Emerging market funds are back in form

Saltydog has bought a China fund to take advantage of strong momentum.

25th January 2021 13:13

by Douglas Chadwick from ii contributor

Saltydog has bought a China fund to take advantage of strong momentum.

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

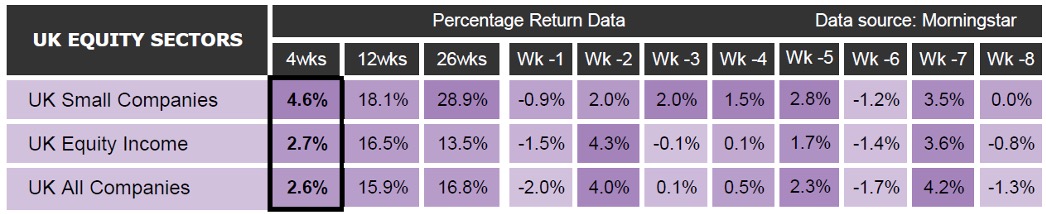

For the last couple of months, our main focus has been UK funds. In November, the UK Equity Income sector had the largest return and last month it was UK Smaller Companies. The UK All Companies sector has also had a good run. These sectors are in our ‘Steady as She Goes’ Group and over the last 12 weeks have seen returns ranging from 15.9% to 18.1%.

Past performance is not a guide to future performance

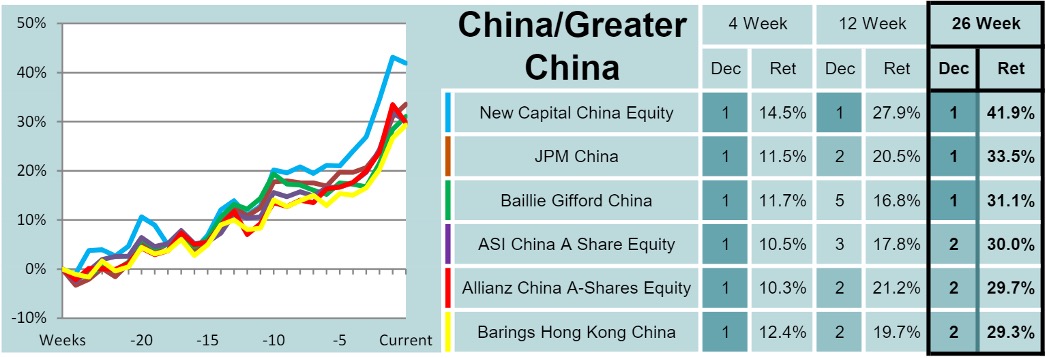

Until recently the UK Smaller Companies sector also had the best returns over four weeks. However, in our analysis last week the China/Greater China sector had moved into the lead, having gone up by 8.9% in the last four weeks.

Past performance is not a guide to future performance

The Global Emerging Markets sector was in second place, with a four-week return of 7.4%, and the combined Asia Pacific including Japan and Asia Pacific excluding Japan sectors were not far behind with a four-week return of 7.2%.

In the past, the emerging market sectors have been more volatile than the UK equity sectors. This means that we would only consider investing in them if their recent performance suggests that they are generating significantly greater returns. That has certainly been the case over the last four weeks.

Last week, our ‘Ocean Liner’ demonstration portfolio invested in the New Capital China Equity fund.

Funds listed in the table: New Capital China Equity, JPM China, Baillie Gifford China, ASI China A Share Equity, Allianz China A-Shares Equity, Barings Hong Kong China

Past performance is not a guide to future performance

It was at the top of our 26-week performance table for this sector, and has also done well over four and 12 weeks. In the last 12 months, it has gone up by nearly 80%.

China was the only major global economy that managed to grow in 2020. In the last three months of the year, GDP went up by 6.5%, which lifted the annual growth rate to 2.3%. Although that is the lowest figure for more than 40 years, it is still an impressive performance when you consider the disruption caused by the Covid-19 pandemic.

The International Monetary Fund has forecasted that the Chinese economy will grow by 7.9% this year. If that is the case, then it would seem likely that some of the funds investing in China will do well.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.