Are Lloyds Bank shares heading to 50p?

23rd August 2018 10:20

by Alistair Strang from Trends and Targets

This popular banking share has made progress since the financial crisis, but share price performance is disappointing. Chartist Alistair Strang takes a look at the big picture.

Lloyds Bank (LSE:LLOY)

As usual, like a dog mess on a park walkway, we've been avoiding our monthly visit to Lloyds Banking Group's share price. However, unlike cutting the grass, it's a task which can be delayed as sod all is happening. Yet!

Okay, to be completely transparent, the "yet!" was a ruse in the hope of giving the illusion we expect a major commitment either up or down anytime soon but in fairness, the share price seems to be messing around a bit.

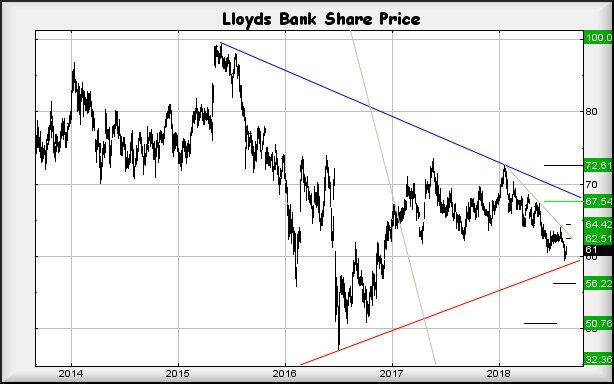

The big picture still demands it intends a visit to 50.75p as a bottom hopefully. The price needs to exceed 63.3p to nullify the prospects on the immediate drop cycle. A serious issue calculates as possible if the price somehow makes it below 50p as "bottom" works out at 32p.

At present, trading around the 61p mark, the price needs above 63.3p to send a message playtime is over, due to the potential of fairly near term growth to an initial 64.4p. If bettered, continued oomph toward 67.5p becomes possible, coming close to challenging the downtrend since 2015.

For now, despite the presence of red, an uptrend since 2012, we suspect it shall find its way down to the 50p level and hopefully bounce with some integrity.

Source: interactive investor Past performance is not a guide to future performance

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.