Asia-Pacific climbing the value chain

A look at how the region presents a uniquely attractive income opportunity for active investors focusing on total return.

27th September 2024 10:05

by Alex Smith and Yoojeong Oh from Aberdeen

Asia-Pacific is more associated with growth than it is with income.

However, the region represents a uniquely appealing income universe for active investors with a total return mindset. The breadth of the universe and underlying growth makes for a powerful combination.

The Asia-Pacific region, encompassing developed and emerging markets, offers a compelling landscape for income investors with a total return mindset. This diverse and dynamic area is characterised by rapid economic growth, demographic shifts, and evolving market structures, making it an attractive destination for those seeking income and capital appreciation.

Yield and growth can go hand in hand

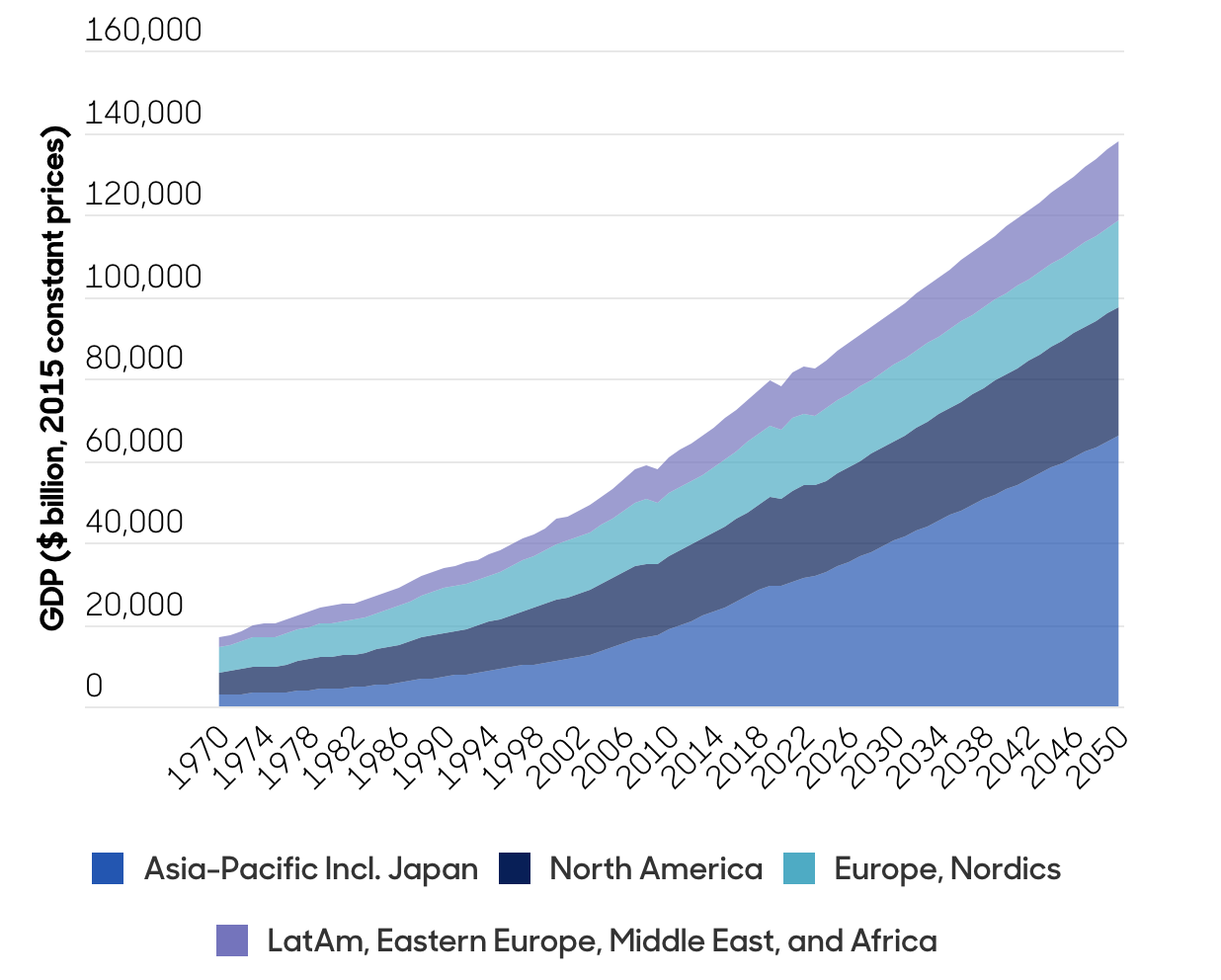

Asia is poised to drive global economic growth – accounting for more than half of the world’s gross domestic product (GDP) growth by 2025. This economic dynamism is driven by industrialisation, urbanisation, and a burgeoning middle class. For instance, despite recent slowdowns, China’s GDP growth remains significant compared to many Western economies. This growth translates into higher corporate earnings and, consequently, better dividend prospects for investors.

Imagine tapping into the immense potential of the region, led by economic powerhouses like China and India. That’s not all – the dynamic Southeast Asian economies, such as Indonesia and Thailand, are also growing rapidly (Chart 1).

Chart 1. Global GDP increasingly driven by Asia

Source: abrdn Global Macro Research, Haver, February 2023.

The focus on dividends is increasing across corporate Asia, making the income universe incredibly attractive. A staggering 85% of companies here now pay dividends, alongside growth that outstrips other major markets [1]. Furthermore, the risk of dividend cuts in the region is low due to robust free cash flow cover and strong balance sheets. This supports dividends that are likely to keep growing.

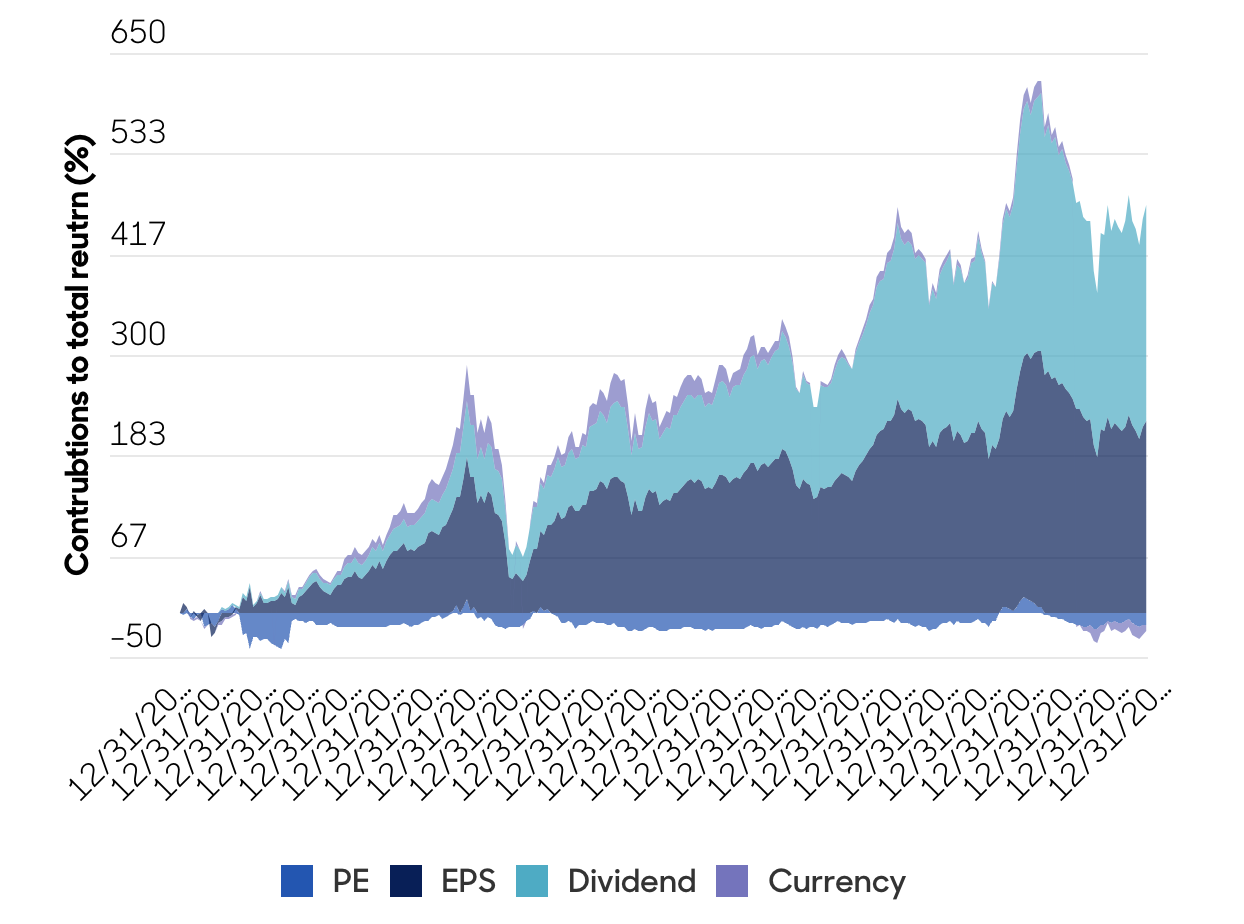

Dividends make up close to half of total returns

Since 2001, Asia has been one of the best-performing markets in US total returns terms, with reinvested dividends being an important contributor [1]. Dividends make up a whopping ~50% of total returns in the region (Chart 2) [2].

Chart 2. Disintegrating total return index[3]

Source: CLSA, FactSet, December 2023. Note: Contribution to total return since Dec 2000.Costs may increase or decrease as a result of currency and exchange rate fluctuations. This may impact what you might get back.

Today, more companies than ever in Asia are paying dividends, compared to even a decade ago, with nearly half of them yielding over 3% [2]. Companies that consistently pay and grow their dividends tend to outperform the broader Asian market over the long term, outshining bonds and other fixed-rate assets.

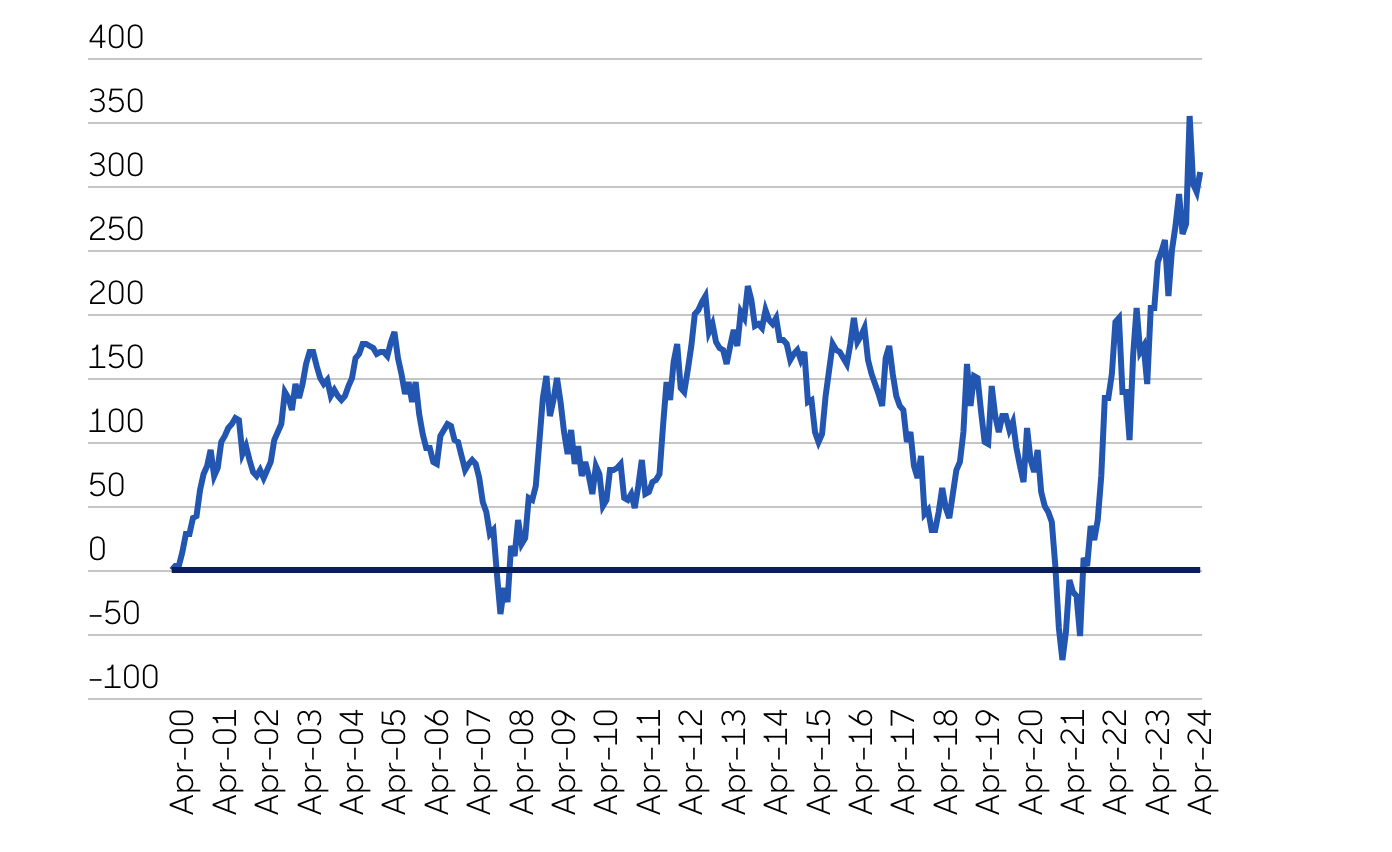

Income stocks, moreover, look cheap compared to the overall market. With economic uncertainties and recessionary pressures building, the market expects the US Federal Reserve to start cutting rates In September, which is already reflected in bond valuations. In such falling rate environments, stock prices tend to rise as companies improve their future earnings potential. So, we expect the market to refocus on dividends as a key driver of total returns (Chart 3).

Chart 3. Relative performance of dividend yield quintiles (20%)[3]

Source: abrdn, MSCI All-Country Asia-Pacific ex-Japan Equities Index, relative returns, April 2024. Note: Quintile 1 = highest yield stocks and Quintile 5 = lowest yielding stocks.

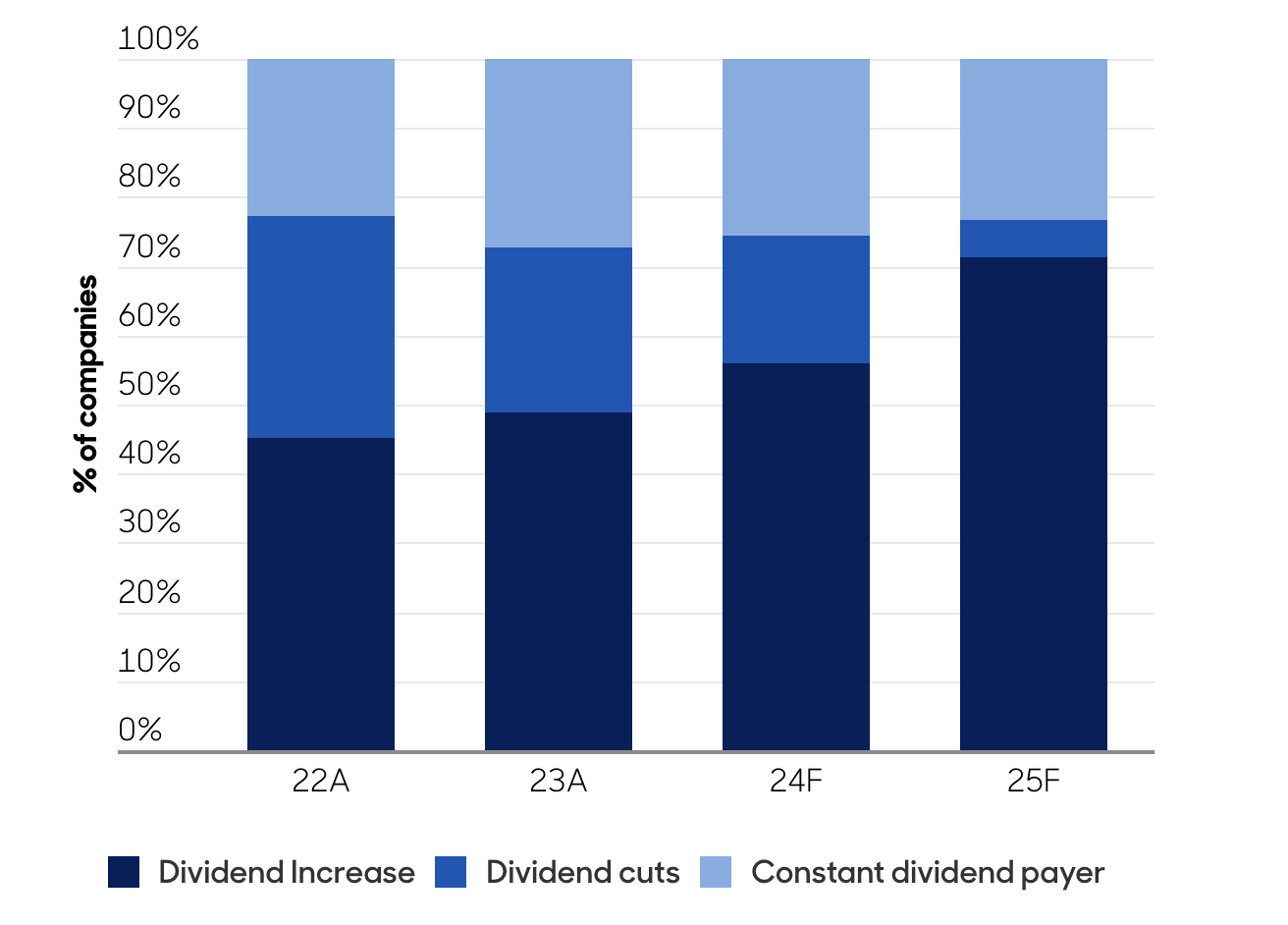

Dividends and share buybacks are rising

The region’s improving fundamentals are the cornerstone of its strong dividend sustainability. Data suggests that dividend and buyback sustainability is high as shareholder payouts are well covered by free cash-flow (Chart 4). High yield is in favour this year at the expense of bond proxies. Buybacks are rising in Asia, with a recent boost from China.

Chart 4. Dividend sustainability[3]

Source: Jefferies, FactSet. Note: Changing universe. Div. cut/increase refers to DPS YoY chg of -5%/5% or more.

The earnings outlook is bright across Asia, as this optimism is materialising into upward revisions in consensus estimates that bode well for the rest of the year.

Emerging market potential

We believe emerging markets, particularly emerging Asia, remain under-researched and under-allocated, providing opportunities for active investors to uncover hidden gems. The rapid industrialisation and urbanisation in these countries lead to robust economic growth, which can translate into substantial returns for investors willing to take on higher risks.

Emerging markets within the Asia-Pacific region, such as Vietnam, Indonesia, and the Philippines, present significant growth potential. For instance, Vietnam has enjoyed an average annual economic growth of 6.2% recently [4]. The manufacturing and services sectors are recovering from the pandemic, and the country is benefiting from growing consumer demand and rising tourist numbers. Similarly, India and the Philippines have shown robust growth rates, averaging 6.1% and 5.0%, respectively [5,6].

Alex Smith is head of equities investment specialists, Asia Pacific, abrdn.

Yoojeong Oh is investment director, Asian equities, abrdn.

ii is an abrdn business.

abrdn is a global investment company that helps customers plan, save and invest for their future.

1 FactSet, Jefferies, January 2024.

2 CLSA, FactSet, December 2023.

3 MSCI All-Country Asia-Pacific ex-Japan Equities Index is an unmanaged index considered representative of Pacific region stock markets, excluding Japan. The index is computed using the net return, which withholds applicable taxes for non‐resident investors.

4 "Vietnam's Annual Growth Rate." Economic Data. World Economics, December 2023. https://www.worldeconomics.com/GrossDomesticProduct/GDP-Annual-Growth-Rate/Vietnam.aspx.

5 "India's Annual Growth Rate." Economic Data. World Economics, December 2023. https://www.worldeconomics.com/GrossDomesticProduct/GDP-Annual-Growth-Rate/India.aspx.

6 "Philippines Annual Growth Rate." Economic Data. World Economics, December 2023. https://www.worldeconomics.com/GrossDomesticProduct/GDP-Annual-Growth-Rate/Philippines.aspx.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.