Is this conservative stock worth buying?

Its slow and steady approach might be sensible just now, and the booming shares are still cheap-ish.

13th September 2019 15:29

by Richard Beddard from interactive investor

Its slow and steady approach might be sensible just now, and the booming shares are still cheap-ish.

Tell me about Colefax, its an old fave isn't it?

Old, yes, I've been following it since the beginning of the decade. Fave? Not so much.

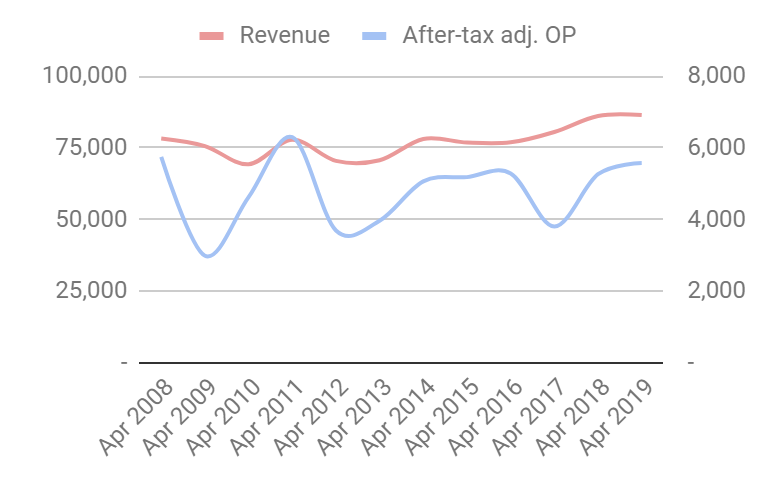

There are two essential components to the Colefax (LSE:CFX) story. It's not growing convincingly:

On the face of it, the company has done little to grow bar refreshing its ranges of posh fabric and wallpaper each year. It has not launched a new range since I have been following it, and has not acquired a smaller rival since Manuel Canovas in the last millennium.

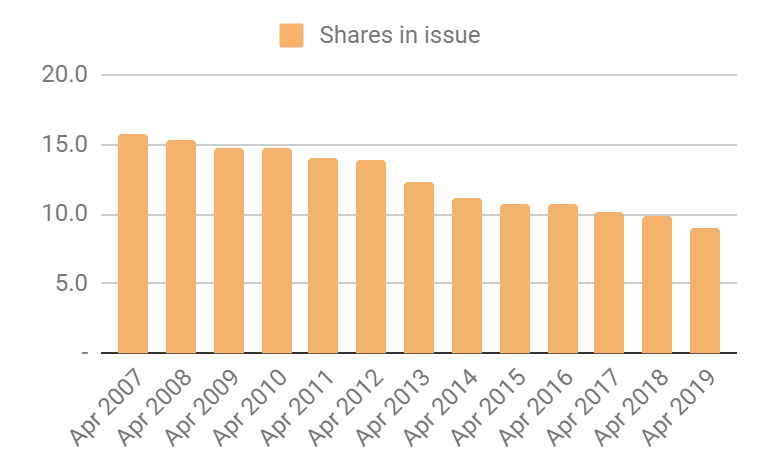

Instead, Colefax has sought to boost returns to shareholders by buying back shares which boosts the value of the shares of committed shareholders because they own a bigger proportion of the firm.

Ah! Financial engineering. Does it work?

Seems to. Between April 2007 and April 2019, the company has reduced its share count by 75% from 15.7 million to 9 million. Over the same period, the share price has increased by 133%. In absolute terms, profit in 2019 is actually marginally lower than it was in 2007, but in terms of earnings per share it is higher.

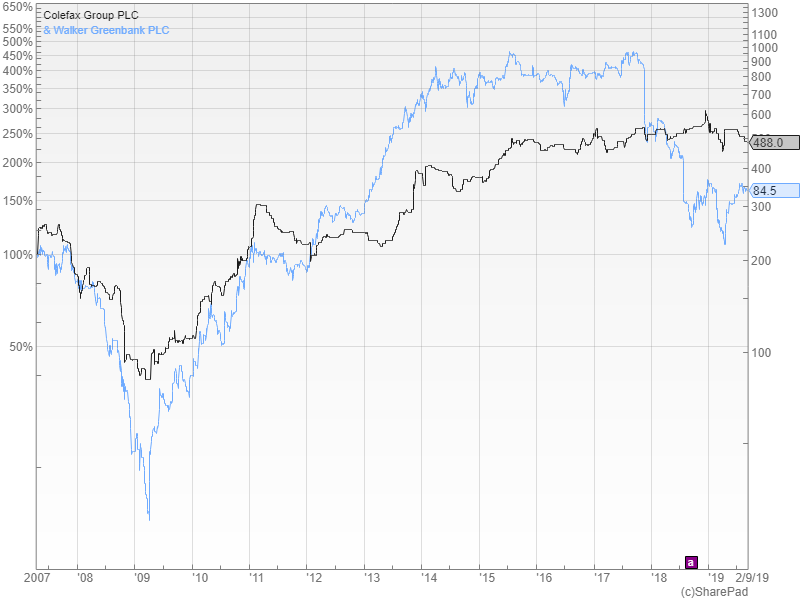

Comparing the share prices of Colefax and its rather more excitable rival Walker Greenbank (LSE:WGB), which has given shareholders acquisitions and new patterns, floods and fires, and significant growth and contraction, there may be something to be said for the slow and steady approach - especially over the long-term...

So what do you make of it? Why is Colefax buying back shares rather than investing in growth?

The investment opportunities are not that attractive. The company explains that the luxury fabric business is fragmented, there are lots of small family businesses, but they do not want to sell, or at least they do not want to sell at a reasonable price. I imagine launching a completely new range is expensive and risky too. It is easier just to buy back shares, grow the existing brands if it can

OK, but it owns famous brands, Colefax and Fowler, Cowtan & Tout etc., it's keeping them up to date, learning more each year. Shouldn't it be growing anyway?

Well, in one sense, yes, you would think so. Its biggest market by far is the USA, where the Fabric Division earned 57% of revenue in 2019. The US economy has been growing for a long time. Government policies have generally made wealthy people wealthier. The pound has devalued substantially against the dollar, which should make its fabric and wallpaper, sourced from suppliers in the UK and Europe, more competitive against local opposition. You can see that revenue has risen over the last three years.

But Colefax has been hampered somewhat by its own hedging policy, which has effectively fixed the exchange rate higher than the levels it has subsequently dropped to, so profit hasn't risen like revenue. The economic backdrop appears to be worsening too. In 2019, the company says, demand in the US may have been affected by reductions in mortgage and property tax reliefs. In the UK, where sales are in decline, Colefax says higher rates of stamp duty and Brexit have stymied the high-end property market. People tend to redecorate when they buy a new house, hence Colefax is sensitive to the level of activity in the housing market.

As well as designing fabric and wallpaper, Colefax operates two much smaller businesses, a decorator, and Kingcome Sofas, you can probably guess what Kingcome supplies. The decorating business lends unpredictability to the results, because the projects it works on are big (mansions in fact), and if the company finishes a few big projects in the same year the impact on profit can be significant. The year ending in 2019 was exceptionally good for decorating, which made up for lower profits from selling fabric and wallpaper.

I sense the metronomic buy-backs are not sufficient to assuage your doubts about Colefax, Richard...

You may be right. Sometimes I am happy to hold companies that are not obviously growing in the hope they might surprise us, but only if they are highly profitable and undervalued. The trouble is, Colefax is only adequately profitable, and I do not see much prospect for change. The company has been run by its executive chairman and majority shareholder David Green since time immemorial (he became chief executive in 1986).

So what are the scores on the doors?

It is not a bad business by any means, but it is not a great one either.

Does Colefax make good money?

In 2019, Colefax earned a 9% return on capital, which is typical and not particularly high, although it earns a similar cash return.

Score: 1

What could prevent it from growing profitably?

Its own conservatism, which may of course be well founded. The inevitabilily of recession sometime and tariffs following Brexit are also a concern. The company uses suppliers in the EU, and exports to it.

Score: 1

How will it overcome these challenges?

It is buying back shares to increase the per-share value of its shareholders' holdings. It is also planning to reduce overheads by moving some operations from central London and New York into the suburbs and in recent years it has been taking more control of distribution - opening its own showrooms where previously it used distributors (particularly in the USA).

Colefax believes it's five high-end brands are sufficiently diversified in terms design (English Country House and contemporary) and price point (luxury and super luxury) to insulate it somewhat from shifts in fashion and circumstance. Manufacturing is outsourced too, reducing fixed costs which may be a good thing in a downturn. To help maintain exclusivity, it focuses on selling fabric to designers and decorators and restricts supply to Internet retailers.

Score: 1

Will we all benefit?

We all benefit from the buybacks, but beyond that Colefax is a bit of a closed book. The executives earn high salaries, and they are not augmented by incentive plans. In one sense this is a good thing, as incentive plans are often a cover for even higher pay, but in another sense the lack of incentives may be connected to a lack of ambition.

Score: 1

Are the shares cheap?

Ish. A share price of 488p values the enterprise at about £75 million, or 13 times adjusted profit. The earnings yield is 7%.

Score: 1.7

A score of 5.7/10 is not sufficient to recommend Colefax for the long-term.

Richard owns shares in Colefax

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.