Don’t Stop: Fleetwood Mac hits snapped up by Hipgnosis

10th August 2021 10:50

by Nina Kelly from interactive investor

Investment trust buys Christine McVie catalogue amid streaming surge, as Hipgnosis founder says ‘songs are an asset class with an incredible future’.

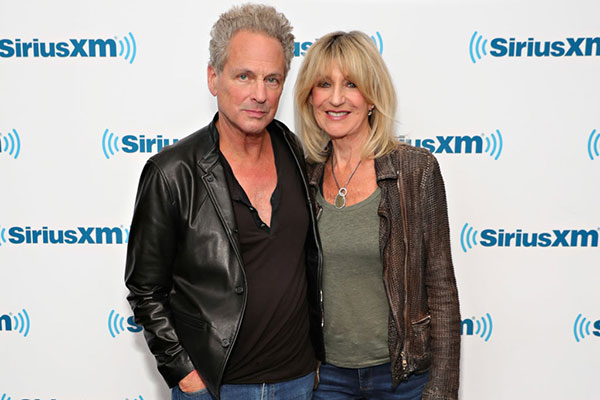

Pic credit: Christine McVie pictured with Lindsey Buckingham

Fleetwood Mac singer-songwiter Christine McVie, who wrote hits for the band including Don’t Stop, Little Lies and Everywhere, has sold her music catalogue to Hipgnosis Songs (LSE:SONG) for an undisclosed sum.

The £1.4 billion investment trust, which “offers investors a pure-play exposure to songs and associated musical intellectual property rights”, bought 115 songs, which includes McVie’s hits Songbird and You Make Loving Fun.

Last year, McVie’s share of the royalties from her song catalogue totalled $1.7 million (£1.2 million).

Hipgnosis’ catalogue boasts works by fellow Fleetwood Mac star Lindsey Buckingham, Mark Ronson, Shakira, and Neil Young.

Commenting on the acquisition of McVie’s work, Merck Mercuriadis, founder of Hipgnosis, said: “Eight of the 16 songs on Fleetwood Mac’s Greatest Hits albums are from Christine…Between Christine and Lindsey [Buckingham], we now have 48 of 68 songs on the band’s most successful albums.”

Snapshot of an alternative income trust

Hipgnosis sits in the Association of Investment Companies (AIC) Royalties sector, alongside its only peer at present, Round Hill Music Royalty (LSE:RHM), which floated on the London Stock Exchange last November.

In June 2021, Hipgnosis announced plans to raise £150 million from investors to add more songs to the thousands that it already owns, and was oversubscribed.

- Ian Cowie on a music royalties investment trust that has won over analysts

- Trust tips: 20 picks for adventurous and conservative portfolios

Year to date, the trust has returned 5.8% in share price total return terms, according to the Association of Investment Companies, and 32.4% over three years. Five-year figures are unavailable since the trust launched in 2018. The trust has a dividend yield of 4.3% dividend yield, and is currently trading on a 4.1% premium to its net asset value (NAV).

In Hipgnosis’ 2021 annual report, which was published last month and covers the year to the end of March, the trust reported a total NAV return in dollar terms of 15.7% (which included dividends) to the end of March 2020. Since launch, its total NAV return stands at 40.7%.

The company paid total dividends of 5.125 pence, with plans to deliver a 5.25p dividend in the current financial year ending 31 March 2022.

A TikTok boom and music as a resilient asset class

While national lockdowns owing to Covid-19 prevented music lovers from attending live concerts and festivals, it was, of course, no barrier to streaming music and FTSE 250-listed Hipgnosis said that higher streaming demand during the pandemic helped it offset losses from other income source, while royalties from emerging social platforms such as TikTok, Peloton (NASDAQ:PTON), and Triller, gave it a boost.

In Hipgnosis’ 2021 annual report, Mercuriadis said that: “There are now over 100 million homes in the US alone that are paying for a premium music streaming service…Songs are very much an asset class with an incredible future.”

- Should investors prepare for an autumn market correction?

- Retail investors move to protect against rising inflation

The annual report notes that: “Driving this surge in engagement are the ‘silver streamers’, the 55+ age group who, following the 12% increase in digital entertainment time afforded by the pandemic-driven lockdowns, now dominate music and TV streaming engagement by virtue of their size and willingness to engage in seemingly digital-native behaviours (MIDiA Research).

“For Hipgnosis, this engagement translates into a higher royalty per stream given this demographic are listening to music on paid-for platforms such as Spotify Premium and Amazon Prime compared to the ‘Gen-Z’ demographic who consume via YouTube, which is predominantly ad-supported.”

The future looks bright for Hipgnosis in emerging markets, too, as numbers streaming in Africa, India and China grows.

‘A full reset of streaming in law’

Last month, Mercuriadis welcomed the recommendation of a UK parliamentary committee report on the music streaming industry that supports higher payments to artists.

The Digital, Culture, Media & Sport Select Committee recommended the government refer the sector to the Competition & Markets Authority, so the watchdog can perform a full industry probe.

- Subscribe for free to the ii YouTube channel for all our latest interviews

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

Mercuriadis said: “We are particularly focused on their recommendations that there be a full reset of streaming in law that gives songwriters and artists a fair share of the earnings.”

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.