Dogs of the Footsie 2017: How our 10 shares yielding 5% plus are faring

22nd May 2017 10:16

by Heather Connon from interactive investor

Our 2017 Dogs have got off to a flying start: the first quarterly update for the 2017 portfolio of unloved companies shows that they are already comfortably ahead of the index, despite the fact that some of them put in a faltering performance.

Regular readers will know that the Dogs of the Footsie strategy picks out-of-favour companies based on their dividend yields. It is one of our most successful investment approaches, beating the index over one, three, five and 10 years based on statistics up to the end of 2016.

Outpacing benchmark

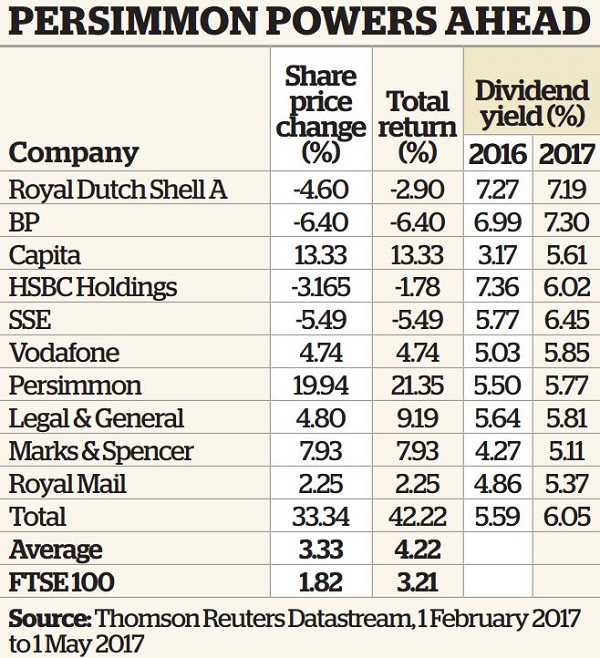

We are now starting to give quarterly updates, and the performance in this first update for the 2017 portfolio is encouraging. Overall, the Dogs recorded a 3.3% rise in share price terms between February and May, compared with 1.8% for the FTSE 100. On a total return basis, taking account of dividend payments, the gap was narrower; but at 4.2% the Dogs were still ahead of the 3.2% achieved by the index as a whole.

The runaway winner was housebuilder , with a total return of more than 21%, helped by an unexpectedly large dividend increase and a trading update showing an 11% boost in forward orders.

In second place was , the outsourcing and services company, which managed a 13% total return despite a gruesome set of results for 2016, the announcement that its chief executive will be leaving in the autumn and its ejection from the FTSE 100 - the first time a Dogs constituent has suffered that ignominy. That illustrates one of the characteristics of the Dogs strategy: when companies fall out of favour, their shares can often fall much more sharply than warranted, so the rebound can also be generous once investors have digested the bad news and started to look to the future.

The good performance from these two was enough to compensate for the four fallers in the portfolio: , which struggled in last place with a 6.4% loss in total return terms, fellow oil major , utility company and banking giant . However, there is still time for them to recover and make a positive contribution for the year as a whole.

Start at any time

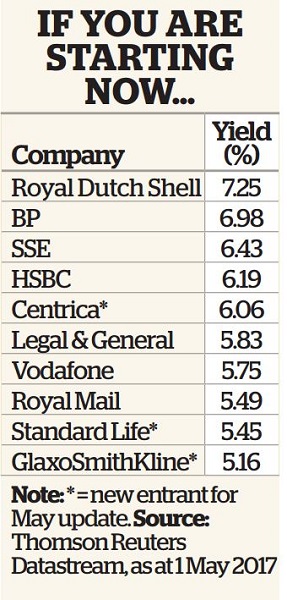

It is straightforward to construct your own Dogs portfolio and it can be started at any time. The Dogs are the 10 companies in the FTSE 100 index with the highest yield, and you should split your total investment equally between them. You should exclude any companies where a dividend cut has officially been announced but not yet implemented.

However, companies should be included if analysts and investors are merely predicting a cut - that may not happen, and past experience with the portfolio shows that, even if it does, the share price can rebound sharply when the cut is confirmed.

You should buy all 10, even if you do not like some of them, and hold them for a year. As the performance of the current portfolio shows, that means there will be enough diversification to ensure that poor performances by some of the constituents will be outweighed by rises elsewhere - as happened in the first quarter of this year.

We will not be changing our portfolio during the quarterly reviews, as the strategy is based on staying invested for the entire year. But those who wish to start the strategy now can compile their own list of the highest yielders using screening tools available on financial websites such as Interactive Investor.

If you are starting now, the portfolio will not be that different from our current 2017 kennel. There are just three new entrants: the energy supplier , which like SSE has been rattled by the Conservatives' election pledge of a cap on electricity prices; , whose shares have fallen despite - or perhaps because of - plans to merge with ; and , an historic Dogs regular. These would replace Capita, which is no longer a FTSE 100 constituent, and and Persimmon, whose yields now rank below the Footsie's top 10 yielders.

Capita Asset Services points out in its latest Dividend Monitor that the fall in the value of sterling since last year's referendum vote to leave the European Union means that, overall, dividends from UK plc rose by 16.2% in the first quarter of the year; but excluding currency effects they saw a slight fall.

No one can accurately predict what will happen to currencies, but it seems likely that the one-off depreciation of last year will not be repeated and may reverse.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.