980s heyday, will be corporations and the wealthy elite.

Although the minutiae of the package still have to be agreed by lawmakers, Wall Street reaction suggests this is one battle Trump has won. Putting the risk of an unmanageable budget deficit aside, analysts are already pricing in upside with regards to US GDP growth.

Mickey Levy, chief US economist at Berenberg, has revised forecasts upwards to 2.9% in 2018 and to 2.7% in 2019, with tax cuts likely to provide Trumponomics tailwinds. Levy says: "The starting point for our forecast is very elevated levels of business and consumer confidence."

Cutting the corporate tax from 35% to 20% could facilitate the repatriation of hundreds of billions of dollars in profits held overseas. Even considering the big tech players in isolation, , , , and account for a collective $450 billion alone.

However, the byzantine nature of the US tax system means there are many loopholes to exploit. Neil Dwayne of Allianz Global Investors talks in terms of an average 22% tax rate for S&P 500 companies, but there will be big winners in the UK, too.

Ferguson (formerly Wolseley)

With infrastructure at the heart of Trump's election rhetoric, would always be a big winner under a Trump presidency. The tax cuts will sweeten the deal for a corporation which derives approximately 90% of group profits from the US.

As a distributor of plumbing, building and other trade supplies, its products are primarily utilised in new-builds and property remodeling. It focuses on a few core brands which operate business-to-business chains across Europe and North America. No surprise, Ferguson's most important subsidiary is Ferguson, the market leader in US plumbing supplies and a primary contributor of group revenue.

It's the only national plumbing trade supplier in the US, a scale advantage which potentially allows Ferguson to further consolidate its US market share. However, the fact that many decisions are made at a local branch level arguably mitigates the possibility of more effective economies of scale.

Ferguson has a 15% market share and is able to use this to great effect in terms of its distribution capacities. The company maintains 100,000 stock-keeping units whereas an average competitor may only stock 3,000.

In addition to representing a disproportionate level of group profits, the US business accounts for two-thirds of revenue and an even larger slice of operating income. Consequently, the corporation has been a great beneficiary of sterling weakness, with reported group revenue and trading profit growth of 16.7% and 9.5% in the first three quarters of FY 2017.

Ferguson remains well-positioned to benefit from any upturn in the US housing market, with growing millennial home ownership likely to be a driver.

Any impact from US tax reform might not be a game-changer, but UBS calculates that every one percentage point reduction in the company's group tax rate - currently 28% - would increase earnings per share by 1-1.5%.

Carnival

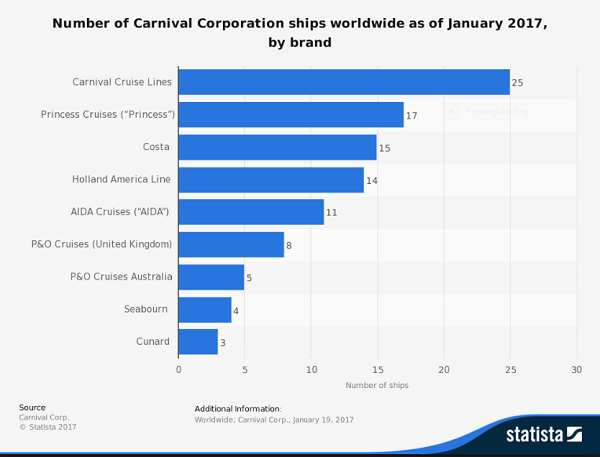

As the only corporation in both the and the S&P 500, it is clear that this cruise company is a dominant player in both markets. Dominant may be an understatement, as is the global market leader and operates 10 global brands from a portfolio of over 100 ships.

From a US perspective, Carnival is part of an oligopoly in North America and, in conjunction with Royal Caribbean and Norwegian, controls around 90% of the market. New entrants would face significant barriers to entry and consequently, the trio's ongoing control of this lucrative market has remained unchallenged.

US market demographics are highly unlikely to change anytime soon, and cost advantages mean new entrants would find it impossible to match Carnival's breakeven pricing.

Carnival Corporation shares on the NYSE are up 25% over the last 12 months. 2017 Q3 results were published in September, with EPS up $0.37 to $2.29 on a year-on-year basis. Revenue was also up on annualised basis in Q3 by $0.42 billion to $5.52 billion. Despite recent hurricane headwinds, the company uprated full-year revenue yield growth from 3.5% to 4%.

BAE Systems

When Trump promised to go on the offence in terms of defence as part of his election pledge, bottom line was always destined to receive a timely boost. As one of the biggest defence contractors globally, it also ranks amongst the sixth-largest suppliers to the US Department of Defence.

It has a 17% share of America's $400 billion F-35 programme, a contract which will enhance earnings for many years to come. F-35 deliveries are also tipped to pick up significantly in 2019 and 2020 as production is fully scaled up.

With a $700 billion defence policy bill passed by the Senate earlier this month, BAE is in prime position to benefit from the budget growth as it filters through to contractors.

BAE generates about 40% of its revenues from the US, enjoying an effective duopoly with General Dynamics in the premium US defence land combat market.

Operating primarily as a sub-contractor within the US aircraft and naval space, BAE is a far less dominant player.

It's made an encouraging start under new CEO Charles Woodburn, with the rise in half-year sales and profits beating market expectations. Its key profit measure increased by 5% after adjusting for exchange rate movements.

Despite underlying growth in sales and core profits in all operating divisions, August's results were treated with a degree of caution by some analysts.

Jefferies analyst Sandy Morris said: "While BAE's outlook in the USA is probably positive, that in the UK and Saudi Arabia is arguably not…Unless the world gets scarier still, BAE's overall progress may remain sedate."

CRH

If the new occupant at the White House remains true to his word, will be a committed participant in the rebuilding process to 'Make America Great Again'.

Investment in infrastructure will be a key tenet of Trump's reign and a favourable US tax environment could boost this Irish multinational further.

Indeed, this sector represents the largest source of demand for CRH, with approximately 50% of all market exposure in the Americas relating to infrastructure.

Although the building materials manufacturer and distributor operates in over 30 countries, approximately 60% of its earnings come from the Americas.

With regards to its actual US operations, CRH is the leading asphalt producer and ranks third in aggregates and ready-mix concrete production respectively.

The international building materials group continues to expand its US exposure.

The takeover of Ash Grove Cement Company is expected to be finalised in Q1 2018 and the acquisition of various assets in Florida (including a cement plant, 18 concrete plants and an aggregates quarry) completes shortly.

The company overcame challenging weather conditions and hurricane activity in Q3, with the Americas operation strengthened by stable US market fundamentals and robust underlying demand.

The FAST Act ensures stable Federal infrastructure investment in the US, as certain States see a pickup in available resources. Materials volumes were universally up in Q3, with heightened US demand driving cement volumes 5% higher.

Considering the group as a whole, earnings for the first three quarters of 2017 were €2.43 billion, a 2% year-on-year increase.

Ashtead Group

While many UK sectors will benefit from expansive US economic policy and tax cuts, it's hard to look beyond infrastructure and construction companies. has major US exposure and rents a range of construction and industrial equipment with a focus on non-residential markets.

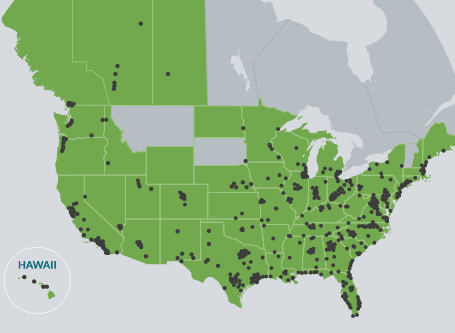

The company has a huge foothold in the US market via its subsidiary Sunbelt Rentals, which operates almost 650 stores and accounts for over 90% of revenues. In 2014, Sunbelt entered the Canadian market where it is gradually building a presence and network of stores.

Sunbelt's North American presence (source: www.ashtead-group.com)

As the second-largest US rental equipment business, Sunbelt tries to offer its client base "a complete, one-stop shop service" for all their rental needs. Profit is rarely a pretty word and helping the recovery process after natural disasters plays a key role in business strategy and revenues. Jefferies analyst Justin Jordan estimated in September that $50 million in revenues could be generated from Hurricane Harvey alone.

Ashtead has a five-year plan to grow its North American business and 18 months into the journey, smooth progress is being made. Daniel Cowans, senior analyst at Lansons, is confident Sunbelt will "…hit the upper end of its revenue range ($5-$5.5bn) by FY21."

Results in Q1 2018 reflect supportive market conditions, with acquisitions and organic growth positive drivers. Year-on-year revenue growth stands at 17% and earnings per share are up 30% on an annualised basis.

Daniel Cowan, an analyst at Investec Securities, estimates that a 23% effective tax rate would increase its estimates of full-year 2019 base case earnings per share by 17%.

Overall, US tax reform is heavily skewed toward corporations over individuals and, although there will undoubtedly be a number of issues to iron out, this overhaul is set to be fully approved by Christmas. Whether it provides a long-term boost to Trump's presidency remains to be seen.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.