The AI boom’s new bottlenecks – and where you might find opportunities

The biggest hurdles – and the best investing opportunities – might not be in the digital realm anymore. Here are four areas where Capital Group is focused now.

22nd November 2024 08:58

by Theodora Lee Joseph from Finimize

- AI's infrastructure needs, especially data centers, are fueling a copper surge, benefiting mining companies and those that are focused on industrial metals.

- Power-hungry AI systems are driving up electricity demands, creating investment opportunities in energy sectors, including across nuclear and renewable energy ETFs.

- AI's rollout has been slowed by a shortage of skilled engineers, positioning tech service firms to thrive as they bridge this talent gap for businesses.

AI’s been aggressively scooping up all the data, coding, and cloud it needs to reshape industries. But now some huge obstacles are standing in the way, and they’re from the last place you might expect – the physical world, where things like commodities, power grids, and workforces are creating stubborn bottlenecks. The good news is that these choke points often hide the best opportunities. That’s why Capital Group, the asset management firm, has been focusing on four of the biggest ones.

1) Copper

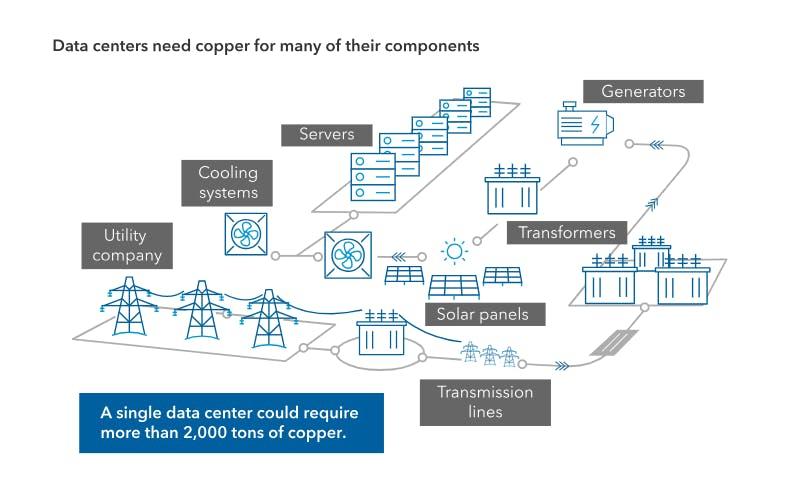

It takes massive computing power to run AI – and that means building huge data centers packed with servers that run 24 hours a day. And those servers – plus all the energy and infrastructure it takes to keep the machines up and running and to keep it all cool – are driving some unprecedented demand for copper. As one example: Microsoft Corp (NASDAQ:MSFT)’s brand new data center near Chicago used over 2,000 tons of copper in its construction – the weight of almost 200 fully loaded school buses.

Anatomy of a data center: servers, power, and cooling systems. Source: Capital Group.

And the thing is, this big old conducive metal was already seeing rising demand before the AI boom. Electric vehicles, renewable energy projects, and power grid upgrades all need copper. So it’s no wonder JPMorgan is predicting a six-million-ton shortage of the stuff by 2030.

Already, mining companies are racing to increase production. Grupo México – which operates some of the world’s lowest-cost copper mines – recently resumed mining in Peru, and Glencore (LSE:GLEN) set out to double production at its mines in Argentina.

Copper is critical for AI – and that makes it interesting to AI investors. You can tap into the copper theme through ETFs.

2) Power

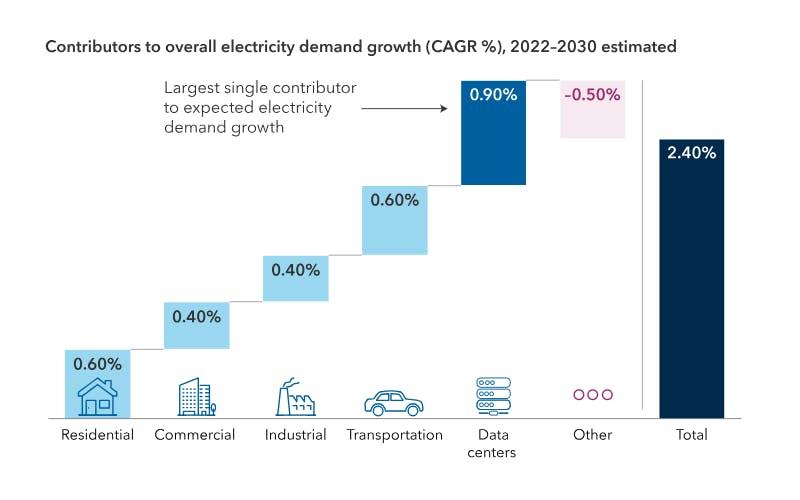

So, AI systems are hungry for electricity – really hungry. Data centers alone could eat up nearly 9% of all US electricity output by 2030 – more than double what they use now. That’s a huge surge in power consumption, pressuring the US grid in ways not seen for at least two decades.

Estimated contributors to overall electricity demand growth from 2022-2030. Sources: Goldman Sachs, US Energy Information Administration (EIA).

Meeting these power demands is no easy feat. For starters, energy supply varies widely by state, which could mean some areas keep pace while others don’t. Plus, many tech giants are committed to reaching net-zero carbon emissions by 2030 – and balancing that goal against their rocketing energy needs is already a puzzle. That’s why companies like Microsoft are taking extraordinary steps, like signing agreements with nuclear power providers to restart plants, like the one at Three Mile Island in Pennsylvania.

In some high-demand areas, the situation is already tight and companies are being told there’s a waitlist for grid connections. It’s no wonder many of the big tech firms are taking matters into their own hands, working to develop the next generation of advanced zero-emission nuclear technology, known as "small modular reactors" – aiming to meet the massive energy needs of their data centers while staying aligned with their climate goals.

With AI driving up energy demand, especially for greener power sources, there’s bound to be growth. And you can invest in this theme through ETFs.

3) Equipment

There’s a huge infrastructure need with AI too – one that goes beyond copper and electricity. This technology requires massive amounts of equipment, from power generators to advanced cooling systems. Companies like GE Vernova Inc (NYSE:GEV)– which supplies gas turbines for backup power – are seeing their order backlogs grow fast. In fact, orders are expected to triple by the end of the year.

Then there’s the need for cooling systems – and they’re essential because AI processors generate a lot of heat. Companies such as Modine Manufacturing Co (NYSE:MOD) and Vertiv Holdings Co Class A (NYSE:VRT), which specialize in these systems, have seen their stock prices double or even triple this year, with that demand.

The point is: AI’s growth isn’t only fueling demand for tech; it’s driving a resurgence in traditional industrial industries that make the critical hardware needed to support AI systems.

4) Humans

I know, most of what you hear is about AI’s potential to replace humans at work. But ironically, AI itself needs skilled human power to work. And a recent Salesforce survey found that 60% of public sector IT professionals cited a lack of AI skills as their top implementation challenge.

Right now, there aren’t enough AI engineers to build and deploy these systems. This shortage affects everything from foundational model building to actual application within companies. And as a result, adoption may be slower than expected, especially for businesses that don’t have in-house AI talent. So it could come down to professional services firms like Accenture Class A (NYSE:ACN) and Oracle Corp (NYSE:ORCL) to play pivotal roles in helping companies define their AI strategies and find ways to carry them out.

There’s no doubt that AI is poised to transform the economy. But, with these four bottlenecks in the way, it might take time for it to reach its full potential. Technological breakthroughs could help – like new chip designs that reduce the need for data center power – but the journey will likely be a slow one.

Theodora Lee Joseph is an analyst at finimize.

ii and finimize are both part of abrdn.

finimize is a newsletter, app and community providing investing insights for individual investors.

abrdn is a global investment company that helps customers plan, save and invest for their future.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.