10 FTSE 250 shares that could rebound quickly

16th November 2022 14:18

by Ben Hobson from interactive investor

UK mid-caps are among this year’s worst performers, and there is potential to pick up stocks that could recover when conditions improve. Stock screen expert Ben Hobson has found some high-quality candidates.

After a year-long stock market sell-off, UK investors are now facing the prospect of a long economic recession.

While that probably spells more volatility for shares, history shows that prices start recovering as soon as the market detects a brighter outlook - and that can be well before recessions are technically over.

- Find out about: Trading Account | Share prices today | Top UK shares

Last week I looked at how good-quality profitability can help protect firms from economic pressures in a downturn. This week I’m taking that further with an index that has had a tough time this year - the mid-cap FTSE 250 - and looking for quality firms that could rebound quickly when there’s a recovery on the horizon.

Pricing in bad news and good news

Andrew Bailey, governor of the Bank of England, said in early November that the UK was on the brink of a two-year recession. Mercifully, he said the Bank believed it would be shallow, with the economy emerging just 3% smaller.

Hopefully he’s right. By comparison, UK GDP fell by 6% in the last prolonged recession in 2008, and the stock market took three years to recover.

Fast forward to today, after 18 months of rising inflation and a string of interest rate hikes to control it, the economy looks set to go into reverse.

The stagflationary impact of rising costs and economic contraction is a real headache for both companies and investors. But there is some solace to take from the way markets have historically performed during these phases.

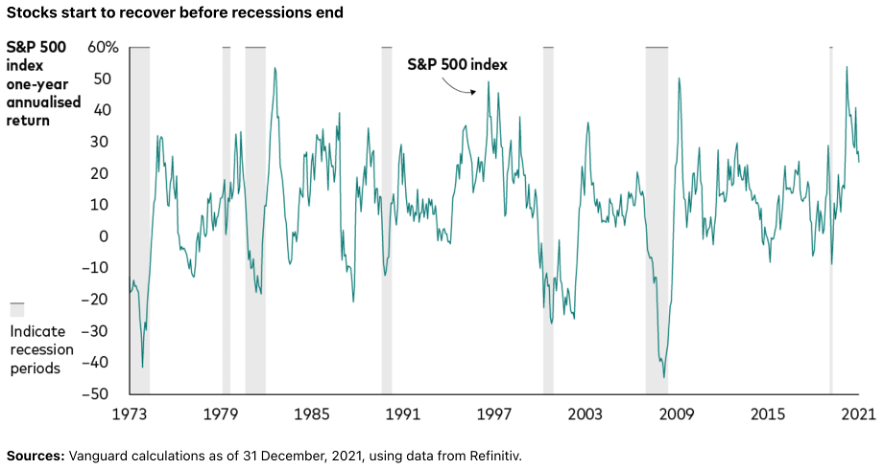

This chart from the fund provider Vanguard shows how the market (in this case the US S&P 500) sells off in anticipation of recessions and often begins recovering before they are over.

It is a reminder of the forward-looking nature of markets, and that bad news often gets priced into shares early. As time progresses - and short of any more bad news - the market starts pricing-in a return to normal before the recession is officially over.

An obvious challenge for investors when a recession is looming is judging how much pain is already priced in. With small-cap firms this can be a difficult thing to do. It’s partly the reason why the AIM market has sold off heavily this year. That decline has left many firms trading at seemingly attractive prices, but the market is far from certain about how they will perform through a recession.

The FTSE 250 has also been hit hard and is currently trading down 19.6% this year. But here, companies are larger, better understood and often financially stronger. Many have broad diversification in terms of product, market and geographical exposure.

An uptick in the overall 250 index value in November suggests investors are looking for signs of optimism - even before a recession has officially got started. Those hopes may yet be dashed but it’s an encouraging sign that keeping an eye on quick recoveries is a strategy worth pursuing.

A toolbox of quality measures

For investors rummaging around in mid-caps that have sold off sharply this year, there are some key considerations:

- Are the company’s costs under control and can it easily handle a period of high inflation?

- Is the company efficient at making profits and will they be protected from higher costs and potentially lower demand in a period of stagflation?

Last week I mentioned research showing how profit margins and the sweating of assets for profits (return on assets) tend to be surprisingly consistent guides when it comes to analysing companies.

Another measure you can use in this environment is how much free cash flow comes from a company’s sales (this is called the free cash flow margin). This is an important relationship because it can be a guide to companies that don’t incur lots of costs in order to generate profits. When costs are rising, that lower capital intensity is a big deal.

With free cash flow margin, the higher the percentage, the higher the proportion of revenues convert to free cash flow.

A second quality metric to consider is the Return on Capital Employed (ROCE). This can tell you a lot about how efficient a company is at reinvesting its own capital in order to generate a continuing return.

ROCE is calculated by comparing the firm’s operating profit to the difference between its total assets and total liabilities (capital employed).

A consistently high ROCE over time can indicate that the company is good at driving profits. Again, this is a comforting measure when judging how protected the firm might be from recession.

This quality screen looks for FTSE 250 companies that have underperformed the FTSE All-Share this year but show promising financial strength. On a five-year average basis, it looks for free cash flow margins of more than 10%, as well as ROCEs and operating margins of more than 15%.

Name | Market cap (£m) | FCF margin 5y av. | ROCE 5y av. | Operating margin 5y av. | Price relative to FTSE All-Share YTD | Industry |

1,750 | 59.4 | 21.5 | 63.8 | -13.6 | Financials | |

684 | 31.9 | 23.6 | 39 | -51.7 | Financials | |

1,540 | 27.1 | 20.7 | 34.5 | -26.8 | Basic Materials | |

760 | 24.6 | 45.4 | 33.9 | -47.2 | Financials | |

1,057 | 22.3 | 43.5 | 28.2 | -6.2 | Technology | |

2,430 | 22.2 | 75.1 | 31.3 | -24.2 | Consumer Discretionary | |

858 | 21.3 | 42.5 | 39 | -50.1 | Basic Materials | |

2,454 | 15.2 | 17.7 | 21 | -17.9 | Industrials | |

757 | 14.4 | 55.8 | 18.8 | -44.1 | Industrials | |

1,788 | 14.3 | 49 | 15.9 | -16.8 | Technology |

It has been a difficult year for some of the shares passing these rules, showing just how much the market has punished companies despite their quality.

Asset managers such as Ashmore Group (LSE:ASHM), Jupiter Fund Management (LSE:JUP) and Liontrust Asset Management (LSE:LIO) are understandably among the top results given the performance of markets this year. You could argue that their fortunes are very closely tied to an eventual recovery, and their financial strength ought to see them through. They have some of the highest free cash flow margins.

Low-capital intensity groups such as Moneysupermarket (LSE:MONY) and Games Workshop (LSE:GAW) have very strong histories of profitability. But even manufacturers and more capital intensive firms like Victrex (LSE:VCT), Ferrexpo (LSE:FXPO) and Howden Joinery Group (LSE:HWDN) have strong quality traits.

Overall, the likelihood of inflation-driven cost increases and a prolonged slowdown in economic activity is hardly an appealing prospect. But the market has a track record for responding quickly to signs of an improving outlook.

While the recent strength in prices in the FTSE 250 might prove to be a false dawn, it does show that the market will react positively when it sees good news.

For investors looking for opportunities in heavily sold-off mid-cap shares, quality is key. A history of strong profitability could play an important part in pinpointing firms that can not only survive economic turbulence but will also bounce back quickly when the recovery starts.

Ben Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.