The equity income trusts with high tech weightings

Many income-focused investment trusts have low weightings to the tech sector, but not in this region, writes a Kepler analyst, who explains the logic behind it.

14th March 2025 14:09

This content is provided by Kepler Trust Intelligence, an investment trust focused website for private and professional investors. Kepler Trust Intelligence is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Material produced by Kepler Trust Intelligence should be considered a marketing communication, and is not independent research.

While the numerous Asian countries surrounding the South China Sea and the western coast of the US may seem like two worlds away, they both share a geological feature known as the Pacific Ring of Fire. This literal hotbed of tectonic activity is home to around three-quarters of the world’s volcanoes and 90% of its earthquakes. While many of the more well-known disasters that these have caused have occurred in the US, such as the eruption of Mount St Helens in Washington, and the 1989 ‘World Series’ earthquake in LA, a significant portion of these occur in Asia, especially volcanoes, of which around half of the total are in Japan and Indonesia alone.

- Invest with ii: Buy Investment Trusts | Top UK Shares | Open a Trading Account

We think there may perhaps be some sketchy parallels to the tech sector. Much of the media focus has been on the large US names such as NVIDIA Corp (NASDAQ:NVDA) and Apple Inc (NASDAQ:AAPL), which make up part of the Magnificent Seven, primarily due to their focus on cutting-edge technologies such as AI, but many of the companies that are crucial to the tech supply chains are based in Asia. This includes companies such as Taiwan Semiconductor Manufacturing Co Ltd ADR (NYSE:TSM) — critical to the world’s supply of semi-conductor chips which will be of crucial importance to the AI revolution — Foxconn — a manufacturing linchpin for the global tech sector — and Samsung Electronics Co Ltd DR (LSE:SMSN) — critical to the memory chip and displays industry.

As such, tech has become an increasingly dominant sector in the region’s equity markets, now making up circa 27% of the MSCI Asia ex Japan Index, not far off the weight in the MSCI USA Index of 30.5% (both as of 28/02/2025). However, some individual country indices have considerably more in tech, most notably Taiwan, which has over 80% represented by the sector.

Over the past few years, tech companies from both sides of the Pacific have performed well, with the most recent boom from AI-driven demand causing a significant rally in the industry. While this has been a big tailwind for many, those focused on income have been left behind in many cases. The growth-focused nature of these tech companies means they are more likely to use excess capital to reinvest into their business, rather than return cash to shareholders by way of dividends meaning they are typically considered low-yielding. As such, many income-focused vehicles have low weightings to the tech sector.

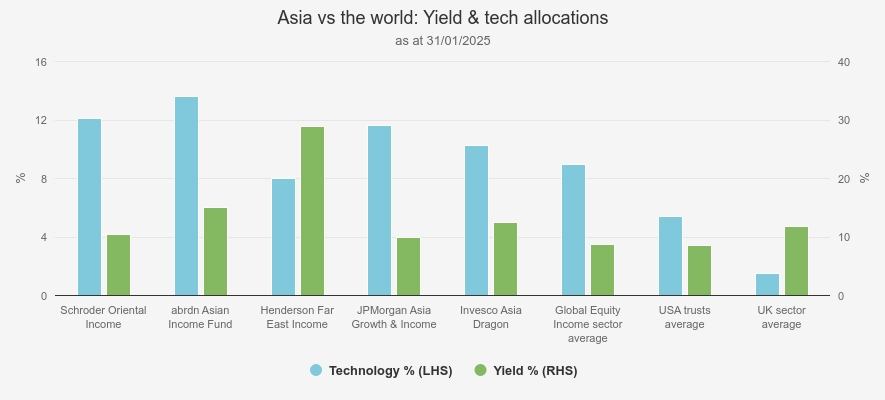

One exception to this is the Asian equity income sector. Here, the five-strong peer group have a simple average of 27.7% of their portfolios in the tech sector. This compares to circa 22% for the average global equity income trust, although on a more country-specific basis, only circa 13% average for the two US income trusts, and just 3.7% for the UK equity income sector. Despite this, the yield of these trusts versus the comparators has not been affected, with every Asia equity income trust yielding more than the average of the global trusts, both the US trusts, and all but two above the average of the UK, although with JPMorgan Asia Growth & Income Ord (LSE:JAGI) soon to enjoy an increase in this figure, as we discuss below.

ASIA TRUST TECH WEIGHTS

Source: Morningstar

Enhancing income

One of the contributing factors behind the high-tech allocations in Asia equity income trusts must be the use of enhanced dividend strategies, which we believe is a standout feature of the investment trust structure. This is where the trust uses a combination of the natural income of the portfolio with a contribution from capital to pay investors a higher yield than would otherwise be achieved. This also allows the managers of the trusts to select stocks that they believe offer the best total return potential without being beholden to a yield target, while the trust still offers a high yield.

In the past few months, three trusts that use enhanced dividends have tweaked their models to either increase their dividend levels or pay one out more regularly. One example isInvesco Asia Dragon Ordinary Shares (LSE:IAD). The trust, formerly known as Invesco Asia, recently won the bidding process to absorb the assets of the former Asia Dragon trust, making it the largest in the sector by net assets.

Managers Fiona Yang and Ian Hargreaves have a contrarian approach, looking to target those companies that are out of favour and therefore available at attractive valuations. As a result, the tech weight in the trust fell in 2024, resulting in the trust having an underweight position relative to its benchmark, the MSCI AC Asia ex Japan Index, although it is still the largest sector allocation at circa 22% (as of 31/12/2024). The trust has paid an enhanced semi-annual dividend of 2% of NAV, meaning the yield is equivalent to 4% per annum, although with the trust’s current discount to NAV of circa 10.6% (as of 06/03/2025), the historic yield is slightly above this at 4.6%.

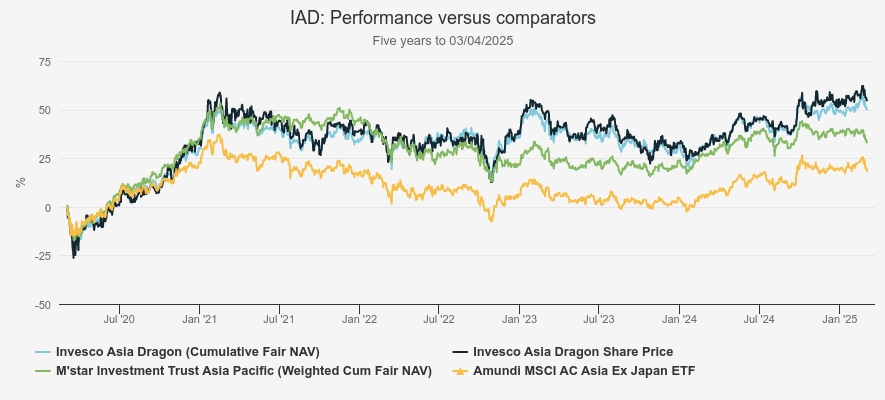

As part of the recent merger, the board has also doubled the number of dividend payments and will, in future, pay 1% of NAV on a quarterly basis. The dividend per share amounts have been approximately double what the portfolio has otherwise generated since the policy was first introduced in 2021, demonstrating the additional income the enhancements have provided investors. Performance has been impressive over this period, with IAD delivering double the return of its benchmark, for which we have used an ETF as a proxy in the chart below, while also currently offering a yield that is over 70% that of the index.

IAD OUTPERFORMANCE

Source: Morningstar. Past performance is not a reliable indicator of future results

Elsewhere in the Asia equity income sector, two trusts have significantly increased the level of their enhanced dividends in the past few months. First, JAGI proposed a 50% increase in their enhanced dividend, moving from 1% per quarter to 1.5%, therefore offering a yield of 6% of NAV per annum starting in March 2025. This means the trust’s yield, indicated above, is likely to increase significantly going forward.

Managers Robert Lloyd and Pauline Ng have a focus on quality when constructing their concentrated portfolio of circa 50 to 60 holdings. They primarily take a bottom-up approach, though also use some top-down input to help guide allocations. This has led to technology being the largest sector in the portfolio at circa 30% (as of 31/01/2025), aided by sizeable positions in TSMC (14.3%) and Samsung Electronics (4.6%), making them the first and third-largest holdings respectively.

As such, the trust’s dividend per share has been about 3x the level of earnings per share over the past few years, demonstrating how much the enhanced dividend policy has improved the income that investors are likely to achieve from the portfolio. Furthermore, the trust itself is trading at a discount to NAV of circa 8.7%, which not only increases the prospective yield but could also contribute to long-term returns should it narrow.

abrdn Asian Income Fund Ord (LSE:AAIF)adopted a similar policy at the beginning of 2025, by introducing its own enhanced dividend policy to pay out 6.25% of NAV per annum, across four equal quarterly dividends. AAIF also has a notable allocation to tech companies, with TSMC as the largest holding at 14.5%, and Samsung Electronics also in the top five holdings at a 3% position. Even so, the trust has a good track record of dividend growth, having achieved 16 consecutive years of growing its dividend, however, this had on occasion required revenue reserves to sustain, albeit not for the past two financial years, which led to revenue reserves slipping to circa 39% of the annual dividend at the end of the 2023 financial year. Therefore, this new policy is an opportunity for the board to pay a high, but sustainable dividend. This appears to have had a positive early impact on sentiment, with the discount on the trust slightly narrowing shortly after the announcement, though the current level of circa 10% could still prove a compelling entry point.

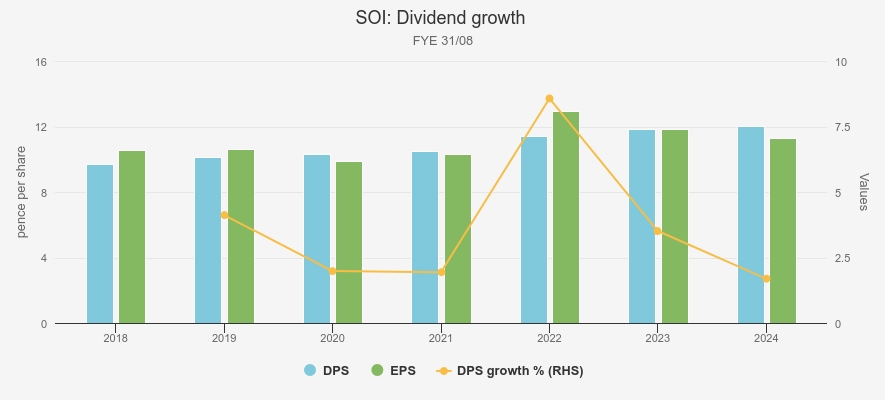

So far, we have only explored trusts with enhanced dividend policies, however, one Asia equity income trust that doesn’t utilise this strategy, but still has a substantial weight to tech companies, isSchroder Oriental Income Ord (LSE:SOI). Manager Richard Sennitt looks for firms generating attractive free-cash flow and good returns on equity which should enable them to deliver a sustainable and growing income over time. This has led to the portfolio having a notable overweight allocation to tech firms, which Richard believes will be a source of dividend growth over the coming years as they benefit from an increase in earnings and fundamentals.

In arecent note, the managers highlighted examples including TSMC, which has rewarded investors for backing its growth journey through a steady and consistent increase in dividends, which have risen by circa 45% over the past couple of years. Similarly, the trust holds Foxconn (which trades as Hon Hai Precision Industry Co Ltd DR (LSE:HHPD)), which has had steady dividend increases over the past five years, with the stock now yielding 3.1% despite the share price also more than doubling in that period. One attractive feature of the Asian tech sector is that many of the key companies do have a decent dividend policy, so a reasonable natural income can be earned from them, unlike from the likes of Apple and Nvidia.

As such, SOI is closing in on 20 years of consecutive dividend increases, which would earn it the AIC’s Dividend Hero status and make it the only Asia-focused trust on that list. The trust yields a respectable 4.3% on a historic basis, above the weighted average yield for the UK equity income sector and has sizeable revenue reserves to support the dividend in more challenging times.

SOI DIVIDEND TRACK RECORD

Source: Schroders. Past performance is not a reliable indicator of future results

Why Asia tech pays dividends

The fact that companies such as Foxconn and TSMC can still justify their place in an income portfolio raises an obvious question why do Asian tech companies tend to yield more than their US counterparts? One key reason is the industry make-up. As mentioned above, Asian firms tend to be more focused on the technology supply chain, including a sizeable portion in manufacturing. While this still offers high growth potential as wider demand increases, these areas tend to produce more reliable and cash-generative revenues. Meanwhile, the US firms are more focused on cutting-edge technology such as AI models, and as such, much of their excess cash generation is reinvested back into the business for further development and growth.

Beyond this, there are slight differences in investor culture between the two regions. The Asian market has a higher proportion of family and government ownership which has contributed to more of a dividend-paying culture. US investors on the other hand have more tolerance for future growth and therefore do not demand much in terms of income from their shareholdings. This has also led to a culture of firms returning capital to shareholders via buybacks instead of using dividends.

While this is a simplified overview, it is a factor that is likely to become more of a driver going forward. There have been several reforms in Asia designed to improve corporate governance, including the treatment of cash and payment of dividends. Inspired by Japan’s corporate governance reforms, South Korea has begun its own “value up” programme. Launched in 2024, one element of this programme is to encourage firms to pay higher dividends and increase their share buybacks as a way of boosting returns for investors. This has yet to gain significant traction but could become a factor going forward should it be more widely adopted.

There have been similar moves in China too, with the government looking to increase dividend payout rates and share buybacks in their domestic markets. They have used their state ownership of a number of companies to push for higher and more stable distributions, as well as encouraging share buybacks, particularly among well-known tech firms with considerable free-cash flow such as NetEase Inc ADR (NASDAQ:NTES) and JD.com Inc ADR (NASDAQ:JD). These reforms began in late 2023 and were expanded on in the stimulus measures of September 2024, with the aim for these firms to be leaders that others in the market will follow. As such, overall dividends have increased by circa 30% from 2023 to 2024, leading to the overall yield of the market to rise to its highest level for a number of years. As this becomes an increasing focus for the government, it is likely to be a factor in markets going forward.

Conclusion

Asian companies have become an increasingly dominant force in the global tech industry, and while the leading companies may not be on the same level of status as the household names in the US, they are arguably more critical to the sector’s supply chain. As such, they have been an increasingly attractive destination for investors which has led to strong share price gains. Despite this, Asian tech firms still offer compelling opportunities for income investors, due to their progressive dividend policies, cultural differences, and the emergence of regulatory factors that have pushed the importance of dividends, the latter of which could continue to support yields going forward.

Furthermore, many investment trusts have capitalised on the ability to use enhanced dividend policies to not only capture the exciting growth opportunity of the tech sector but also pay attractive dividends to shareholders.

As such, the Asia equity income sector could appeal to both income and growth investors, and with the current wide discounts available across much of the sector, and arguably attractive valuations in the region, this could prove a compelling entry point.

Kepler Partners is a third-party supplier and not part of interactive investor. Neither Kepler Partners or interactive investor will be responsible for any losses that may be incurred as a result of a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important Information

Kepler Partners is not authorised to make recommendations to Retail Clients. This report is based on factual information only, and is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

This report has been issued by Kepler Partners LLP solely for information purposes only and the views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment. If you are unclear about any of the information on this website or its suitability for you, please contact your financial or tax adviser, or an independent financial or tax adviser before making any investment or financial decisions.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. Persons who access this information are required to inform themselves and to comply with any such restrictions. In particular, this website is exclusively for non-US Persons. The information in this website is not for distribution to and does not constitute an offer to sell or the solicitation of any offer to buy any securities in the United States of America to or for the benefit of US Persons.

This is a marketing document, should be considered non-independent research and is subject to the rules in COBS 12.3 relating to such research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research.

No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not to be taken as advice to take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm's internal rules. A copy of the firm's conflict of interest policy is available on request.

Past performance is not necessarily a guide to the future. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is a limited liability partnership registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771.

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority.