Coming soon: five-day trading fee-free offer for US shares

21st October 2021 09:44

by Jemma Jackson from interactive investor

Between 25 to 29 October, interactive investor is running a special offer.

Next week is a super-sized week for Q3 2021 US corporate earnings (including popular tech names such as Facebook (NASDAQ:FB), Alphabet (NASDAQ:GOOGL), Microsoft (NASDAQ:MSFT), Amazon (NASDAQ:AMZN) and Apple (NASDAQ:AAPL)). interactive investor, the UK’s second-largest DIY investment platform, is running a 5-day trading fee-free offer for US shares.

The offer will apply across all buy and sell trades of US shares (only), executed from 2.30pm Monday 25th until 9pm on Friday 29th October. See notes to editors for terms and conditions.

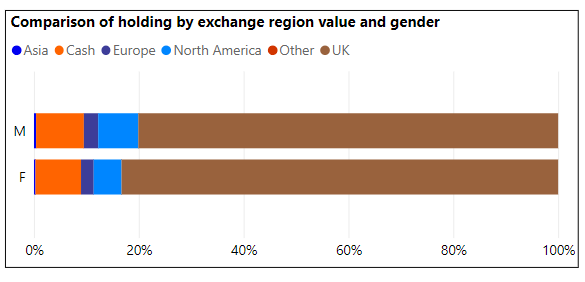

While direct equity exposure overall on interactive investor has a focus on UK stocks, it is North America which accounts for the lion’s share of overseas exposure, as measured by ii’s latest Private Investor Performance Index. he average male ii customer account has 8% of direct equity exposure in US stocks, versus 5% for women. This compares to 80% in UK direct equity stocks (men) and 83% for women.

Victoria Scholar, Head of Investment, interactive investor, says: “To date at least, US markets are enjoying a strong performance so far this year, despite September’s wobble and even after a surprisingly rapid recovery from the Covid-driven sell-off in the first quarter of last year.

“The S&P 500 and the tech-heavy Nasdaq 100 are both up more than 20% year-to-date as we approach the final two months of the year. In the third quarter, in terms of sectors, financials and technology led the march higher while industrials, materials and consumer staples each logged quarterly losses. In the first half of this year, energy was the top-performing sector, although prices retreated from the highs over the summer. September was a blip in an otherwise very positive year for stocks. The S&P 500 recorded a 4.8% loss, the worst month since the height of the pandemic, weighed down by concerns about rising price levels, tighter monetary policy and a potential US government default. Investor focus is now starting to shift away from inflation and yields towards corporate earnings as third-quarter results season kicks into gear.”

Most-bought overseas stocks on interactive investor, in rank order, over the year to date to 19 October 2021

Tesla (NASDAQ:TSLA)

GameStop (NYSE:GME)

AMC Entertainment (NYSE:AMC)

Apple (NASDAQ:AAPL)

NIO (NYSE:NIO)

Palantir (NYSE:PLTR)

Microsoft (NASDAQ:MSFT)

Amazon (NASDAQ:AMZN)

Alibaba (NYSE:BABA)

Coinbase (NASDAQ:COIN)

NVIDIA (NASDAQ:NVDA)

Airbnb (NASDAQ:ABNB)

Riot Blockchain (NASDAQ:RIOT)

Virgin Galactic (NYSE:SPCE)

Facebook (NASDAQ:FB)

Direct equity geographical exposure among average ii customer (excludes collective investments) as measured by the latest ii Private Investor Performance Index

Notes to editors

Trading fee free US trading terms and conditions

- A trading fee of £0 (the “Offer”) is applicable to all buy and sell orders of US equities placed via the ii website and using the interactive investor mobile apps. Orders must be executed between 2.30pm (BST) on 25 October 2021 and 9pm (BST) on 29 October 2021 (the “Offer Period”) in order to be eligible for the Offer. For the avoidance of any doubt, any orders placed within the Offer Period but not executed until after the Offer Period has ended will not be eligible for this Offer.

- The Offer is open to new and existing customers.

- Before you can buy US-listed shares, you need to complete the relevant IRS W-8 form. If you are a UK resident and your account is in your individual name you can complete the form online. We cannot guarantee that the process of either opening a new account and/or enabling the account for international share dealing will be completed before the Offer closes.

- These terms and conditions should be read in conjunction with the Interactive Investor Services Limited (“IISL”) Terms of Service and the ii SIPP Terms (together, the “Terms of Service”). In the event of a conflict between these terms and conditions and the Terms of Service, these terms shall prevail.

- After the Offer has ended, the trading fee you will be required to pay will be as set out in our Rates and Charges.

- Orders placed via telephone dealing are not included in this Offer and will be subject to the charge set out in our Rates and Charges.

- All other fees, for example foreign exchange rates for currency conversion and Government charges, are not subject to this Offer and shall continue to apply notwithstanding.

- Anyone who is seen to be abusing the offer may be excluded at our sole discretion.

- We reserve the right to alter, withdraw or amend this Offer and/or these terms and conditions at any time without prior notice.

- All participants to this Offer agree to be bound by these terms and conditions.

- IISL is the promoter of this offer. The registered office for IISL is 201 Deansgate, Manchester M3 3NW.

*ii customer performance from the ii private investor performance index are quoted are median values to avoid the influence of outlier performance skewing the data.

The performance is calculated using the Time Weighted Rate of Return with returns calculated before each money transaction, then the results compounded over the reporting period. The time-weighted rate of return (TWR) is a measure of the compound rate of growth in a portfolio. It eliminates the distorting effects on growth rates created by inflows and outflows of money.

Then median averages are calculated independently for each group we analysed – so that outlier performances did not skew the results.

Portfolio values under £20,000 were stripped out to keep the sample representative of ii’s core customer base.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.