eyeQ: has BP’s share price overheated?

Experts at eyeQ have used AI and their own smart machine to analyse macro conditions and generate actionable trading signals. Today, it’s generated a signal on the oil major.

11th February 2025 09:51

by Huw Roberts from eyeQ

"Our signals are crafted through macro-valuation, trend analysis, and meticulous back-testing. This combination ensures a comprehensive evaluation of an asset's value, market conditions, and historical performance." eyeQ

- Discover: eyeQ analysis explained | eyeQ: our smart machine in action | Glossary

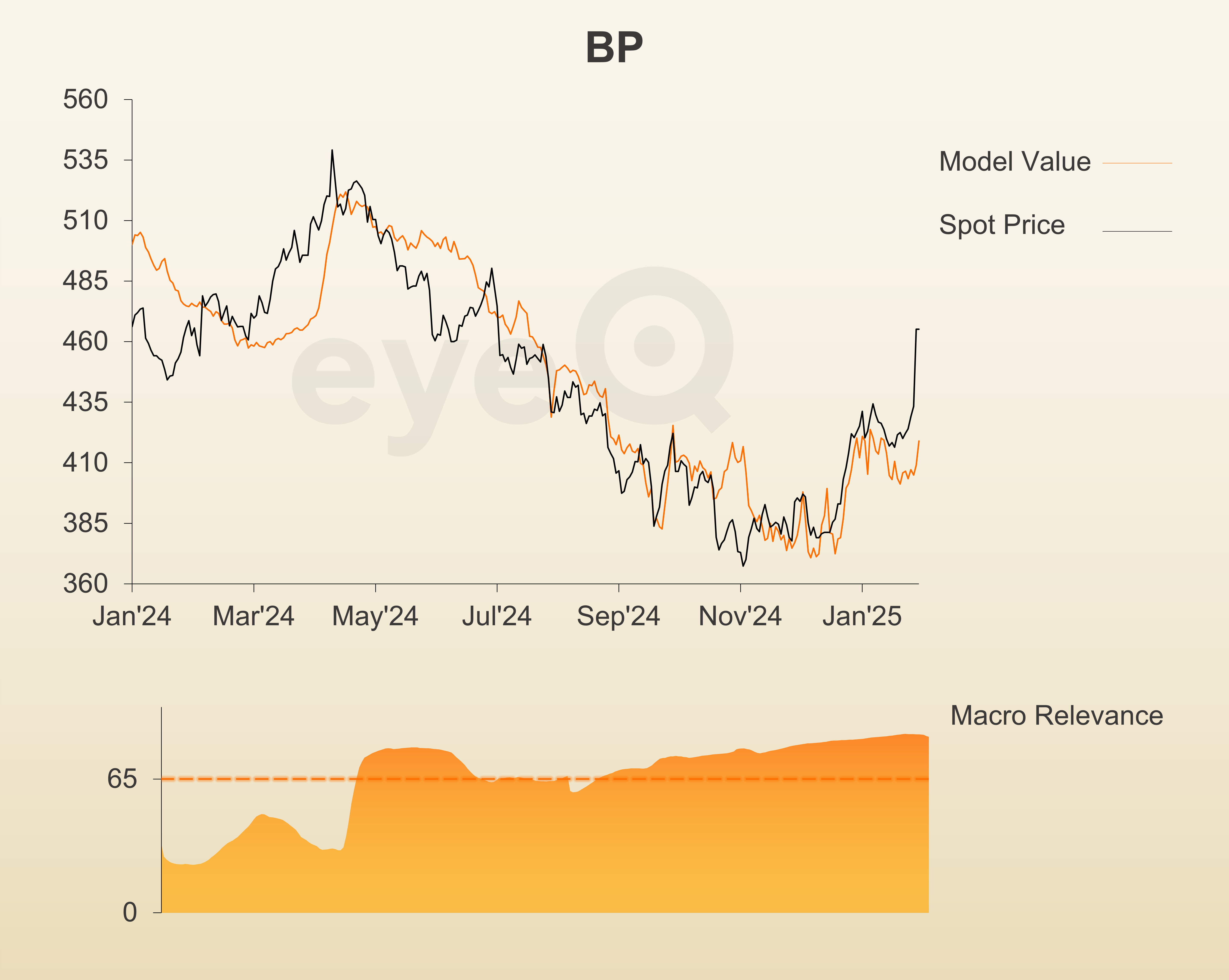

BP

Macro Relevance: 85%

Model Value: 418.98p

Fair Value Gap: +9.93% premium to model value

Data correct as at 11 February 2025. Please click glossary for explanation of terms. Long-term strategic model.

It’s been a busy start to the week for oil giant BP (LSE:BP.).

This morning’s results were a mixed bag but, in effect, they were overshadowed by yesterday’s news about activist investor Elliot Capital taking a stake in the company. BP’s response has been to promise to “fundamentally reset” strategy. Whether that’s enough for Elliot, which will be agitating for significant changes, is unclear. After prolonged underperformance, investors will be hopeful that this is a catalyst for positive change.

But for any investor not already long BP, is this a sign that it’s time to get in?

On eyeQ, the answer is no, the timing is not great.

Admittedly all these stories are company specific, and these headlines will dominate in the near term. However, note that macro explains 85% of BP price action right now, so it cannot be ignored. And eyeQ’s model value sits around 419p, which means this latest rally has taken the stock 9.9% above where macro conditions say it “should” trade. That’s enough for a bearish signal – the stock has run too far ahead of macro fundamentals.

Once again, we should stress that company news will be key in the near term. Details from BP on their strategic reset, or clues on what Elliot will push for will prompt analysts to re-visit their price targets for the company. That will move the stock price.

But, from a purely macro perspective, these are not levels to chase. Even the bulls should take note and wait for better entry levels.

Source: eyeQ. Past performance is not a guide to future performance.

Useful terminology:

Model value

Where our smart machine calculates that any stock market index, single stock or exchange-traded fund (ETF) should be priced (the fair value) given the overall macroeconomic environment.

Model (macro) relevance

How confident we are in the model value. The higher the number the better! Above 65% means the macro environment is critical, so any valuation signals carry strong weight. Below 65%, we deem that something other than macro is driving the price.

Fair Value Gap (FVG)

The difference between our model value (fair value) and where the price currently is. A positive Fair Value Gap means the security is above the model value, which we refer to as “rich”. A negative FVG means that it's cheap. The bigger the FVG, the bigger the dislocation and therefore a better entry level for trades.

Long Term model

This model looks at share prices over the last 12 months, captures the company’s relationship with growth, inflation, currency shifts, central bank policy etc and calculates our key results - model value, model relevance, Fair Value Gap.

These third-party research articles are provided by eyeQ (Quant Insight). interactive investor does not make any representation as to the completeness, accuracy or timeliness of the information provided, nor do we accept any liability for any losses, costs, liabilities or expenses that may arise directly or indirectly from your use of, or reliance on, the information (except where we have acted negligently, fraudulently or in wilful default in relation to the production or distribution of the information).

The value of your investments may go down as well as up. You may not get back all the money that you invest.

Equity research is provided for information purposes only. Neither eyeQ (Quant Insight) nor interactive investor have considered your personal circumstances, and the information provided should not be considered a personal recommendation. If you are in any doubt as to the action you should take, please consult an authorised financial adviser.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.