eyeQ: why you should buy the FTSE 250 now

Experts at eyeQ have used AI and their own smart machine to analyse macro conditions. Here they consider a bullish signal for UK equities.

25th February 2025 10:57

by Huw Roberts from eyeQ

"Our signals are crafted through macro-valuation, trend analysis, and meticulous back-testing. This combination ensures a comprehensive evaluation of an asset's value, market conditions, and historical performance." eyeQ

- Discover: eyeQ analysis explained | eyeQ: our smart machine in action | Glossary

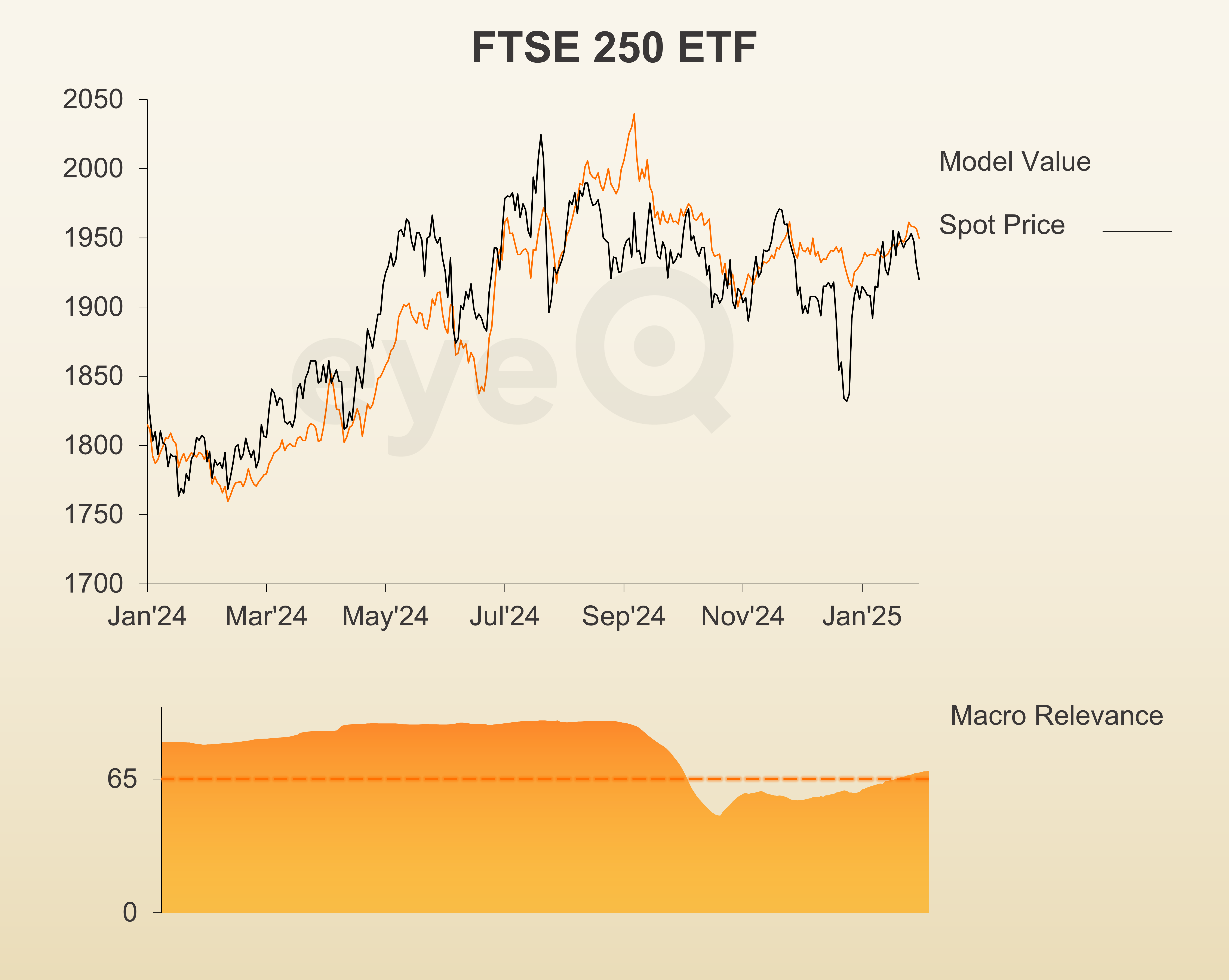

iShares FTSE 250 ETF (MIDD)

Macro Relevance: 68%

Model Value: 1,959.77p

Fair Value Gap: -2.61% discount to model value

Data correct as at 25 February 2025. Please click glossary for explanation of terms. Long-term strategic model.

It feels like the mood music has changed.

- talk around Microsoft Corp (NASDAQ:MSFT) cancelling AI data-centre leases has rekindled fears around the whole (AI) story

- earnings season has been OK, but anyone missing expectations sees their stock price suffer by more than usual, while beats haven’t been rewarded to the same degree

- the Trump winners such as Palantir are wobbling as fears mount over policies like tariffs and Department of Government Efficiency (DOGE) cost-cutting

- Bitcoin and meme stocks are threatening to break critical supports.

All this at a time of year when seasonals are poor – late February often sees US equities struggle. Typically this is associated with annual tax payments being due, so retail investors sell their winners to pay bills.

The prospects of a more meaningful pullback might mean many investors are happy to stay on the sidelines and wait for still better levels before adding.

Fair enough, but it’s worth noting that on eyeQ the ETF tracking the FTSE 250, iShares FTSE 250 ETF GBP Dist (LSE:MIDD), now screens as 2.6% cheap to overall macro conditions, and that’s enough of a valuation gap to trigger a bullish signal.

Sometimes the benefit of using maths rather than an individual’s discretion is that it removes the human emotion element to investing. Emotion can cloud judgement.

Ultimately every investor is different and has their own process. But the idea is to use eyeQ as a screening tool to suggest possible ideas for you to then decide on. It’s used by professional asset managers at some of the biggest funds in the world, and is now available to you on interactive investor.

Currently it’s saying domestic mid-cap UK equities are starting to offer some value relative to the broad macro environment.

Source: eyeQ. Past performance is not a guide to future performance.

Useful terminology:

Model value

Where our smart machine calculates that any stock market index, single stock or exchange-traded fund (ETF) should be priced (the fair value) given the overall macroeconomic environment.

Model (macro) relevance

How confident we are in the model value. The higher the number the better! Above 65% means the macro environment is critical, so any valuation signals carry strong weight. Below 65%, we deem that something other than macro is driving the price.

Fair Value Gap (FVG)

The difference between our model value (fair value) and where the price currently is. A positive Fair Value Gap means the security is above the model value, which we refer to as “rich”. A negative FVG means that it's cheap. The bigger the FVG, the bigger the dislocation and therefore a better entry level for trades.

Long Term model

This model looks at share prices over the last 12 months, captures the company’s relationship with growth, inflation, currency shifts, central bank policy etc and calculates our key results - model value, model relevance, Fair Value Gap.

These third-party research articles are provided by eyeQ (Quant Insight). interactive investor does not make any representation as to the completeness, accuracy or timeliness of the information provided, nor do we accept any liability for any losses, costs, liabilities or expenses that may arise directly or indirectly from your use of, or reliance on, the information (except where we have acted negligently, fraudulently or in wilful default in relation to the production or distribution of the information).

The value of your investments may go down as well as up. You may not get back all the money that you invest.

Equity research is provided for information purposes only. Neither eyeQ (Quant Insight) nor interactive investor have considered your personal circumstances, and the information provided should not be considered a personal recommendation. If you are in any doubt as to the action you should take, please consult an authorised financial adviser.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.