The emerging market country that’s flying and we are buying

11th October 2021 12:35

by Douglas Chadwick from ii contributor

Saltydog analyst has been increasing exposure to a country that’s forecast to be the fastest growing next year.

September was a disappointing month for most developed economies. The US stock markets suffered their worst losses since last March, which was when they first really woke up to the likely consequences of the Covid-19 outbreak.

Last month, the Dow Jones Industrial average fell by 4.3%, the S&P 500 was down 4.8%, and the Nasdaq lost 5.3%. Unfortunately, what happens in the US tends to have knock-on effects all around the world.

In the UK, the FTSE 100 was lucky to get away with only losing 0.5%, but the FTSE 250 did not do as well, falling by 4.4%. Over the channel, the Paris CAC 40 was down 2.4%, while the Frankfurt DAX dropped by 3.6%.

- How Saltydog invests: a guide to its momentum approach

- Fund flows booming, but investors turning cautious

- Top 10 most-popular investment funds: September 2021

On the whole, emerging markets did better, with the Shanghai Composite, Mumbai Sensex and Moscow RTSI all making gains. Unfortunately, the Hong Kong Hang Seng and São Paulo Ibovespa let the side down, one fell by 5% and the other was down 6.6%.

The Japanese Nikkei 225 bucked the trend, gaining 4.9% in September, but gave nearly all of that back from 1 October to 8 October as the index declined by 4.8%.

| Stock Market Indices 2021 | ||||||

| Index | 1st Jan to 31st March | 1st April to 30th June | July | Aug | Sept | 1st Oct to 8th Oct |

| FTSE 100 | 3.9% | 4.8% | -0.1% | 1.2% | -0.5% | 0.1% |

| FTSE 250 | 5.0% | 4.0% | 2.6% | 5.0% | -4.4% | -2.1% |

| Dow Jones Ind Ave | 7.8% | 4.6% | 1.3% | 1.2% | -4.3% | 2.7% |

| S&P 500 | 5.8% | 8.2% | 2.3% | 2.9% | -4.8% | 1.9% |

| NASDAQ | 2.8% | 9.5% | 1.2% | 4.0% | -5.3% | 0.9% |

| DAX | 9.4% | 3.5% | 0.1% | 1.9% | -3.6% | -0.4% |

| CAC40 | 9.3% | 7.3% | 1.6% | 1.0% | -2.4% | 0.6% |

| Nikkei 225 | 6.3% | -1.3% | -5.2% | 3.0% | 4.9% | -4.8% |

| Hang Seng | 4.2% | 1.6% | -9.9% | -0.3% | -5.0% | 1.1% |

| Shanghai Composite | -0.9% | 4.3% | -5.4% | 4.3% | 0.7% | 0.7% |

| Sensex | 3.7% | 6.0% | 0.2% | 9.4% | 2.7% | 1.6% |

| Ibovespa | -2.0% | 8.7% | -3.9% | -2.5% | -6.6% | 1.7% |

| RTSI | 6.5% | 12.0% | -1.7% | 3.6% | 5.6% | 4.7% |

Data source: Morningstar. Past performance is not a guide to future performance.

The Indian Sensex is the only index in our table that went up in July, August, and September. July was only a modest 0.2% gain, but in August it shot up by an impressive 9.4%. In September, it only added another 2.7%, but when you consider how many other indices made losses that is still a good result. So far this year, it has gone up by over 25%.

The Indian economy struggled, along with other countries, when the first wave of the coronavirus spread around the world at the beginning of last year. Then in October, the Delta variant, which was first discovered in India, led to a massive second wave of Covid-19 cases in the country that then spread globally.

- Top 20 funds in the third quarter of 2021

- Don't be shy, ask ii...how do I tidy up my investment portfolio?

Last year, the Indian economy contracted by 7%. However, the situation is now improving and in the United Nations latest Trade and Development Report, released last month, India was forecasted growth of 7.2% in 2021. That is the second highest in the world, after China, and the report went on to suggest that the Indian economy would be the fastest growing in 2022.

The Investment Association (IA) has recently launched an India/Indian Subcontinent sector, but before that the funds investing in this region were in the Specialist sector.

In our Saltydog weekly analysis, we have always used our own sub-zones to help classify the funds in the Specialist sector.

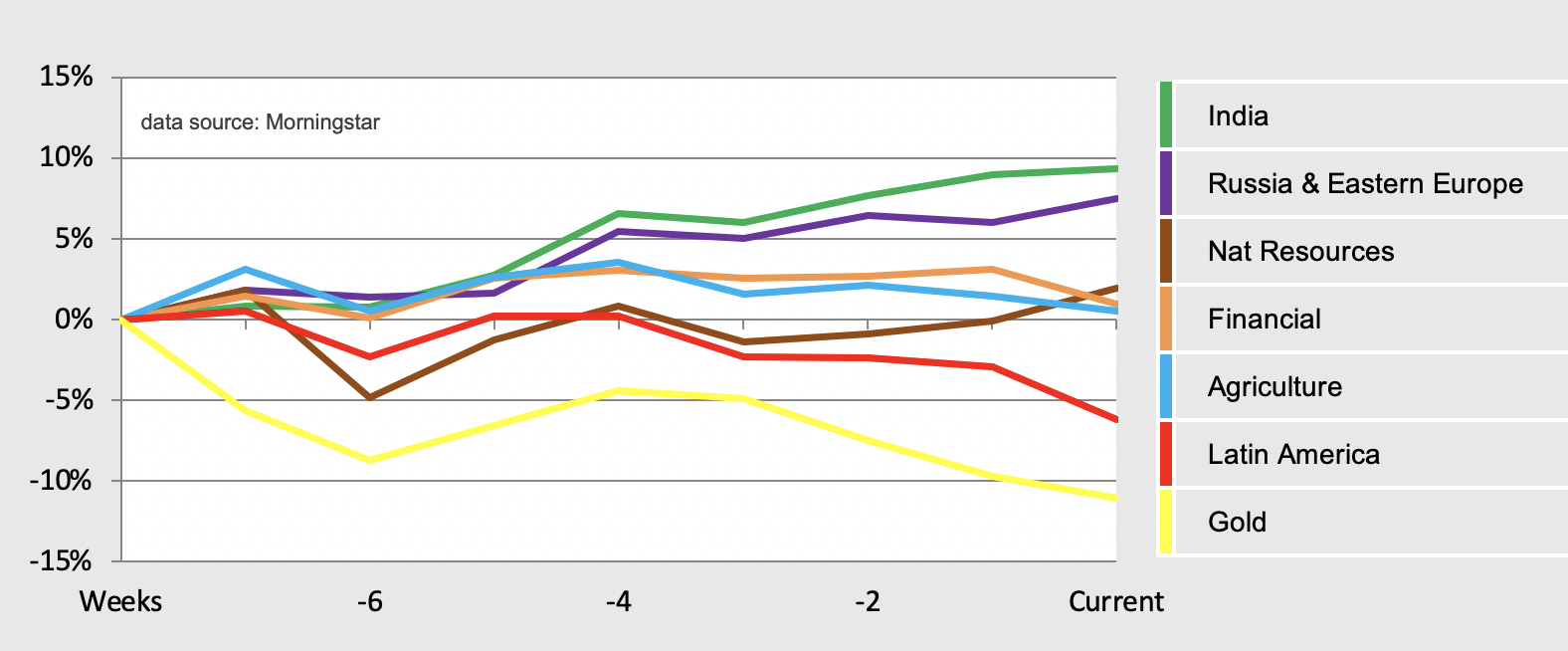

Here's a graph showing how they performed in the eight weeks leading up to the end of September.

Past performance is not a guide to future performance.

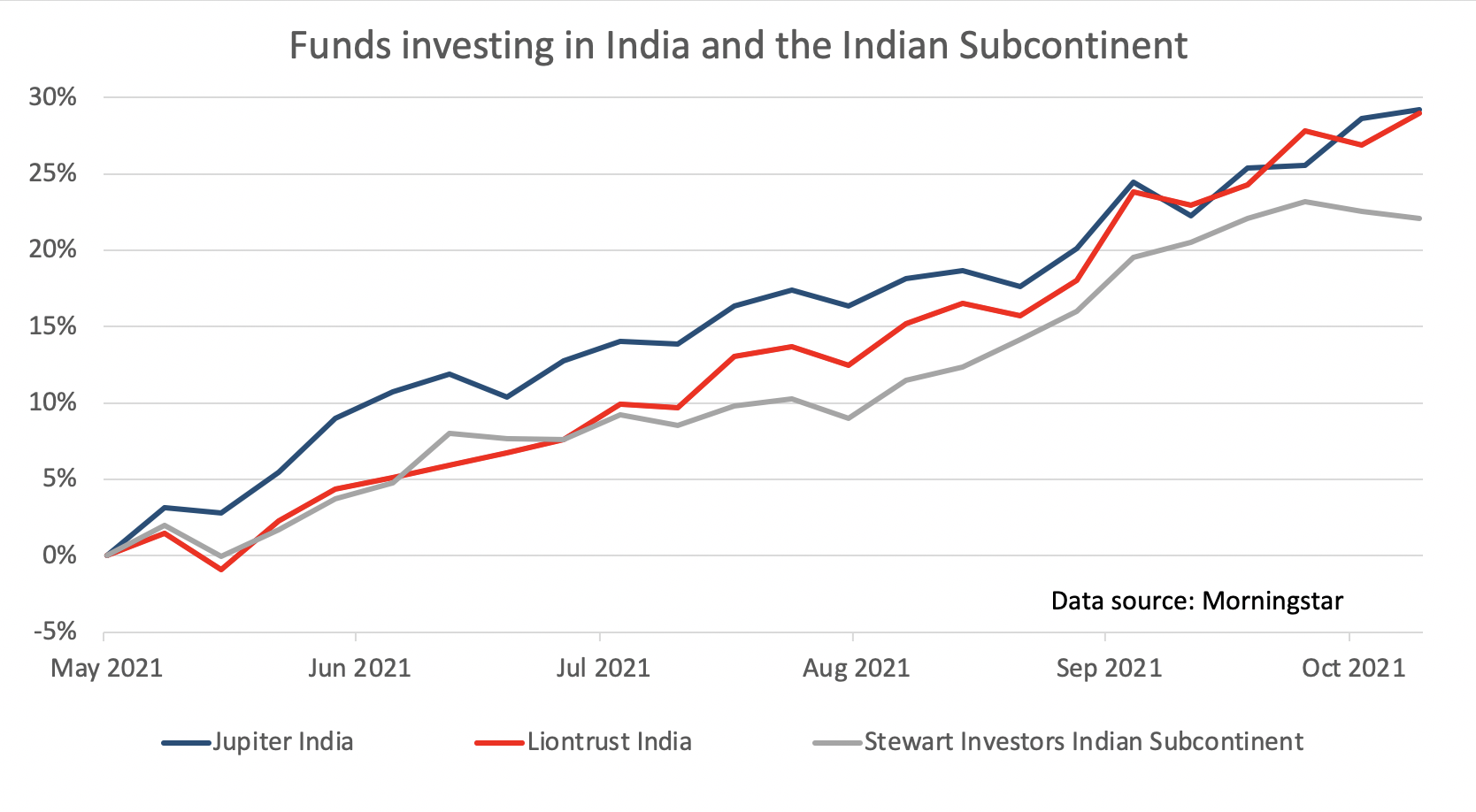

The funds in the India sub-zone have been performing well for some time. Our Ocean Liner portfolio invested in the Jupiter India fund at the beginning of August, and it is now up over 9%. Last week, we increased our holding, and our Tugboat Portfolio also made a small investment in this fund.

There are three funds that we track in our India sub-zone. They are Jupiter India, Liontrust India and Stewart Investors Indian Subcontinent.

Here is a graph showing how they have performed since the beginning of May.

Past performance is not a guide to future performance.

Another sub-zone that has caught our attention is Russia and Eastern Europe. We have not put any money into funds investing in this region yet, but they have been a topic of discussion in our recent weekly portfolio reviews.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.