The compelling case for mid-caps

27th April 2023 10:53

by Anjli Shah from Aberdeen

We explain why we believe there is a compelling case for a dedicated allocation to global mid-cap equities.

Key takeaways

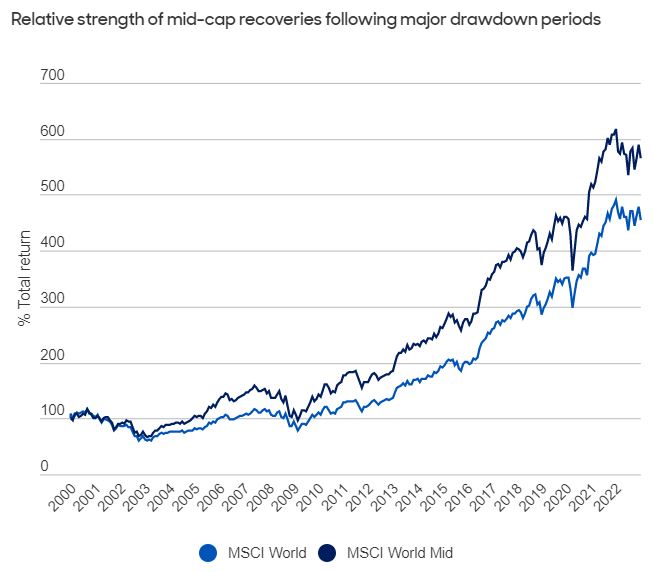

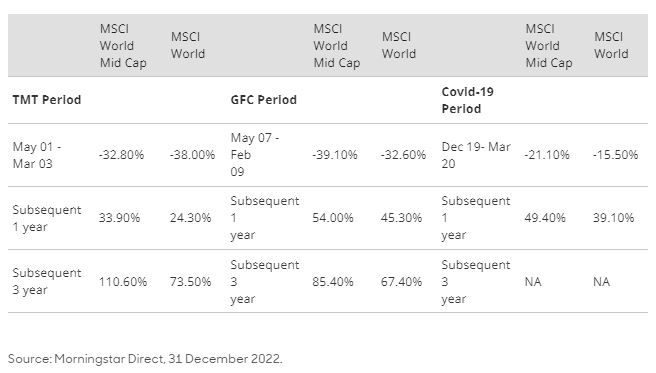

Global mid-caps have historically outperformed large caps, including following market selloffs.

Many mid-caps typically sit on the ‘sweet spot’ of the company lifecycle – offering the similar growth potential of small caps with a risk profile more like large caps.

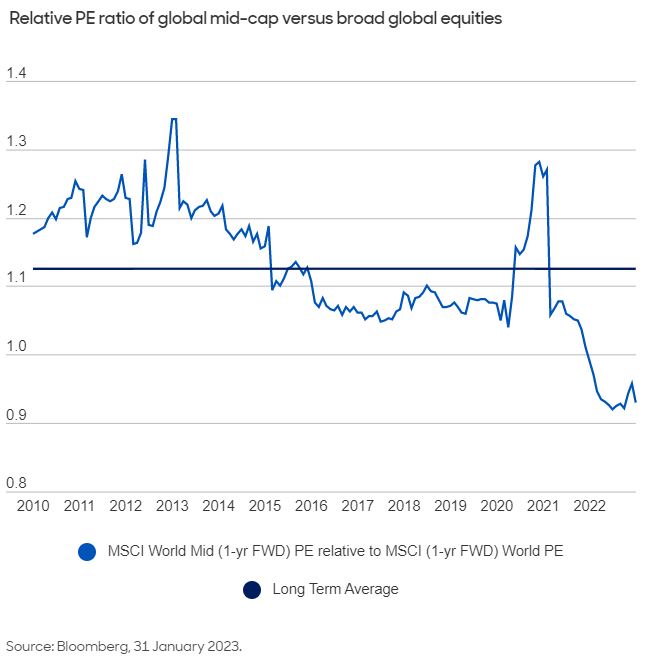

Current valuations are attractive on a relative and historical basis.

Like most risk assets, global mid-cap equities endured a tough 2022. In 2023 so far, they have participated in a tentative recovery. Nonetheless, the global economic backdrop – characterised by weaker growth, elevated inflation, and rising interest rates – remains challenging. Despite this, we think the current environment is an opportune time for investors to consider a more dedicated allocation to mid-cap equities.

We cover the numerous reasons in our latest paper The compelling case for a dedicated allocation to mid-cap equities. However, before you read that, here’s a quick run through the evidence.

Global mid-caps – a brief recap

As the name suggests, mid-cap equities are between large caps and small caps in terms of market capitalisation. Looking at the MSCI All Country World Index (ACWI), large caps represent the biggest segment – 70% of the total market cap. At the other end of the scale, small caps make up 15% of the total index market cap, with mid-caps accounting for the middle 15-30% of the entire global equity market cap1.

However, it’s important to understand that while mid-caps are smaller than large caps, they’re not small. In the global equities context, the average market cap of global mid-caps is US$6.1 billion (bn). This is more than four times the average global small-cap size of US$1.3bn, but just a fraction of the average global large-cap size of US$32.6bn2.

Structural attractions

In terms of risk/return characteristics, global small caps outperform broader global equities and large caps over the long run3. This, though, is at the expense of more risk. Global mid-caps occupy the middle ground. They outperform large caps and trail small caps, but with considerably lower volatility than the latter.

Furthermore, mid-cap companies combine the attractive traits of both large caps and small caps. Like large caps, mid-cap businesses tend to be diversified in terms of products/business lines and regions. This can provide an element of earnings stability. Additionally, the global mid-cap segment contains many recognised, high-quality companies with proven product and service offerings, which can give a degree of pricing power in tougher times. On the flip side, like small caps, mid-caps tend to have more unexplored organic growth opportunities and greater operational flexibility (including the ability to scale up or down) depending on prevailing conditions.

Given these factors, mid-caps typically sit on the ‘sweet spot’ of the company lifecycle. As you can see from the blue-shaded area below, they tend to be early-to-midlife companies – they are often sufficiently well-established to avoid some of the greater risks of small-cap companies, while at the same time have ample growth opportunities and less risk of demand obsolescence/saturation risk that can affect large-cap companies. That’s why a mid-cap allocation within a global equity portfolio can help investors diversify.

Even with these positives, mid-cap equities are a relatively under-researched part of the market, with global equity investors potentially under-allocating to the asset class. This creates significant opportunities for active investors.

Why now?

Aside from the structural benefits, we think there’s also a case for global mid-cap equities in the current economic and market environment.

Firstly, as a sector, global mid-caps are full of premier companies, with robust balance sheets and good pricing power. This means there’s a large (cross-sector) pool of global companies that are equipped to deal with today’s challenging economic climate.

Secondly, as shown below, the historically attractive long-term returns of global mid-caps are supported by their track record of bouncing back ahead of large caps, following major drawdown periods.

Thirdly, global mid-caps are trading at relatively attractive valuations. As shown below, global mid-caps have typically traded at a premium valuation relative to broader global equities. Since 2015, they’ve been even cheaper, with a notable increase in the size of the discount in the past two years.

Final thoughts

We believe the case for global mid-caps is clear. They offer the higher growth potential of small caps but with the more controlled risk of large caps. These are ideal dynamics for those looking to diversify their broader equity portfolio. Furthermore, the mid-cap sector is home to numerous leading companies, with robust balance sheets and proven earnings capabilities. This means that many are resilient in the current climate. And yet despite these factors, analyst coverage of mid-caps is relatively poor – creating excellent opportunities for active investors. Finally, relative valuations are presently attractive, with global mid-caps offering an increased discount to global equities.

The MSCI information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis, should not be taken as an indication or guarantee of any future performance analysis forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI” Parties) expressly disclaims all warranties (including without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages (www.msci.com) Morningstar ©2023 Morningstar. All Rights Reserved.

The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results. For more detailed information about Morningstar’s Analyst Rating, including its methodology, please go to: http://corporate.morningstar.com/us/document The Morningstar Analyst Rating for Funds is a forward-looking analysis of a fund. Morningstar has identified five key areas crucial to predicting the future success of a fund: People, Parent, Process, Performance, and Price. The pillars are used in determining the Morningstar Analyst Rating for a fund. Morningstar Analyst Ratings are assigned on a five-tier scale running from Gold to Negative. The top three ratings, Gold, Silver, and Bronze, all indicate that our analysts think highly of a fund; the difference between them corresponds to differences in the level of analyst conviction in a fund’s ability to outperform its benchmark and peers through time, within the context of the level of risk taken over the long term. Neutral represents funds in which our analysts don’t have a strong positive or negative conviction over the long term and Negative represents funds that possess at least one flaw that our analysts believe is likely to significantly hamper future performance over the long term. Long term is defined as a full market cycle or at least five years. Past performance of a security may or may not be sustained in future and is no indication of future performance. For detailed information about the Morningstar Analyst Rating for Funds, please visit http://global.morningstar.com/managerdisclosures

- MSCI Indices, December 2022

- Source: MSCI ACWI Large Cap, MSCI ACWI Mid Cap and MSCI ACWI Small Cap index factsheets, 28 March 2023

- From 2001 to 2022, MSCI World Mid index returned 315% versus 221% for MSCI World Index and 202% for MSCI World Large Index (Source: Morningstar Direct)

Anjli Shah is Investment Director at abrdn

ii is an abrdn business.

abrdn is a global investment company that helps customers plan, save and invest for their future.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.