This company’s shares are up nearly 200% this year, thanks to bitcoin

An interesting tactic means this firm currently owns more bitcoin than any other publicly traded company. Will it remain a top performer?

18th October 2024 11:07

by Jonathan Hobbs from Finimize

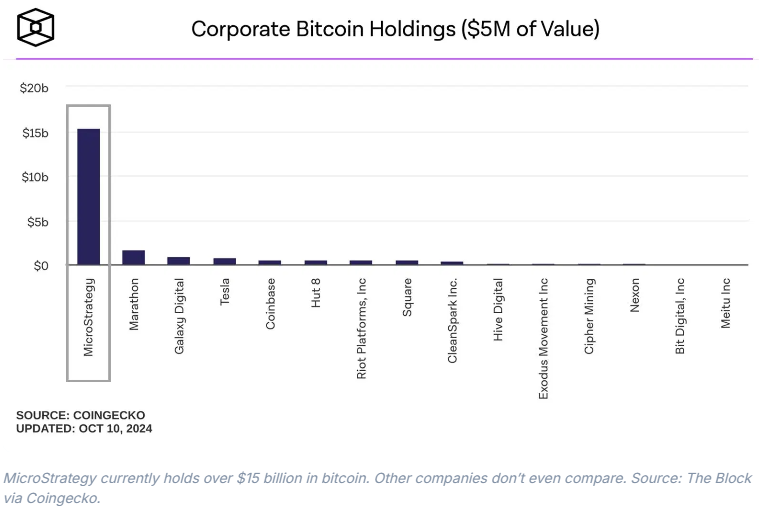

MicroStrategy currently holds more than 250,000 bitcoins (about 1.2% of the crypto’s existing supply) as part of its corporate treasury. It acquired a lot of them with borrowed funds – by issuing “convertible” notes to institutional investors.

The convertible notes offer folks more upside than regular corporate bonds, since investors can convert the notes into MicroStrategy stock at a discount if the company does well. That upside potential has attracted more investors.

By funneling bond market liquidity into bitcoin, MicroStrategy has created a feedback loop that is working nicely in its favor (for now). But the company’s future success is heavily tied to the price of bitcoin.

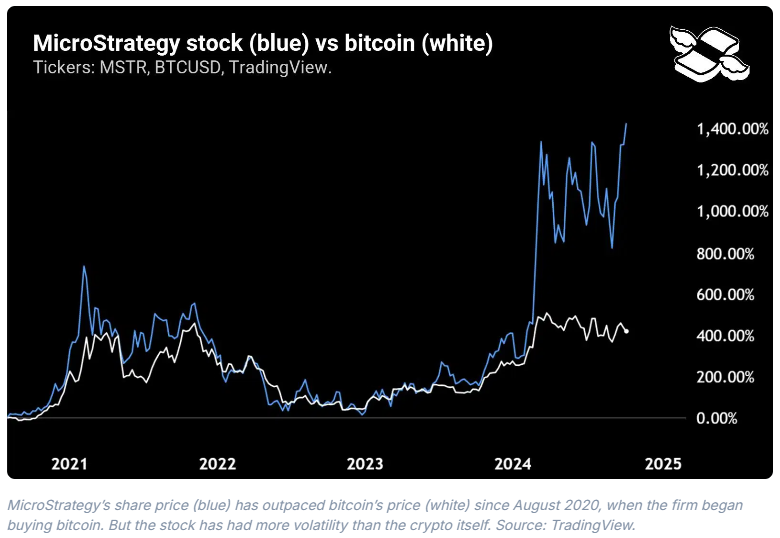

MicroStrategy Inc Class A (NASDAQ:MSTR) is a software developer, sure, but it’s also one of the world’s biggest bitcoin holders – having used an interesting “convertible note” tactic to acquire a ton of its coins. Co-founder Michael Saylor’s intriguing bitcoin playbook has made the company’s stock a top performer, with its share price up almost 200% this year alone.

So here’s how the plan works, along with a potential opportunity for you.

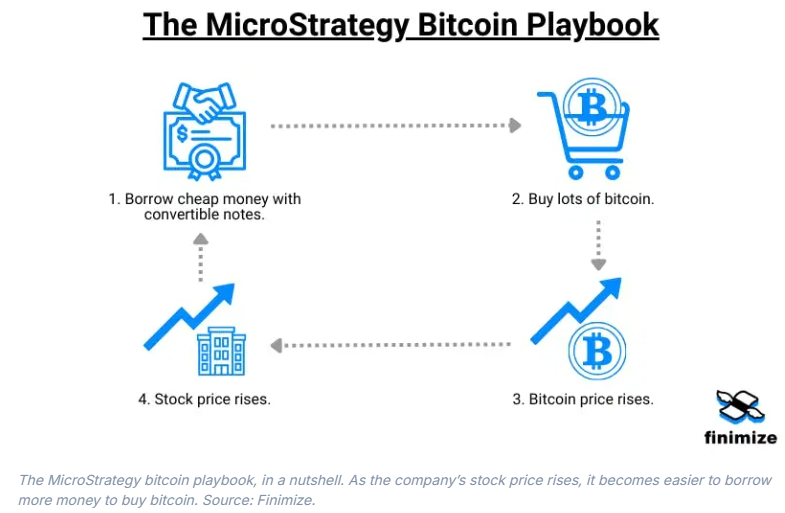

How does this convertible note bitcoin strategy work, then?

Back in August 2020, MicroStrategy started hoarding bitcoin for its corporate treasury as part of its core business strategy. According to tracker Bitbo, the firm now owns 252,220 bitcoins – or 1.2% of the total supply. That cost the company $9.9 billion overall (about $39,000 per coin), which it paid for through its own cash reserves, stock sales, and loans. Most of the borrowing (roughly $3.9 billion worth) came in the form of convertible notes, sold to big institutional investors.

You can think of convertible notes like bonds with a bonus. When investors buy these securities, they’re lending money to MicroStrategy – much like they would with a traditional corporate bond. But if the company’s stock price goes up beyond a certain threshold, these notes allow investors to “convert” them into MicroStrategy shares at a price that’s below market value. This gives investors a chance to earn more upside than they would from just collecting interest – making it a win-win if the company does well. And because the notes offer investors that potential upside as a bargaining chip, MicroStrategy can get away with paying some ultra-low interest rates on the debt.

Put differently, convertible notes work like call options, giving investors the right (but not the obligation) to buy shares at a discounted price if MicroStrategy's stock rises. And since its stock is heavily tied to bitcoin’s value (remember: it owns a lot), the notes become a de facto call option on bitcoin's price. But if bitcoin doesn’t deliver, the investors still own the notes – and MicroStrategy still owes them the interest and principal.

The MicroStrategy feedback loop.

MicroStrategy’s convertible notes are an attractive option for big money managers. In theory, the notes offer limited downside (assuming MicroStrategy can repay its debt) and unlimited upside (if the stock price keeps rising). That combination makes it relatively easy for MicroStrategy to borrow money – with its notes typically oversubscribed from the get-go.

But here’s where it gets interesting for Saylor and his team: the more money MicroStrategy borrows, the more bitcoin it buys – effectively taking those coins out of circulation. This creates a feedback loop that can push bitcoin’s price higher, along with MicroStrategy’s stock. As its stock price rises and bitcoin holdings grow, the notes become even more attractive to investors. So the firm can then raise even more money at cheap rates to buy more bitcoin.

Bottom line: MicroStrategy has found a way to tap into cheap and abundant liquidity from the bond market to load up on scarce bitcoin.

Okay, but what’s the catch?

Look, borrowing money to buy one of the world’s most volatile assets has its fair share of risks. Sure, MicroStrategy does earn some revenue from its business operations – but bitcoin is its bread and butter. So really, MicroStrategy’s success hinges on where the ol’ bitrocket goes next – and that’s not always easy to predict.

Now, whenever you “buy on margin” (a.k.a. with borrowed money), there’s always a price point at which the chickens could come home to roost. Meaning, if bitcoin’s price goes low enough, MicroStrategy won’t have the assets to pay off its debt. Problem is, it’s hard to say exactly where that unlucky number is, given all the moving parts. For example, MicroStrategy raised its debt in various issuances, each with a set “maturity date” – or deadline for paying investors back. This staggered debt structure has helped spread the company’s risk, but it also makes it tricky to pinpoint an exact “one size fits all” liquidation price.

But here’s the simple version: “if” bitcoin were to have one of its infamous 70%-plus crashes again, it wouldn’t be good for MicroStrategy or its share price. What’s more, there are “company-specific risks” with owning the stock that you won’t get from just holding bitcoin itself. With MicroStrategy, you’re betting on the management team to execute. With bitcoin, there is no management team.

So what’s the opportunity?

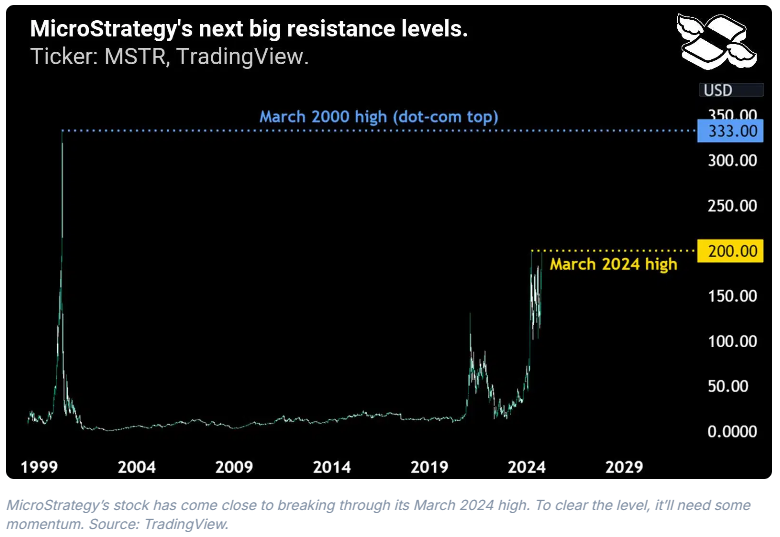

If you believe bitcoin will trend upward over time, owning MicroStrategy stock could be a higher risk, higher reward bet. Just keep in mind that the stock has already run up a lot this year, and is now trading just below its March high of $200 (yellow). That's still a major “resistance” level, where big technical traders might look to sell and take their profits. If it pushes through that ceiling, however, the next boss level would be the all-time high of $333 (blue), which it reached at the peak of the dot-com bubble.

In my view, the real opportunity is what happens to the price of bitcoin if more companies adopt the MicroStrategy playbook. That, in theory, could make that positive feedback loop a whole lot bigger – with bitcoin as the main benefactor.

For now, as the chart above clearly shows, MicroStrategy is by far the biggest bitcoin holder among all publicly traded companies. So it's still the king of leveraged bitcoin bets. The extent to which other companies follow its lead remains to be seen.

Jonathan Hobbs is an analyst at finimize.

ii and finimize are both part of abrdn.

finimize is a newsletter, app and community providing investing insights for individual investors.

abrdn is a global investment company that helps customers plan, save and invest for their future.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.