10 shares to generate £10,000 income in 2018

30th January 2018 13:39

by Lee Wild from interactive investor

A turn in the rate cycle is good news for savers, but there will be no return to the heady days before the financial crisis when banks offered interest on current accounts of 6%. So with wage growth lagging inflation, the need to identify more generous income streams is as urgent as ever.

It's clear, then, why equities have been and will likely remain a primary source of income for investors this year. With that in mind, and following the success of our previous income portfolios, we've scoured the stockmarket for companies offering attractive dividends that are well covered by earnings. We are looking for a mix of risk that maximises the income-generating capabilities of the portfolio as a whole.

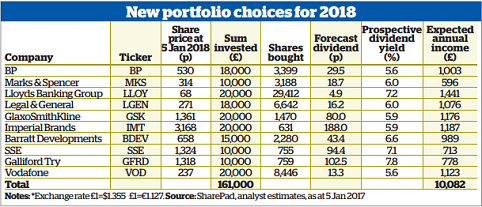

Our objective, as it has been for the past three years, is to achieve an annual dividend income of £10,000. As we are reluctant to tinker with a winning formula, the 2018 portfolio will once again include 10 constituents, mostly blue chips but with a couple of wild cards to supercharge potential returns.

Succesful 2017

The 10 high-yielding shares picked for last year's income portfolio delivered an income of £9,905, just £95 short of our objective. However, last year's portfolio required less upfront capital than in 2016 - only £168,500 - and it managed to generate a capital return of 4.6%, amounting to an extra £7,700, over and above the dividend income.

We can justifiably blame the small miss in income on a 10% rebound in sterling against the dollar from its post-Brexit referendum lows. That reduced the benefit to UK investors of dividends paid in expensive dollars. The pound also appreciated in value against the euro, although by only half as much.

Oil major , a dollar dividend-payer, short changed us on dividends, but not by much. Global bank was a little light too.

That said, it's hard to argue with a yield of 6% for both these heavyweights. Job done. We also took some pain on after the Serious Fraud Office launched an investigation into possible bribery, corruption and money laundering at the oilfield services provider. A decline in capital investment also hit cash flow, prompting a 42% cut in the dividend.

Most of the other choices did pretty much what we expected them to do, in particular drugs major , telecoms big-hitter and utility .

But there was a significant windfall from , the housebuilder, which has so much cash sloshing around that it returned an extra £175 million to shareholders in 2017. The share was the portfolio's second-best performer too, up 32% over the year.

However, share price outperformance or dividend generosity last year has not necessarily guaranteed a place in the 2018 portfolio, and there have been some changes to the constituents this year.

Who misses the cut?

Obvious casualties first, so Petrofac gets the chop. It's a good company and very likely undervalued, but the decision to slash the dividend gives us no choice but to look elsewhere.

At the other extreme, we also say goodbye to . We stuck our neck out on this one by making a small investment in a stock that hadn't paid a dividend yet.

But the fund manager kept its promise to make quarterly payouts, yielding 5.8% over the 12 months. However, the shares are no longer cheap, following an 83% surge in its share price. Such a significant re-rating means even the expected jump in the firm's dividend this year would only give a yield of 4%.

HSBC has been ever-present in our series of portfolios, delivering substantial capital gains for the past two years and a consistently high yield from day one. Last year it rose by 15% and yielded 6%. But now there's a new bank play in town, with even greater income potential.

Ready for new blood

Once again, despite the continuing upward trend in the index, we've managed to reduce the outlay required to reach our objective of £10,000 annual income by £7,500 to just £161,000, for a prospective yield of 6.3%.

There have been just three changes to this year's portfolio. We had no choice but to eject lower-yielding Petrofac and Premier. As promised in previous years, we will only change holdings if a better option exists, and for HSBC this is the case, so it has to go.

After years of careful rebuilding following the credit crunch, has become established as a home for income seekers since returning to the dividend list in 2015.

And it's easy to see why. Given that it's currently returning cash to shareholders, the likelihood of a recession is slim, and UK interest rates will probably rise again this year, Lloyds is well-positioned to keep growing its payout.

With a sector leading dividend and PPI fines less of a concern, Lloyds is expected to return a third of its market capitalisation to shareholders over the next four years, so we will take it as our bank stock for 2018.

Barratt - 'a knockout dividend on the cheap', we said last year - stays, a reward for repaying our faith during 2017. But cash-rich housebuilders are tipped to remain a happy hunting ground for income-seekers in 2018, so we find space also for .

Galliford underperformed the sector last year because of cost overruns at its construction division, which have been resolved. That presents a value opportunity and the chance to lock in a prospective yield of around 8%.

In terms of risk, is up there as a true contrarian play. A string of big names has tried and failed to halt its embarrassing decline. However, we have room for risk in the portfolio, especially in return for a 6% yield.

Chief executive Steve Rowe and industry legend Archie Norman stand as good a chance as anyone of making M&S special again. The shares are cheap, and strong cash inflows should mean M&S keeps paying a generous dividend through 2018.

Who stays in the portfolio?

We like the prospects for oil in 2018. The sector has been a rich source of income for us over the years, and the OPEC supply deal agreed last year - as well as various outages since - underpin crude prices at 30-month highs.

Stocks aren't as cheap as they were and yields are not as high, given sterling's resurgence, but we see little risk to income generation.

It would be easy to keep shifting back and forth each year between and BP.

When oil prices hit multi-decade lows, we put our faith in Shell and its steadfast refusal to cut its dividend payout. But circumstances have changed. Last year there was little difference between the two companies, but we believed BP to be better value, so we ditched Shell, which had made us a 58% profit.

BP generated the 6% yield we wanted and made us money too, so despite Shell doing a little better in 2017, we keep the faith with BP, which yields a fraction more than its rival.

We've also decided to stick with our other reliable blue chips - GlaxoSmithKline, Vodafone, and SSE.

Glaxo promises to keep the dividend at 80p this year, Vodafone should get better at monetising mobile data and cost-cutting, and Imperial will be keen to make 2018 a tenth consecutive year of dividend growth of 10% or more.

SSE is the only niggle. A government clampdown on energy suppliers forced the planned merger of its household supply business with Npower to be delayed. But whether it happens or not, SSE shares are not expensive, and a 7% yield is well covered by earnings.

ii publishes information and ideas which are of interest to investors. Any recommendation made in this article is based on the views of the writer, which do not take into account your circumstances. This is not a personal recommendation. If you are in any doubt as to the action you should take, please consult an authorised investment adviser. ii do not, under any circumstances, accept liability for losses suffered by readers as a result of their investment decisions.

The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Members of ii staff may hold shares in companies included in these portfolios, which could create a conflict of interests. Any member of staff intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. We will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, staff involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.