Is AIM's Dewhurst a good business worth buying?

Buying A&A should strengthen its market position, but can this good small business become a great one?

25th January 2019 13:46

by Richard Beddard from interactive investor

Buying A&A should strengthen its market position, but can this good small business become a great one?

Revenue growth of 3% and profit growth of 8% in the year to September 2018 is not quite as impressive as the headlines suggest because the result includes income from Dewhurst's (LSE:DWHT) biggest ever acquisition, A&A, a UK lift component distributor.

Dewhurst, a lift component manufacturer, owned A&A for four months of the financial year and without its contribution, Dewhurst's revenue would have fallen 4% and profit would have fallen 6% compared to the year ending in September 2017.

Regardless of the halting performance of the existing businesses, the acquisition may be a humdinger. Had Dewhurst owned A&A for the whole financial year it would have contributed nearly £3 million to a total operating profit of £8 million. Dewhurst will end up paying a maximum of about £13 million for A&A, including the assumption of a £1 million loan, and an estimated £1.5 million deferred consideration (depending on the profit A&A earns over the next two years). Assuming A&A can sustain about £3 million in profit a year, as it has done in recent years, it should only take about five years profit to return Dewhurst's investment.

A&A stocks about 30,000 products, aiming to supply everything required for a lift installation or modernisation, and usually fulfilling orders with its own fleet of vehicles the next day. Dewhurst describes it as the "foremost lift component supplier" in the UK and a longstanding customer, so it has taken control of an important sales channel. The company will improve A&A by putting its catalogue online, and Dewhurst's says subsidiaries in Australia and North America will adopt aspects of A&A's business model.

As usual, I am scoring Dewhurst to determine whether it is profitable, adaptable, resilient, equitable, and cheap. Each criterion can achieve a maximum score of 2, and a minimum score of zero except the last one. The lowest score for companies trading at very high valuations is -2.

Profitable: Does it make good money?

Score: 1

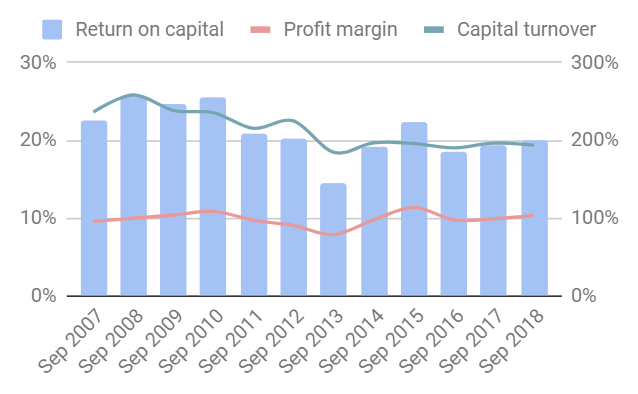

The attractive thing about Dewhurst is its ability to create order in the form of stable and impressive levels of profitability...

Source: interactive investor Past performance is not a guide to future performance

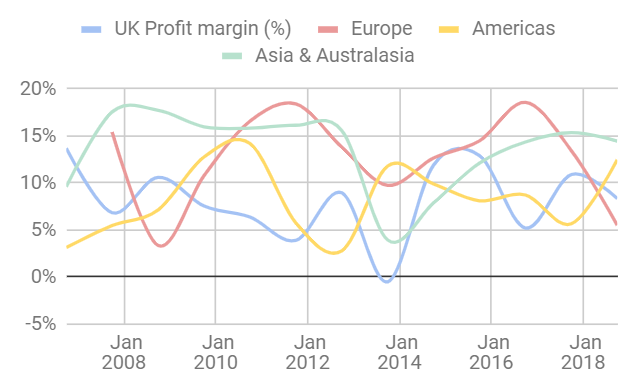

...Out of chaos, in the form of wildly fluctuating profitability from its subsidiaries in different territories:

Source: interactive investor Past performance is not a guide to future performance

Demand depends on the economic situation in each territory, which explains some of the variation, but Dewhurst is most active in the maintenance and modernisation market, which is more stable than new construction.

Idiosyncratic factors matter too. Profitability in the Americas has been depressed by loss-making lift cab and door supplier Winter & Bain, which Dewhurst sold during the year, and Thames Valley Controls in the UK is recovering from two years of disruption as it implemented new EU safety standards.

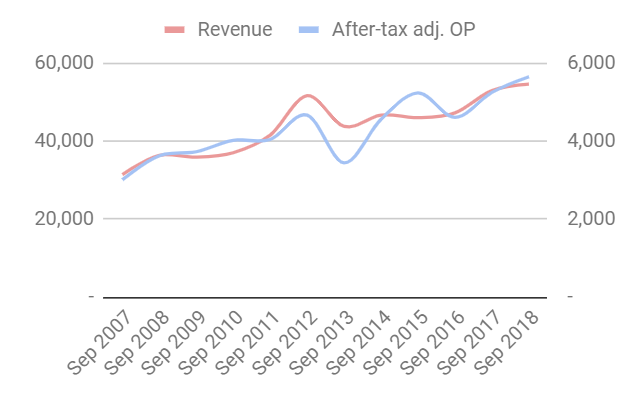

Through the regional ups and downs, Dewhurst has grown modestly, at a compound annual growth rate in revenue and profit of 3-4%:

Source: interactive investor Past performance is not a guide to future performance

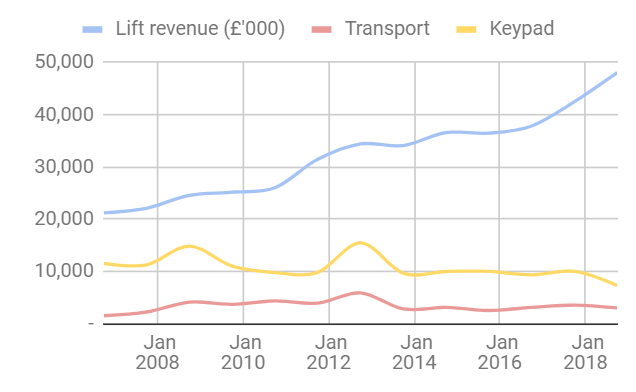

But all the growth has come from lift components. Two much smaller divisions: keypads and transport seem hidebound:

Source: interactive investor Past performance is not a guide to future performance

In cash terms, Dewhurst makes less money than it reports in profit, principally because it is paying roughly £1.4 million to close the deficit in its defined benefit pension scheme. While the deficit is coming down, and we can perhaps look forward to a time when the company stops making the payments, that date may still be a long time coming.

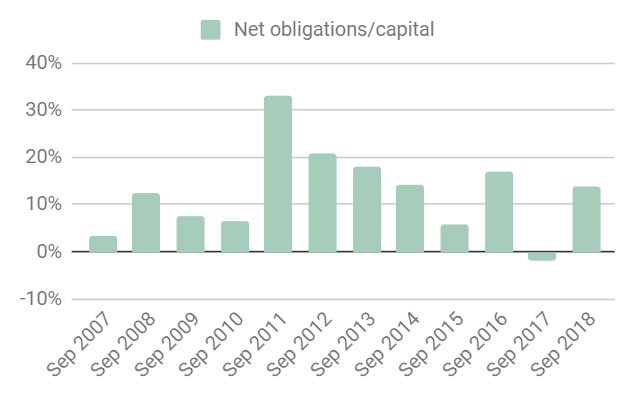

Nevertheless, and despite splurging £10.5 million so far on A&A and weaker than normal cash flow, Dewhurst is still self-funding its gradual expansion. At the year end in September it had more than £8 million in cash and no bank borrowings. Even after including estimated obligations to Dewhurst's pension fund and landlords, net debt was very modest.

Source: interactive investor Past performance is not a guide to future performance

Adaptable: How will it make more money?

Score: 2

Though it makes a relatively small percentage of revenue from loose pushbuttons these days, Dewhurst pioneered a pushbutton design that has become ubiquitous in lifts. Today, Dewhurst assembles the pushbuttons into control panels also using bought-in components like LCD displays, telephones and LED signals, as well as hall lanterns, and lift controls. For decades, Dewhurst has been deepening and widening its niche in the lift industry by developing new products and buying companies in far flung places, often its own customers. This strategy has probably worked because of Dewhurst's commitment to quality and service, the pushbuttons can withstand being bashed by a hammer many times, which gives lift consultants and lift engineers confidence to specify the components.

Resilient: What could go wrong?

Score: 1

Although innovations in man/machine interfaces may kill off the humble pushbutton eventually, it may not matter much. Dewhurst buys in touchscreens for lift operating panels already, but much of the value is in the software, which Dewhurst owns, and in most circumstances regulations require a set configuration of pushbuttons so blind people can operate the lift.

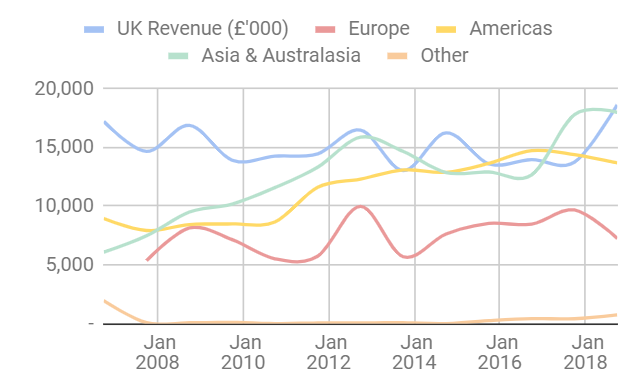

The popularity of electronic forms of payment are perhaps a bigger technological risk to a smaller part of the business. Dewhurst makes ATM keypads and the increasing popularity of electronic forms of payment may herald the obsolescence of ATMs. Revenue from keypads fell significantly in 2018, but maybe it is not yet the beginning of the end. Dewhurst reports a recovery in 2019.In the shorter-term Dewhurst is stockpiling imported and exported components, which will cover immediate disruption from a hard Brexit, at least for a while. Longer-term the company is waiting to find out what Brexit really means, but it might worsen the terms of trade, increasing the cost of imported components and imposing costs on exports to the European Union, a less significant geographical market than Dewhurst's big three:

Source: interactive investor Past performance is not a guide to future performance

Equitable: Will we all benefit?

Score: 2

Dewhurst's durable products and interest in A&A demonstrate how it puts quality first, which is good news for customers. There is plenty of experience in the board of directors. Dewhurst is still controlled by the founding family. Brothers David and Richard Dewhurst have run the company for more than thirty years while finance director Jared Sinclair and Richard Young, managing director of Thames Valley Controls, have been with the company since the 1990's. The newest executive, John Bailey, came with A&A, where he has worked since 2008. None of the directors are immodestly paid, which bodes well for other people with a claim on the company's profits, specifically employees and shareholders.

Cheap: Is the firm's valuation modest?

Score: 2

Every year I battle with myself about Dewhurst: Is it a good business or a great business? This year I'm plumping for good. A relatively modest valuation of 15 times 2018's profit on a debt-adjusted basis means the overall score is 7/10, high enough for me to recommend for the long-term.

Richard owns shares in Dewhurst

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.