Worst could be over for this American tech icon

One of the oldest technology companies around, this business has struggled in recent years, but overseas investing expert Rodney Hobson thinks the shares are now worth buying for recovery.

25th September 2024 08:06

by Rodney Hobson from interactive investor

With “Intel inside” stickers on practically every computer you see, shareholders could be forgiven for thinking that they had bought into a gold mine. Recent results have indicated otherwise but that is now reflected in the share price and this could be the time to consider buying for recovery.

Intel Corp (NASDAQ:INTC) will suspend its dividend for the fourth quarter of 2024 and is in the process of sacking 15% of its workforce after a disappointing second quarter. However, the messages coming out of the company are confusing to say the least.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

For a start, Intel said it had hit key product and technology milestones in the second quarter, yet revenue slipped just under 1% to $12.8 billion and, rather more alarmingly, a net loss of $1.65 billion was recorded, more than the net profit made in the same quarter last year.

As well as cutting back on operating costs, Intel is reducing capital expenditure in the hope of saving $10 billion next year and preserving liquidity. At the same time, it is talking of maintaining core investments, which highlights the difficulty that technology firms have in keeping pace with a rapidly changing and expensive landscape while keeping costs under control. Gross margins have been squeezed by the accelerated rollout of Intel’s AI product for personal computers, unfortunately at the same time as the company incurred higher charges for non-core products.

Some critics feel that Intel has been trying to back its horses both ways by designing and also manufacturing chips rather than concentrating on one or the other. It has thus allowed competitors such as NVIDIA Corp (NASDAQ:NVDA) in design and Taiwan Semiconductor Manufacturing Co Ltd ADR (NYSE:TSM) in production to gain dominant market positions.

Another conundrum is what to do with the Mobileye Global subsidiary, which provides automated driving systems. Intel bought it for $15.3 billion in 2017 but it has struggled in a market that should have so much promise. Intel would probably get less than $10 billion for its remaining 88% stake and, while it insists it does not want out, it may yet feel the cash would be useful.

- Equities: reasons to believe

- Terry Smith: two reasons why I haven’t bought Nvidia

- Sign up to our free newsletter for share, fund and trust ideas, and the latest news and analysis

Life will not get easier any time soon, although revenue in the third quarter has probably edged higher to around $13.5 billion. Trends in the second half so far have been more challenging than previously expected, although it is encouraging that management has taken quick and decisive action.

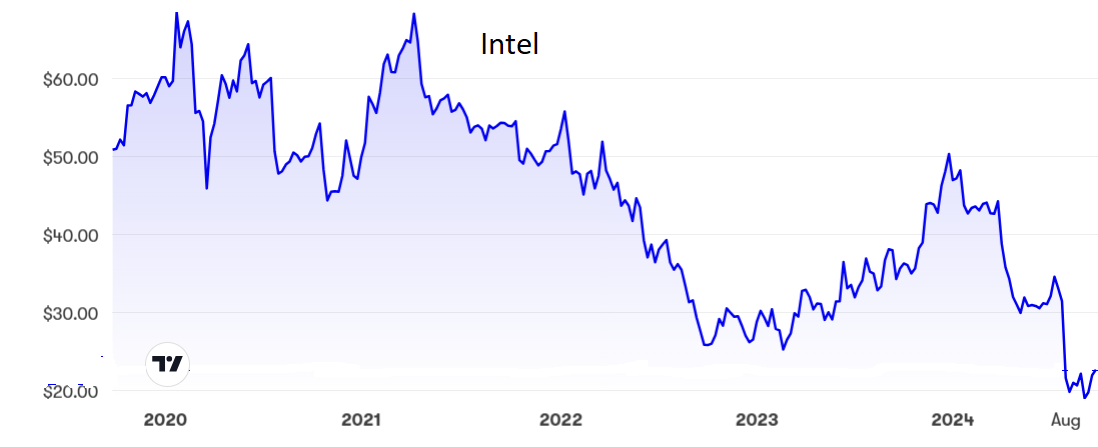

Intel shares have fallen heavily this year, including a tumble of 18% in response to those second-quarter figures. From $50 just after Christmas they have been below $20. However, since hitting a $19 low in early September they really do seem to have turned the corner and have now picked up to $23. The uncertainty over profits and dividend makes any ratio calculations meaningless.

Source: interactive investor. Past performance is not a guide to future performance.

One reason for the pick-up is a rumour that asset management firm Apollo Global Management has offered to make a $5 billion investment in Intel in return for an equity stake, though that would dilute existing shareholdings. Less likely is a purported plan by rival chipmaker Qualcomm Inc (NASDAQ:QCOM) to launch a full takeover bid. If it happened, it would be the largest technology acquisition ever but it would surely fall foul of competition regulators.

Another plus is that Amazon.com Inc (NASDAQ:AMZN) has awarded Intel a multibillion dollar contract to make chips, followed by the US Government placing a $3 billion order for manufacturing advanced chips for the armed forces.

Hobson’s choice: Intel is not out of the woods yet but the worst could be over. Buy for recovery but consider taking profits above $30, a level that could be reached before the end of the year, especially if the third quarter produces genuine signs of a turn around. The take profits advice needs to be adjusted in the unlikely event of Qualcomm making a bid.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.