The best sector in 2024 is not what you think

Saltydog Investor explains why this ‘specialist’ investment area is performing so well.

21st October 2024 15:05

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

The best-performing sector so far this month has been Financials & Financial Innovation, with a month-to-date gain of over 6%. It has now also become the leading sector in 2024, just edging ahead of the North American Smaller Companies, North America, and Technology & Technology Innovation sectors.

- Our Services: SIPP Account | Stocks & Shares ISA | What is a Managed ISA?

The Investment Association (IA) is the representative body for investment managers in the UK. Its 250 members manage a total of £9.1 trillion for clients around the world. Their mission is “to make investment better. Better for clients, so they achieve their financial goals. Better for companies, so they get the capital they need to grow. And better for the economy, so everyone prospers.”

One of the ways they help customers is by assigning funds to their sectors. It makes it easy to do like-for-like comparisons between funds in the same sector, as well as comparing the overall performance of the different sectors.

- Watch our video: RIT Capital Partners: portfolio not to blame for share price slump

- Why is China’s stock market soaring, and will it last?

Most sectors are for funds targeting growth, income or capital protection. However, there are a few Specialist sectors that do not naturally fall into one of these categories. In 2021, the IA increased the number of Specialist sectors by introducing the Financials & Financial Innovation, Healthcare, Infrastructure, and Commodities/Natural Resources sectors.

The sector definition for the Financials & Financial Innovation sector is: “Funds that invest at least 80% of their assets in equities of financial services companies and related sectors including industries such as banking, insurance, capital markets, fintech and consumer finance in any country. Some funds in the sector may have a specific focus such as an industry focus (e.g. insurance, money management), country focus (e.g. US) or thematic focus (e.g. fintech). These funds may exhibit different characteristics to diversified financial funds, and investors should take extra care when making comparisons.”

The sector had a good start to the year. In the first quarter it made a gain of 9.3%. It was the best of the Specialist sectors, and only beaten by the Technology & Technology Innovation and North America sectors.

Unfortunately, the next three months were less impressive. It went down by 2.9% in April, and although it rallied during May and June, it still ended the quarter with a three-month loss of 1.8%.

- Funds and trusts four pros are buying and selling: Q4 2024

- Terry Smith vs Nick Train: who is right on Diageo

In the third quarter of this year, the top-performing sector was China/Greater China, up 12.5%, followed by Infrastructure, which rose by 7%. However, the Financials & Financial Innovation sector came in third, with a very respectable three-month gain of 7%.

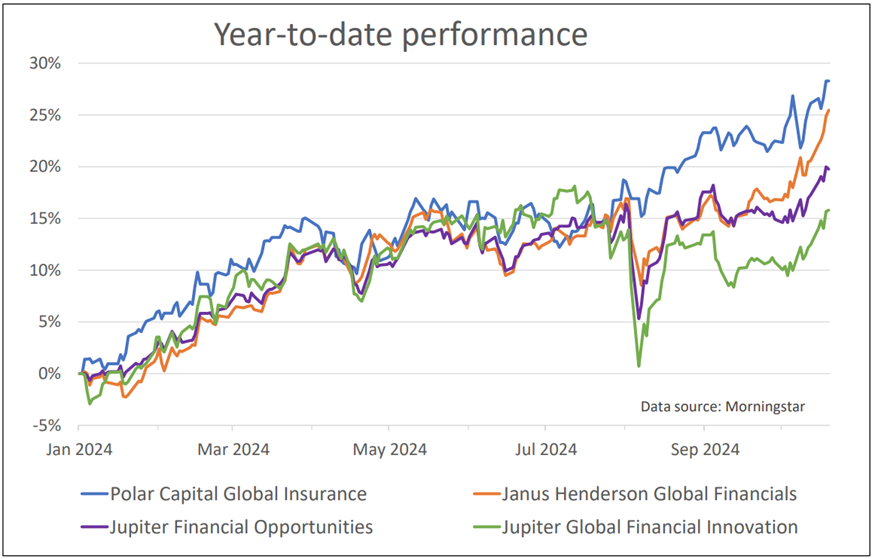

Financials & Financial Innovation is a relatively small sector and, at Saltydog Investor, we track only a handful of funds. Here is a graph showing how the top four have done since the beginning of the year.

Past performance is not a guide to future performance.

Polar Capital Global Insurance, which we wrote about last month, is at the top with a year-to-date return of 28.3%.

As you would expect, funds in this sector are heavily influenced by economic activity. An improving economy typically leads to increased lending activity, higher consumer spending, along with more business investment. A stable or growing economy also boosts investor confidence, leading to increased investments in financial services, banking and insurance.

These funds are also affected by interest rates. For the past couple of years, we have seen interest rates rising. In the UK, they went from 0.1% in 2021 to 5.25% in 2023, and they have only just started to come down.

- The funds most at risk of AIM stocks losing IHT relief

- Is this the catalyst for a bounce back in UK shares?

- Sign up to our free newsletter for share, fund and trust ideas, and the latest news and analysis

Higher interest rates can be good for financial companies, especially banks. They can earn more on the money they hold, and the difference between lending and borrowing rates tends to increase, boosting profitability.

However, if interest rates rise too quickly, it makes new borrowing less attractive, and also puts increasing financial pressure on companies and households with outstanding loans.

As is often the case, there is a sweet spot where interest rates are low enough to encourage borrowing and investing, but high enough to make servicing them profitable.

Interest rates are currently in a favourable position for financial companies, and that will not change if they slowly come down. The main concern is the state of the global economy, and the US in particular.

Stock markets fell at the beginning of August, following a disappointing jobs report in the US, which sparked fears of a recession. The funds in the Financial & Financial Innovation sector also went down, but they have subsequently recovered.

As long as a recession is avoided, then funds in this sector could continue to perform well.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.