Beyond the ‘Magnificent’: five big growth themes to watch

Not all stock investing themes are ‘magnificent’ – but a few are rather splendid. Here are the ones that Capital Group thinks you should know about.

11th October 2024 13:14

by Theodora Lee Joseph from Finimize

- Big Tech’s biggest names dominate the investing scene, but for a more balanced portfolio, you might consider the stocks within their ecosystem – and in growing sectors like healthcare and industrials.

- Industries like energy, defense, and gene therapy are booming too, with high barriers to entry making some firms potential long-term winners.

- With a growing middle class and thriving private sector, India presents a massive growth opportunity, making it a strong contender for investors looking to explore emerging markets.

Nothing stays the same forever – and that’s especially true in the market. While Big Tech stocks still hold the crown, smart investors are diversifying and looking beyond those titans. They’ve got very real concerns about concentration risk – having too much exposure to just a handful of massive companies. So they’re looking for ways to balance their portfolio, seeking out new growth assets, while not letting go of their tech winners completely.

Capital Group, one of the world’s biggest asset managers, has some ideas on that front. Here are five places where the firm sees growth in the next five years.

1) First and foremost, tech. The giants keep growing, but so does their ecosystem

Let’s be clear here: the big dogs of technology – Meta Platforms Inc Class A (NASDAQ:META), NVIDIA Corp (NASDAQ:NVDA), Apple Inc (NASDAQ:AAPL), Microsoft Corp (NASDAQ:MSFT) – aren’t slowing down. In fact, they’re expanding in ways that make traditional growth barriers irrelevant. Take Meta, which slashed its workforce yet managed to grow revenue by 22% in 2024. Or Nvidia, whose gaming chips have become must-haves for AI processing, sending its sales skyrocketing from $11 billion in 2020 to $60 billion in 2024. That’s not just a growth story: it’s a scale story.

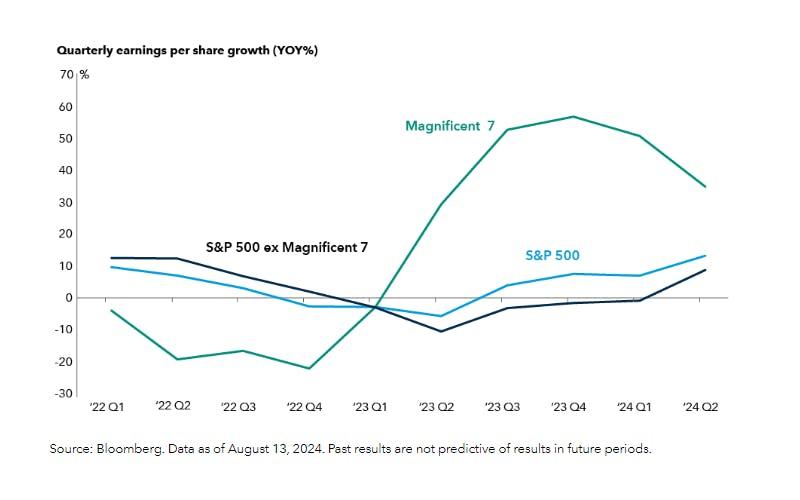

Profit growth outside of Big Tech has perked up. This chart shows year-over-year growth in quarterly earnings per share for the Magnificent Seven tech stocks (green), the S&P 500 (blue), and the S&P 500 stocks, excluding the Magnificent Seven (black). Sources: Bloomberg, Capital Group.

What does this mean for you? Those Magnificent Seven names – Microsoft, Nvidia, Meta, Apple, Amazon.com Inc (NASDAQ:AMZN), Alphabet Inc Class A (NASDAQ:GOOGL), and Tesla Inc (NASDAQ:TSLA) – do tend to hog the spotlight, but the ecosystem surrounding them is just as important – and possibly less volatile. Companies that provide the infrastructure – like data centers, chip designers, and utility providers – are primed to benefit from Big Tech’s relentless expansion. Firms like Broadcom Inc (NASDAQ:AVGO), Taiwan Semiconductor Manufacturing Co Ltd ADR (NYSE:TSM), and ASML Holding NV (EURONEXT:ASML) – key players in the semiconductor space – may offer growth opportunities without the wild swings of direct tech investments.

2) Industrials. They’ve got high barriers, big moats, and serious potential

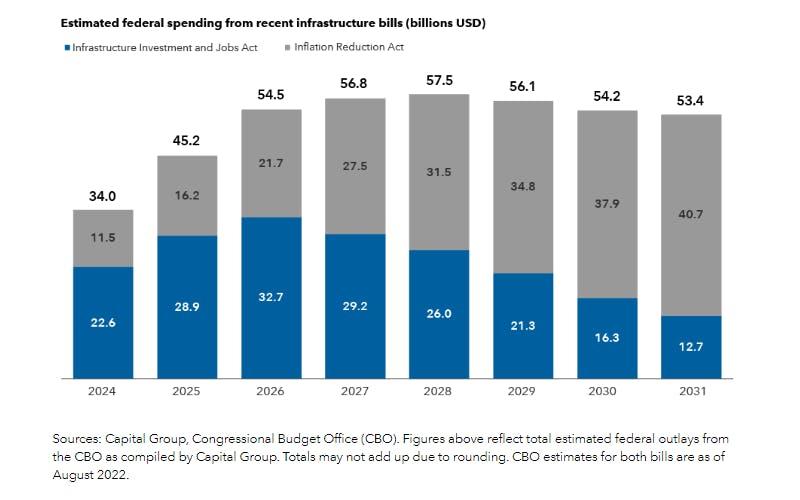

Beyond tech, industries like defense, energy, and infrastructure are quietly building moats – those high barriers to entry that make it tough for competitors to catch up. The US and Europe are pouring billions into moving their supply chains closer to home and boosting their energy security, setting the stage for a massive investment super-cycle. Eaton Corp (NYSE:ETN), a US-based electrical products company, is a prime example. Its backlog of orders has grown from $2.8 billion in 2019 to over $11 billion in 2024. Similarly, Schneider Electric SE (EURONEXT:SU), which helps commercial buildings become more energy-efficient, is projecting solid growth through 2027.

Even niche areas like aerospace are booming. Companies like Lockheed Martin Corp (NYSE:LMT) and RTX Corp (NYSE:RTX) are getting a boost from rising global defense budgets, with military expenditures hitting a staggering $2.4 trillion in 2023.

Estimated federal spending from recent infrastructure bills (measured in billions of US dollars). Sources: Capital Group, Congressional Budget Office (CBO).

What does this mean for you? Industrials might not have the glitz and cutting-edge appeal of tech, but with steady cash flows and high barriers to entry, these companies are long-term winners. Companies like Eaton, Schneider Electric, The AES Corp (NYSE:AES), and NextEra Energy Inc (NYSE:NEE) – involved in power generation, energy efficiency, and defense – are especially well-positioned for sustainable growth.

3) Healthcare. It’s a growth story for the ages

Healthcare often flies under the radar, but it’s a sector that investors would be wise to keep an eye on – especially right now. In 2022, healthcare spending in the US hit an eye-watering $4.5 trillion, and, as the population ages, that number seems only to go up. What’s more, we’re riding a third wave of innovation, driven by genetics and AI.

One of the most exciting developments is gene therapy, which allows scientists to tackle diseases at the genetic level. Companies like Alnylam Pharmaceuticals Inc (NASDAQ:ALNY) are leading the charge with RNAi therapeutics – essentially “silencing” genes that cause diseases. Meanwhile, Vertex Pharmaceuticals Inc (NASDAQ:VRTX) recently won approval for a sickle cell disease treatment created using innovative CRISPR gene editing technology.

What does this mean for you? Healthcare stocks as a group are undervalued compared to the broader market, but the potential for innovation is massive. Look for companies at the forefront of gene therapy, AI in healthcare, and cutting-edge drug development. Eli Lilly and Co (NYSE:LLY) and Novo Nordisk AS ADR (NYSE:NVO) are dominating the obesity drug market. Vertex is leading in gene therapy. These companies could drive significant returns as the healthcare sector evolves.

4) Consolidated industries. Dominant players lead the pack

Some companies are so commanding in their industries, it’s hard to imagine anyone knocking them off their perch. Think about it –Lvmh Moet Hennessy Louis Vuitton SE (EURONEXT:MC) and Hermes International SA (EURONEXT:RMS) practically own their lane in the luxury goods market, while TSMC controls 80% of the world’s advanced computing chips. Netflix? Still the king of streaming. Meta and Google? They have an iron grip on online advertising

But it’s not just tech and luxury enjoying this kind of dominance. Companies like Caterpillar Inc (NYSE:CAT) (heavy machinery), Costco Wholesale Corp (NASDAQ:COST) (retail), and Airbus SE (EURONEXT:AIR) (aviation) have built empires that are tough to topple. Years of industry consolidation, a well-honed business model, and a lack of serious competition make these companies especially resilient.

What does this mean for you? Leader-of-the-pack companies are often more resilient to market swings. Mind you, they’re not immune to setbacks – long-dominant Boeing Co (NYSE:BA) has seen a string of troubles, for example – but over time, they tend to deliver solid returns. If you’re looking for stability and long-term growth, keep an eye on these industry bosses. And, for a smart way to identify the tough compounders, check out their rate of return.

5) India. It’s the next big market

Step aside, China – India’s taking the spotlight. With a booming economy, a thriving private sector, and a rapidly expanding middle class, India is shaping up to be the next major growth market. It’s on a development trajectory that mirrors China’s of 20 years ago, offering massive potential in manufacturing, consumer goods, and technology.

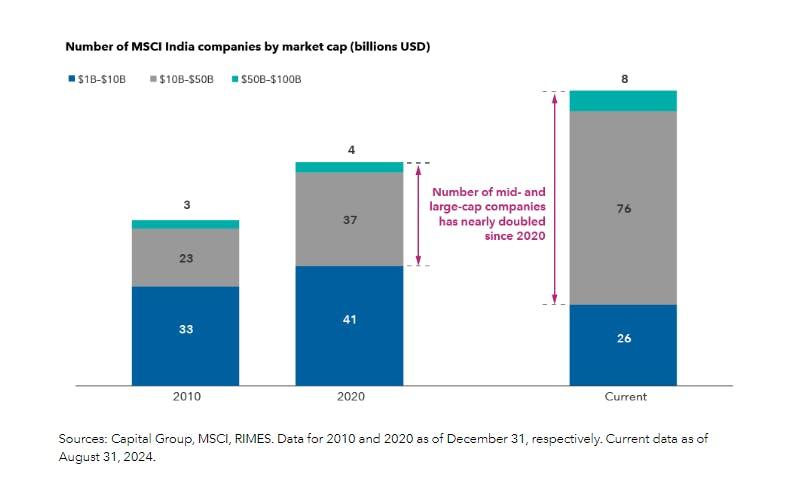

India’s mid-cap companies are particularly exciting: they’ve nearly doubled in numbers in the past four years. And there are huge growth opportunities for the country’s small-cap firms. These businesses – with market caps ranging from $1 billion to $10 billion – now make up a third of the MSCI India index. Sectors like housing, healthcare, and consumer finance are flourishing as the middle class grows. India is also emerging as a strong alternative to China for manufacturing, especially in electronics and home appliances. With heavy government investment in infrastructure and digital connectivity, these companies have plenty of room to scale.

Number of MSCI India companies by market cap in 2010, 2020, and 2024 (as of August 31st). Sources: Capital Group, MSCI, RIMES.

What does this mean for you? India presents a massive growth opportunity for patient, long-term investors. The country’s private sector is full of high-quality companies that are poised for serious growth. With global growth expected to pick up again, this might be a good time to explore emerging markets in general – and India, in particular.

The big takeaway here is this: although the Magnificent Seven stocks have been stealing the spotlight, other places offer the potential for strapping growth too. And that’s good – no one wants to put all their eggs in one basket. Remember: diversify across a few key themes, stay patient, and keep a long-term view. You'll be well-positioned to ride the growth wave over the next five years.

Theodora Lee Joseph is an analyst at finimize.

ii and finimize are both part of abrdn.

finimize is a newsletter, app and community providing investing insights for individual investors.

abrdn is a global investment company that helps customers plan, save and invest for their future.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.