Analysis: FTSE 100's Frasers Group and thoughts on bitcoin

21st September 2022 07:21

by Alistair Strang from Trends and Targets

After its recent promotion to the top index, independent analyst Alistair Strang runs the numbers on Frasers. He also looks at bitcoin and what's in store for the volatile crypto.

Due to my little bout of leukaemia (incurable but treatable), I’ve become used to being singled out, when called in for Covid-19 vaccines. However, today brought a shock. The village hall had a Vaccine Day and I hadn’t been called! Popping along revealed a pleasant truth; it was “only for grown ups". It’s quite nice to discover I was too young for something, the current vaccine only being given to over 65’s.

Another thing we currently suspect as being “only for grown ups” is bitcoin, and the chart illustrates quite clearly why.

- Find out about: Trading Account | Share prices today | Top UK shares

The crypto has formed a glass floor just above the 18,700 level and is behaving badly, almost as if it’s trying to convince folk this level is impermeable. Our suspicion remains of the crypto lying in wait, the market planning a “Gotcha Suckers” movement, with closure below 18,700 making reversal to 16,200 with secondary, if (when) broken, at a bottom around 12,900 dollars.

Remember, bitcoin appeared to stabilise between 40,000 and 50,000 for three months at the start of this year, then fell sharply. It also stabilised between 60,000 and 70,000 for a couple of months at the end of 2021.

We’re far from convinced the current four-month period of “stability” at 20-25,000 shall assure the market a bottom has been found and, literally daily, now expect to see yet another “gotcha” drop.

On the bright side, we do anticipate a reasonable bounce if the $13,000 level makes itself known.

Past performance is not a guide to future performance

Frasers Group

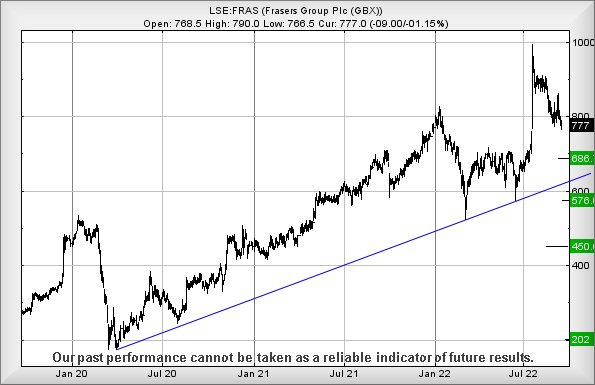

Frasers Group (LSE:FRAS) share price is presenting a bit of a puzzle currently. A couple of pretty significant news items fuelled a suspicion of happier times coming, but the reality looks quite different. Perhaps Mr Ashley stepping down from the board is a bad thing, along with other news the company has returned to the FTSE 100. A chair at the top table of the UK market created due to Meggitt being bought by US defence giant Parker Hannifin.

Maybe it’s the case the market regards the retail market as facing challenging conditions due to ridiculous inflation, coupled with an expected recession impacting company profit margins.

- Market movers: FTSE 100, Haleon, TUI, Frasers Group, Moonpig

- Insider: ex-easyJet chief builds stake in two big companies

- Stockwatch: is this the UK’s best-placed housebuilder?

- Why reading charts can help you become a better investor

For now, the visuals suggest ongoing weakness below 765p shall promote the potential of share price reversal to an initial 688p. Should such a price level break, our secondary presents a major issue as it calculates down at 576p, along with a break of the uptrend since 2020.

Past performance is not a guide to future performance

Movement like this effectively risks triggering a “Big Picture” scenario, along with the potential of reversal commencing to an eventual bottom around 202p.

We’d love to say this drop target is ridiculous but a glance at the chart below reveals an unpleasant reality. It has been there, done that, and there’s no rule inhibiting it happening again. Well, perhaps that’s wrong as their share price need only exceed 866p to turn this miserable outlook into a pile of tosh.

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.