Could Vodafone shares really be worth 265p?

14th November 2018 14:17

by Graeme Evans from interactive investor

They've sunk 40% in 2018, but some think Vodafone shares could one day trade at prices not seen for 18 years. Graeme Evans explains.

With the nightmare scenario of a Vodafone dividend cut out the way, investors were sitting a little more comfortably today as analysts began to talk up the company's prospects under new boss Nick Read.

Shares had been down as much as 40% this year, until yesterday's reassuring half-year results commentary from Read eased fears that a rising debt pile could jeopardise pay-outs from the most valuable income stock in the FTSE 100 Index.

Analysts at Barclays said that it looked to be the "end of the downgrades" from Vodafone, which they rate as overweight with a price target of 220p. Deutsche Bank is even more upbeat at 265p, a level that is marginally higher than the post-dotcom crash records achieved by Vodafone in 2014 and 2015.

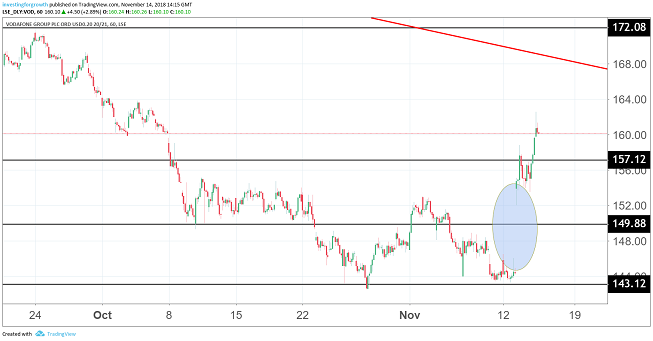

Their optimism helped lift shares another 3% to back above 160p, having risen by 8% yesterday in the wake of the results. The blue-chip stock started the year at more than 230p but has moved steadily lower on fears about the dividend, which has not been cut since it was first introduced in 1990.

Vodafone (one-hour chart). Source: TradingView (*) Past performance is not a guide to future performance

It is thought that Vodafone accounted for £1 of every £14 paid by listed companies over the past decade. But with the share price yielding as much as 10%, there were clear signs that the market thought this was under threat.

Deutsche's Robert Grindle said: "Even this analyst started to doubt his sanity in the face of what the market was implying about the group's dividend with the yield approaching 10%.

"In the event, Q2/H1 results (slightly ahead) alongside robust FY guidance and a reiterated dividend, extinguished at least some investor concerns."

Until top-line growth recovers, Grindle thinks the market will continue to fret about Vodafone's ability to sustain its dividend.

However, he said the strategy announced by Read in relation to cost controls, capital expenditure, higher returns from infrastructure assets, and business simplification all looked to be supportive of the long-term dividend.

Grindle said:

"We anticipate that a more illuminated appraisal of Vodafone's prospects should see further share price gains."

Yesterday's half-year results showed a 3% rise in underlying earnings, driven by cost discipline and operational momentum outside Spain and Italy.

Barclays viewed this as an encouraging sign that Vodafone is able to withstand the impact of competitive pressures on its cash flows and dividend.

They said: "Dividend concerns have understandably picked up in recent months due to increased price competition and FX (earnings downgrades) and higher leverage (spectrum costs and M&A).

"In providing a hard three year net cost target for Europe, we believe management has provided a cushion for free cash flow in the face of lower revenues and hence should be able to keep a flat dividend."

Barclays estimates that Vodafone trades on a 2020 enterprise value to underlying earnings multiple of just 6%.

*Horizontal lines on charts represent levels of previous technical support and resistance. Trendlines are marked in red.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.