The Baillie Gifford fund we have just bought

Saltydog analyst points out tech funds have been staging a comeback of late and has positioned to profit.

5th July 2021 13:56

by Douglas Chadwick from ii contributor

Saltydog analyst points out tech funds have been staging a comeback of late and has positioned to profit.

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

The Nasdaq Composite, an index of more than 3,000 stocks listed on New York’s Nasdaq stock exchange that includes the world’s leading technology and biotech companies, went up 5.5% in June. Last year, it rose more than 40% as companies in the technology sector took advantage of the global lockdown.

This year it has not performed as well, and in May it went down while other indices were still rising. However, last month it reversed the trend. Is the sector about to make a comeback?

| Data source: Morningstar | Stock Market Indices 2021 | |||||||

|---|---|---|---|---|---|---|---|---|

| Index | Country | Jan 2021 | Feb 2021 | March 2021 | April 2021 | May 2021 | June 2021 | 1st Jan to 30th June |

| FTSE 100 | UK | -0.8% | 1.2% | 3.6% | 3.8% | 0.8% | 0.2% | 8.9% |

| FTSE 250 | UK | -1.3% | 3.4% | 2.9% | 4.5% | 0.8% | -1.4% | 9.2% |

| Dow Jones Ind Ave | US | -2.0% | 3.2% | 6.6% | 2.7% | 1.9% | -0.1% | 12.7% |

| S&P 500 | US | -1.1% | 2.6% | 4.2% | 5.2% | 0.5% | 2.2% | 14.4% |

| NASDAQ | US | 1.4% | 0.9% | 0.4% | 5.4% | -1.5% | 5.5% | 12.5% |

| DAX | Germany | -2.1% | 2.6% | 8.9% | 0.8% | 1.9% | 0.7% | 13.2% |

| CAC40 | France | -2.7% | 5.6% | 6.4% | 3.3% | 2.8% | 0.9% | 17.2% |

| Nikkei 225 | Japan | 0.8% | 4.7% | 0.7% | -1.3% | 0.2% | -0.2% | 4.9% |

| Hang Seng | Hong Kong | 3.9% | 2.5% | -2.1% | 1.2% | 1.5% | -1.1% | 5.9% |

| Shanghai Composite | China | 0.3% | 0.7% | -1.9% | 0.1% | 4.9% | -0.7% | 3.4% |

| Sensex | India | -3.1% | 6.1% | 0.8% | -1.5% | 6.5% | 1.0% | 9.9% |

| Ibovespa | Brazil | -3.3% | -4.4% | 6.0% | 1.9% | 6.2% | 0.5% | 6.5% |

| RTSI | Russia | -1.4% | 3.2% | 4.6% | 0.5% | 7.6% | 3.5% | 19.2% |

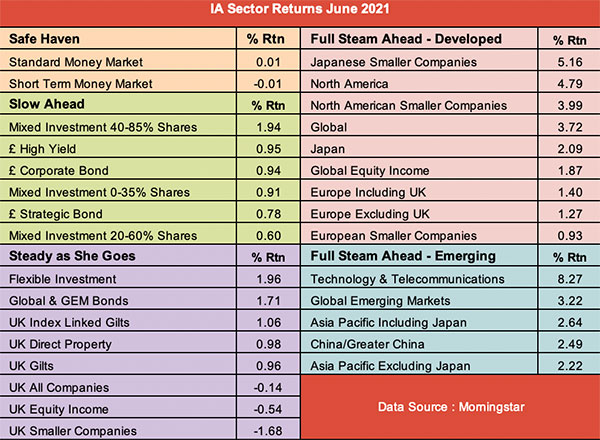

The resurgence of the technology stocks can also be seen in our latest Investment Association (IA) sector analysis. The best-performing sector in June was ‘Technology and Telecommunications’ with a one-month return of nearly 8.3%. A big improvement on the 3.6% loss that we saw in May.

The UK Smaller Companies sector, which was the leading sector in May and is still the best-performing sector so far this year, went down in June. It looks as though the tide may be turning.

Over the last few weeks, our demonstration portfolios have been reacting to this change in momentum.

- How Saltydog invests: a guide to its momentum approach

- Time to put tech funds back into our portfolios

- Open an ISA with interactive investor. Click here to find out how

We have reduced our holdings in the Franklin UK Smaller Companies and FP Octopus UK Micro Cap Growth funds. We have sold the Artemis UK Select, Premier Miton UK Smaller Companies and the Jupiter UK Smaller Companies Equity funds. A couple of weeks ago we invested in the L&G Global Technology Index and the AXA Framlington Global Technologyfund and they are already showing gains.

Last week, we added the Baillie Gifford American fund. It is from the ‘North American’ sector, and not the ‘Technology and Telecommunications’ sector, but it does hold a lot of tech stocks and was the best-performing fund in our analysis with a four-week return of 14.4%.

This is another one of the funds that we held last year. We bought it in April and sold it in September. In that time, it went up by 59%.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.