Chart analysis: BAE Systems and JD Sports Fashion

Both these FTSE 100 companies have had a strong run, but independent analyst Alistair Strang's charts suggest one has better prospects than the other.

3rd October 2024 07:21

by Alistair Strang from Trends and Targets

In an almost funny phase of self flagellation, Wednesday evening was spent deciding whether to lead with BAE Systems (LSE:BA.) or JD Sports Fashion (LSE:JD.), both companies suddenly showing some interesting potentials.

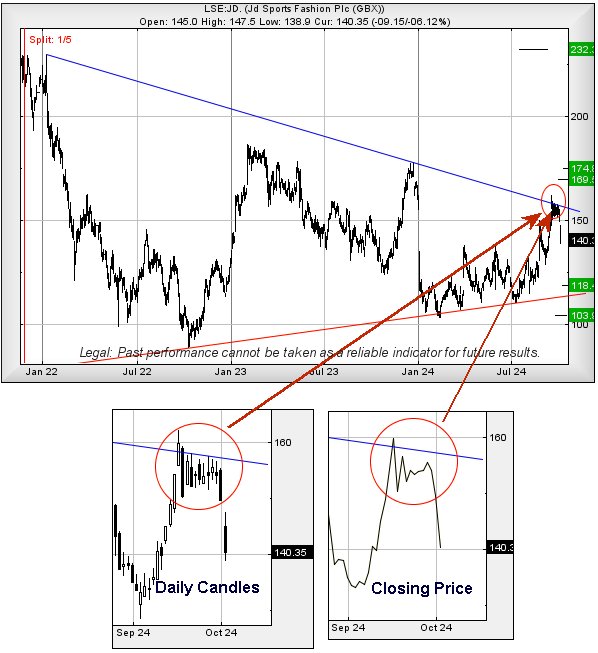

Starting with JD Sports, their share price has thrown itself off a Blue downtrend which commenced back in 2021. The extract on the chart below is of interest, the share price exuberantly exceeding the trend on 17 September, only to be smacked back into place the following day as if the market already knew it had a cunning plan for the days ahead.

- Invest with ii: Open a Stocks & Shares ISA | ISA Investment Ideas | Transfer a Stocks & Shares ISA

The situation now suggests ongoing weakness below 138p risks promoting reversals down to an initial 118p with our secondary, if broken, an eventual bottom of 103p and hopefully a rebound.

If things intend to turn positive, the share price now needs above 158p to hint at a trigger movement toward an initial 169p with our secondary, if beaten, at 174p and a need for us to revisit our calculations. Alas, for now we suspect it intends to drop, hopefully with a bottom at 103p as the market certainly appears to be enacting a secret scenario.

Source: Trends and Targets. Past performance is not a guide to future performance.

In a world without any shortage of regional conflicts, perhaps it’s the time to take a hard look at BAE Systems again. After all, should the USA go a little crazy following their election on 5 November, surely any pause in US arms supply could be filled from the UK as our country hosts one of the largest weapon suppliers in the world. The only problem is the UK’s lack of available skilled workers for the defence industry.

However, BAE is suddenly looking pretty interesting. Movement above just 1,308p should now trigger price recovery to an initial 1,330p with our longer-term secondary, if beaten, at a future 1,457p.

If trouble is planned, below 1,221p risks triggering reversals to an initial 1,166p with our secondary, if broken, at a potential bottom of 1,070p.

For now, we think BAE Systems' share price intends some gains.

Source: Trends and Targets. Past performance is not a guide to future performance.

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.