Important information: As investment values can go down as well as up, you may not get back all the money you invest. Currency changes affect international investments, and this can decrease their value in sterling. If you’re unsure about investing, please speak to an authorised financial adviser.

Enjoy £100 towards your trading fees when you open an ii Trading Account. That’s up to 25 free trades to kick-start your year.

Offer ends 28 February 2026. New customers only. Terms and fees apply.

With a low, flat monthly fee, the more your investments grow, the more you can save. UK and US trade fees are usually £3.99 a trade. And with free regular investing, you could save even more.

Hold up to 9 currencies in your ii Trading Account. Track exchange rates and convert when you want. Buy investments in their original currency without paying separate FX fees on every trade.

Your money’s security is our priority. As an FCA-authorised and regulated platform, we have a robust range of systems and controls in place to protect your assets. Your cash and investments are also protected up to certain limits by the Financial Services Compensation Scheme (FSCS).

As ADVFN’s Best Online Stockbroker and Best Stockbroker for International Dealing, we’re always striving to provide the best experience possible.

And with our award-winning journalists, you also have access to impartial insights and analysis to help guide your investment strategy.

Unlike percentage-based fees charged by many providers, with ii you will always pay a low, flat fee. This can add up to real cost savings as your wealth grows.

Start on our Core plan at £5.99 a month and upgrade when you want access to a wider range of benefits - or when your portfolio grows above £100,000.

It’s a transparent, cost-effective way to invest flexibly for your future.

It takes just 10 minutes to open your Trading Account. You can also transfer your investments or leave it until a later date.

Don’t worry: you won’t be charged until you deposit money and start using your Trading Account.

Add any money you want to your account. There’s no limit to how much you can invest. Trading Accounts are an ideal choice if you’ve used your £20,000 ISA allowance.

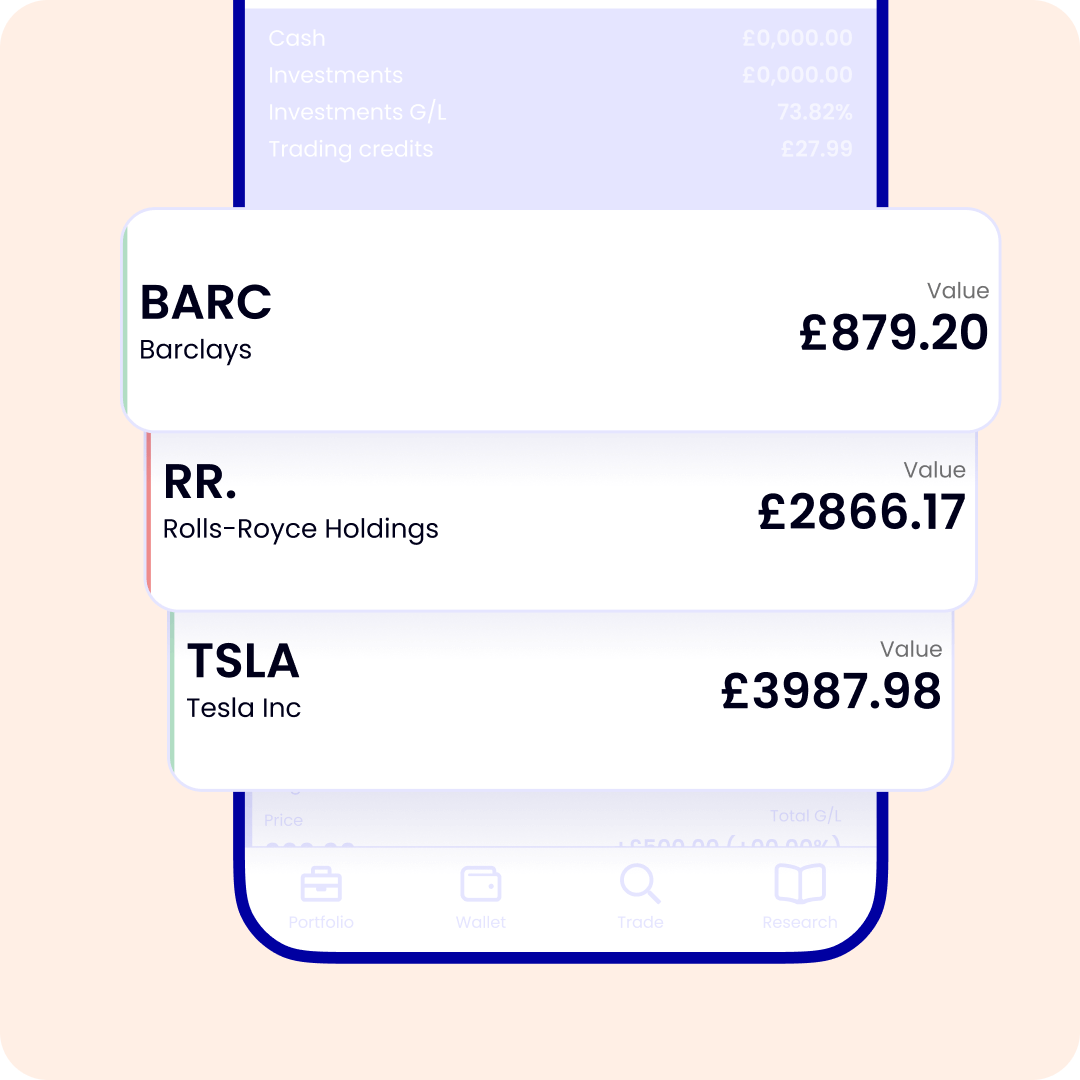

Once you’re set up, you’re good to go. Choose from a range of UK and international stocks, funds, trusts, ETFs and more.

Some of the most well-known companies are outside the UK. With an ii Trading Account, you can invest in 17 international markets across 3 continents.

Expand your options beyond the UK market. International investing can be a key pillar of a successful investment strategy. It allows you to diversify and spread your risk across multiple markets, meaning the performance of your portfolio isn't tied to the UK.

Invest directly on markets from around the globe. You’ll benefit from genuine market prices and full trading hours, and can access IPOs and share splits when they happen.

Access live pricing via our website and mobile app. Keep your finger on the pulse of the market wherever you are and invest globally at your convenience.

Whether you’re investing here in the UK or exploring our international offering, there’s a range of investment types to choose from...

Trading is the buying and selling of financial assets in an effort to make a profit.

While you might have heard of stocks and shares, you can trade a variety of assets – such as funds, investment trusts, Exchange-Traded Funds (ETFs) and more. You can also trade internationally in markets around the world.

To start trading stocks and shares, you need to open an account with an investment platform – like ii.

From there, simply choose an investment option that you'd like to invest. You would need to do your own research when deciding where to invest. But when you open an account with us, you'll have direct access to latest insight and trends from ii's editorial team of award-winning journalist.

Opening a Trading Account is quick and easy. You just need your bank account details and National Insurance number. Then click here to open an account.

Once your account is open, you'll need to add cash to buy your first investments. You can either buy investments as and when you choose, or you can set up regular investing to top up your investments monthly.

Yes, you can transfer investments from another provider to ii.

You can transfer when you first open your account or any time after that. If you want to trade while your transfer is in progress, most providers will be able to do this as long as your investments aren’t in the process of being re-registered.

Don’t forget to keep both us and your current provider updated on any changes to the investments in your account. We can’t be held liable for any missed opportunity if you choose not to trade while your transfer is in flight.

Please note: if a Trading Account transfer includes any investments we don't offer, we won’t be able to bring them across. You can search our shares, funds, trusts and ETFs pages to search for a particular investment.

Join over 500,000 investors and see why we’re Boring Money’s Best For Share Traders and Best For Investment Enthusiasts.