Chart analysis: Tullow Oil

This oil company is not for the faint-hearted, experiencing a rollercoaster ride for a number of years. Here's what independent analyst Alistair Strang thinks of share price potential.

29th January 2025 07:37

by Alistair Strang from Trends and Targets

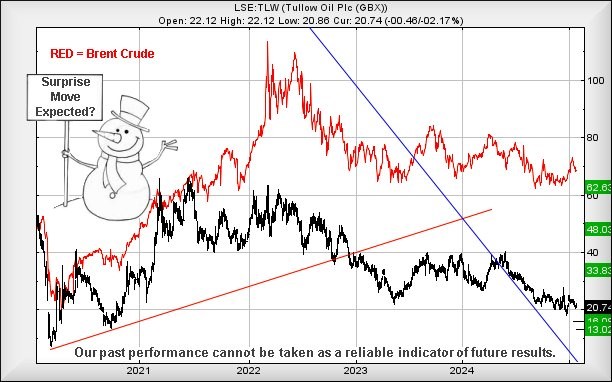

There's always plenty going on at Tullow Oil (LSE:TLW), share price currently around 20.74p, but if we anchor the price at the point of the Covid market reversal in 2020, the shares arguably followed the price of crude oil until Russia invaded Ukraine.

In time, it chose to follow the rate of oil price decline with a collapsing share price, moving from 60p to 20p in just 18 months, a decline of two-thirds in a period when crude declined by half.

- Invest with ii: Open a Stocks & Shares ISA | ISA Investment Ideas | Transfer a Stocks & Shares ISA

If there was a working relationship between Tullow and crude, Tullow should have bottomed out at a pitiful 30p. However, visually there remains some sort of relationship between crude and Tullow, but currently there is the risk that Tullow experiences another whack.

If the price of Brent intends to be an indicator, the next "bottom" for Tullow should occur when Brent crude hits $66 a barrel, not a completely improbable scenario given recent price movements. Unfortunately for Tullow, this now suggests the next "bottom" should be just above 16p ideally.

If such a level breaks, we can produce a future 13p as an ultimate bottom, a point below which we cannot comfortably present any targets. We've quite a strong suspicion just above the 16p level should present a solid "bottom", meaning a rebound can be hoped for, essentially anytime now.

If our thoughts are correct, Tullow needs to exceed 25p to potentially trigger a proper bounce, giving an initial target at a hopeful 33p with our longer-term secondary, if beaten, a less confident sounding 48p.

We're simply not sure about Tullow. While Brent crude doesn't exhibit potentials for any really dramatic drops currently, Tullow does, and we suspect/hope the market shall inflict a panic positive correction of Tullow.

Time will tell.

Source: Trends and Targets. Past performance is not a guide to future performance.

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.