Pension stories

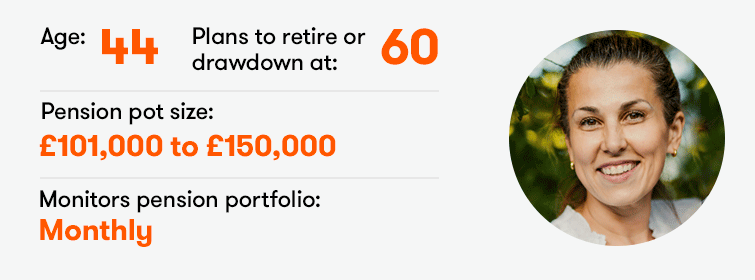

Margaret Stoikovich

Did you find it easy to start investing for a pension?

Yes. I started aged 23.

What current pension contributions do you make, either monthly or otherwise?

I don’t, my growth is purely from existing investments.

Have you ever taken a break from pension saving?

Yes, for nine years. After I had children, I left my corporate career and began working alongside my husband in a private company that we own, and I have been drawing mainly dividends rather than salary. I have not contributed to my pension during this time.

What do you invest in for your pension?

I have historically invested in a ready-made portfolio, but now I invest in international shares and funds. Most recently, I have been buying natural resources and precious metals equities and exchange-traded funds (ETFs). I hold London-listed securities in the main, but also Australian-listed equities, as they have a more vibrant natural resources market and many more companies to choose from.

What are your five largest holdings?

Currently my largest holding is the WisdomTree WTI Crude Oil ETC (LSE:CRUD) and I hold a second Australian-listed gold miner (as of 30 November 2020). I presently hold only two investments in my SIPP, with about a third of it in cash waiting for my next investment ideas. I also have a similar size ISA with ii, in which I hold natural resource securities. I generally don’t invest for dividend yield, but capital gains, but this will likely change as I get older and my risk appetite changes.

What is your investment objective/target pension pot or annual retirement income?

I’m hoping to achieve a minimum of £600,000.

Is that objective based only on your portfolio of stocks and funds?

I hold other investments outside my SIPP, such as residential real estate/buy to let, that I have always considered would form part of my retirement plan. So I am aiming to achieve £600,000 from the SIPP, and will consider making regular contributions to the SIPP again in the future. In the meantime, I will continue to actively trade securities.

As a SIPP holder, what advice would you give to anyone thinking of opening one?

Read up about whether it is the right choice for you and then invest in a way to maximise your return based on risk factors that you feel comfortable with. I tend to invest in commodities and watch the market during times of adversity or major change. There are always opportunities that allow for good returns.

I tend to invest in commodities and watch the market during times of adversity or major change.

Do you have any pension savings tips?

I am still figuring it out myself, but I would say that investing myself has delivered far greater returns than the set portfolio I relied on for so many years.

How do you feel about your pension?

Pensions have been on my mind from when I was young, and I have invested from the start of my working career. I lost interest in investing for a few years when I started a family, but now want to build it up again, as I think I need to be saving more. I do not worry too much about my pension as I believe in diversifying my investments outside of my SIPP.

Is there anything relevant/significant that affects your attitude towards saving for the future?

I have invested in properties and land in the hope of helping fund my retirement and diversify my portfolio. I am also hoping that my husband’s business will continue to grow to deliver returns for us in the future.

Pensions can be a party pooper topic, but not at ii. We want to know more about the retirement hopes and fears of the nation. Please help us paint the fullest picture yet by taking part in our annual Great British Retirement Survey

Our expert’s view

Victoria Scholar writes...

Margaret took nine years out of pension saving and has still managed to build an above-average pot size, thanks to strong investment growth. Like many self-employed people and company directors, she hasn’t contributed to her pension since leaving formal employment. However, she is still a good 20 years off retirement and stands to boost her pot considerably if she starts to contribute again. Even without contributions from an employer, she will receive tax relief on her pension.

Margaret clearly puts thought and time into her SIPP investment research. She also points out that she has diversified her retirement planning with buy to let, so will have a range of income sources.

She should keep the faith with pensions and continue to contribute for the tax relief. She seems to be on track for a decent retirement off her own back and won’t need to rely on her husband selling his business for retirement income, as long as she keeps at it. It sounds as though now her children are a bit older, she’s newly inspired to consider investing more into her pension. Now is as good a time as any.

Dzmitry Lipski suggests a fund which might interest an investor in their 40s

A more cautious and informed investor could consider infrastructure to diversify and generate income. The Legg Mason IF ClearBridge Global Infrastructure Fundinvests in a diverse basket of global listed infrastructure assets, such as water utilities, gas, and electricity ,to generate reliable income and capital growth above the level of inflation.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Take control of your pension

The ii SIPP is aimed at clients who have sufficient knowledge and experience of investing to make their own investment decisions and want to actively manage their investments. A SIPP is not suitable for every investor. Other types of pensions may be more appropriate. The value of investments made within a SIPP can fall as well as rise and you may end up with a fund at retirement that’s worth less than you invested. You can normally only access the money from age 55 (age 57 from 2028). Prior to making any decision about the suitability of a SIPP, or transferring any existing pension plan(s) into a SIPP we recommend that you seek the advice of a suitably qualified financial adviser. Please note the tax treatment of these products depends on the individual circumstances of each customer and may be subject to change in future.