Europe’s stocks are crushing it. The question is whether that can last

US stocks have a way of keeping the lead, but they’re suddenly lagging behind their European peers. The question is: for how long (and what you should do about it).

28th March 2025 08:47

by Theodora Lee Joseph from Finimize

- Lower interest rates, China’s recovery, and attractive valuations have fuelled Europe’s stock market surge, delivering its best start to a year since the 1980s

- Even though the US stock market has been lagging, it’s still a powerhouse, particularly with its dominance in tech and AI. And if the Federal Reserve cuts interest rates faster than expected or if US earnings growth accelerates, American stocks could quickly reclaim their long-held leadership

- Instead of choosing between US and European stocks, consider going for a balanced portfolio for the long haul. Europe has room to run if its structural reforms take hold, while the US is likely to continue to benefit from its deep capital markets and knack for innovation.

For the first time in a decade, European stocks are outshining their US counterparts, flipping the script on what many investors have come to expect. The Stoxx 600 index – which tracks Europe’s biggest 600 public companies – is up 9% this year, while the S&P 500 is down 3%. That’s the best start to a year for European equities since the late 1980s, and it’s forcing investors to take a fresh look at a market that has long played second fiddle to Wall Street.

But the real question is whether this rally has staying power or is just a temporary hot streak, doomed to fizzle when the US reclaims its usual dominance.

Let’s break it down.

S&P 500 (red line) versus the STOXX 600 (red and green “candles”), since the start of the year. Source: TradingView.

Well, well, well. What’s going on with Europe’s stocks?

European stocks have been on a tear this year, and there are a few big reasons why.

Reason 1: Central bank moves

The US Federal Reserve (Fed) has been slow to cut interest rates, but the European Central Bank (ECB) has sprinted ahead. And those lower borrowing costs are giving a boost to European businesses and consumers, after years of sluggish growth. In fact, with so much liquidity flowing into this long-parched system, investors have been lapping up European stocks, betting that cheaper lending will support corporate earnings.

Reason 2: The China effect

Europe’s rally isn’t only about what’s happening at home: it’s also about China. As Beijing has been rolling out brand-new stimulus measures aimed at reviving the country’s consumers and its economy, European companies that depend on Chinese demand – everything from luxury brands to industrials – are reaping the rewards. For investors who want exposure to China’s rebound without all the regulatory and geopolitical risks, European stocks are a bright and dazzling alternative.

Reason 3: A bargain-hunter’s market

For years, US stocks – especially tech giants – have traded at much higher valuations than their European counterparts. And even after the latest rally, European stocks are still far cheaper than their US peers. Investors, then, are just finally waking up to the idea that they can buy strong, well-established European companies at a fraction of the cost of similar US firms. While the economic outlook across the continent might not be perfect, much of the pessimism was already priced in, making the region an appealing value play.

Reason 4: A possible end to the war in Ukraine

Europe was hit hard by the economic fallout from Russia’s invasion of Ukraine, particularly the sky-high energy prices that followed. But with the two sides at least now talking about a resolution, markets have been more optimistic. Investors have shifted their focus from geopolitical risks to improving economic fundamentals. The idea is that if Europe can finally move past this crisis, that will remove a major drag on growth.

Can Europe’s rally continue?

Now, just because European stocks are doing well now, that doesn’t mean it’ll last forever. The big question is whether the tailwinds pushing markets higher will keep blowing or whether some headwinds are about to hit.

One concern is interest rates. The European Central Bank has been cutting its key rate to encourage growth, but it can only trim them so much. If inflation remains sticky, the ECB could be forced to slow down or even stop its slicing, removing one of the key drivers behind this rally.

Another worry is China. Right now, its recovery is giving Europe a boost, but that may not last. If China’s stimulus efforts don’t lead to sustained economic growth, or if new geopolitical tensions flare up, the optimism about European stocks could fade fast.

Then there’s the question of where these market gains are really coming from. A big chunk of the rally has been driven by Germany’s DAX index, which is packed with multinational companies that make most of their money overseas. Germany’s more domestically focused index – which more accurately reflects the strength of the local economy – has been struggling, at least until the government announced a big increase to its defense budget. That suggests much of Europe’s stock market gains aren’t coming from a strong economic recovery at home but from external factors. And if that’s the case, the rally could be more fragile than it seems.

So, could US stocks regain their dominance then?

The US stock market may be down, but it’s never been out. If history has taught us anything, it’s that betting against Wall Street long-term isn’t a great idea.

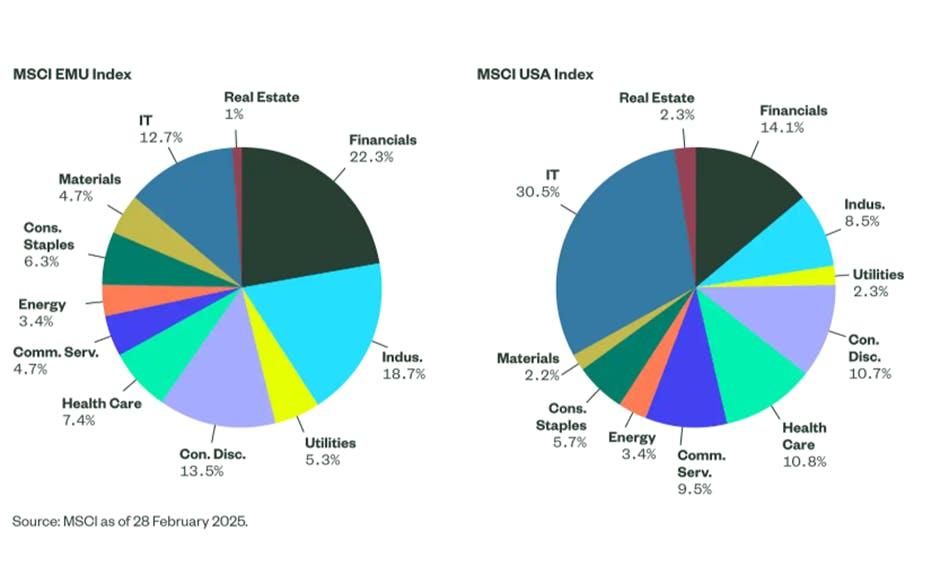

And one thing that could trigger a rebound is US tech dominance. While European markets lean heavily on financials, industrials, and consumer staples, the US is home to the world’s biggest tech powerhouses. AI overspending fears have rattled markets recently, but if companies like Microsoft Corp (NASDAQ:MSFT), Alphabet Inc Class A (NASDAQ:GOOGL), and NVIDIA Corp (NASDAQ:NVDA) continue to deliver strong growth, investors could quickly return to America’s so-called Magnificent Seven.

And then there’s the dollar. A weaker greenback would give a lift to S&P 500 earnings, as foreign revenues – making up around 40% of the index – translate into more dollars when brought back home, padding profits for multinationals like Apple Inc (NASDAQ:AAPL), Microsoft, and Coca-Cola HBC AG (LSE:CCH).

That said, there are signs that the US economy might be losing steam. Consumer sentiment has weakened, interest rates are still elevated, and new import taxes are threatening to increase the price of much of what Americans buy. That’s a concern for Europe, given that roughly a quarter of European companies’ sales are tied to the US.

And it’s not just about exports. Many European firms own businesses and operations in the US, meaning a slowdown would hit them twice – once through reduced exports and again through weaker earnings from their American divisions.

In short, Europe may look strong for now, but if the US stumbles, European stocks could feel the pain sooner than expected. You know the old saying: when America sneezes, the world catches a cold.

What’s the opportunity here?

If you’re heavily invested in US stocks, now might be a good time to add some European exposure. There are plenty of undervalued opportunities to be had, especially in financials, industrials, and healthcare. As an added perk, European markets also give you more sector diversification. The big European index carries a more balanced mix of industries, with IT making up just 12.7% of the whole – compared to 30.5% in the US.

The sector breakdown of the MSCI Eurozone index and US index. Source: State Street.

Just remember, investing isn’t an either-or proposition: you don’t have to choose between the US and Europe. Too often, investors think in zero-sum terms – assuming that if one region is winning, the other must be losing. The reality is that a balanced approach is often the best strategy.

Yes, Europe could continue crushing it – but only if it keeps its eye on the ball. That means fixing its infrastructure, ramping up defense spending, cutting energy costs, and making smart budget decisions that support growth. If all that happens, Europe’s stocks could outshine the rest of the world’s.

That said, you can’t count the US out just yet. If the Fed cuts rates faster than expected or if AI-driven growth pushes earnings higher, American stocks could easily regain the lead.

The smart thing to do is stay diversified. A mix of US and European stocks gives you the best shot at steady gains, no matter which market pulls ahead.

And if you're looking for stability among all the world’s chaos, fixed income could be your friend. If central banks continue cutting interest rates, bonds could offer solid returns while keeping your portfolio balanced.

Theodora Lee Joseph is an analyst at finimize.

ii and finimize are both part of abrdn.

finimize is a newsletter, app and community providing investing insights for individual investors.

abrdn is a global investment company that helps customers plan, save and invest for their future.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.