A world-class British AIM share

This firm has gone through a remarkable transformation that has made it a leader in three markets.

8th March 2019 11:59

by Richard Beddard from interactive investor

This firm has gone through a remarkable transformation that has made it a leader in three markets.

RWS: March of the machines

Recently I booked an Airbnb property in France. My host had written the description of the house in French, so I started to make the arrangements in his mother tongue.

Being the proud owner of a 1982 vintage grade B 'O' level in French, my initial messages were bumbling at best. But then I noticed our host's replies were in fluent English even though he was typing in French. So I just gave up, and let Google, embedded in the Airbnb site, take my English and turn it into grade A French. We could have both been English, or French*.

I share this anecdote to warn you I am going into this investigation of a world-class UK listed translation firm with a naive fear that RWS Holdings (LSE:RWS) could lose its edge to machines.

Extraordinary acquisitions

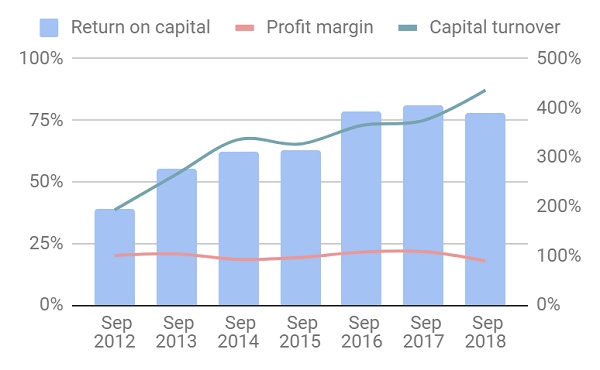

There's something extraordinary going on at RWS. Revenue has more than quadrupled to over £300m over the last six years and adjusted after-tax profit has nearly tripled to around £55m. Return on capital has risen to 75%, which is both amazing and not quite what it seems:

The company has done more translating in the period and earned more profit from it, but the main driver of growth has been acquisitions. It has bought a number of small firms, two big ones, and a monster. Return on capital has increased because the numerator of the calculation, profit, has increased by a greater proportion than the denominator, operating capital.

Translators do not require much capital of the kind we can easily value, physical assets. They will own or lease offices and computers of course, but most of the capital they employ is intangible, expertise, systems, and customer relationships. This is what RWS is interested in when it buys businesses, but accountants don't even try to measure the value of most intangible assets, so we're measuring returns against only a small part of what generates them.

Intangible assets do find their way onto balance sheets when a company acquires another company though. Then, acquired intangible assets are balancing items, the difference between how much the acquirer paid for a business and the value of its physical assets. Accountants will try and put a value on the acquired intangibles they can identify, and the rest sits on the balance sheet as goodwill.

The value of goodwill and acquired intangible assets is not very useful in judging the ongoing profitability of a business because they are a sunk cost. If we were to include them in our definition of capital, it would also mean firms that acquired businesses would earn much lower returns on capital than comparable companies that built them, rendering the ratio useless as a means of comparison.

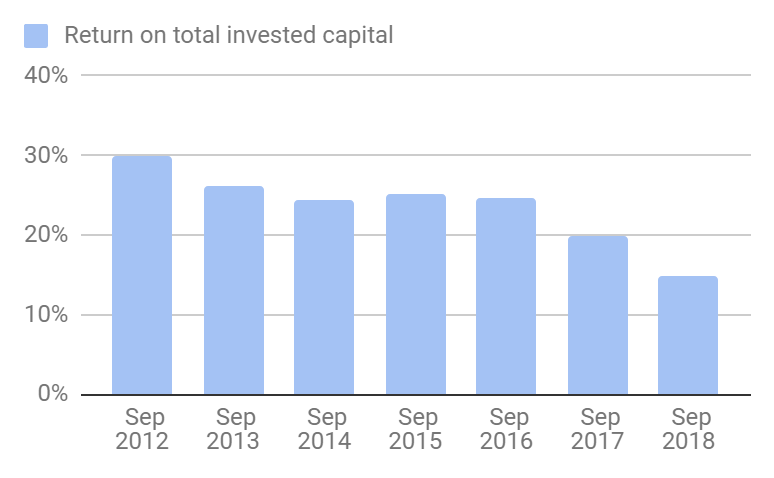

Including the value of acquired intangible assets at cost value in the return on capital calculation can help us judge whether the acquisitions were worth the price, though:

Contrary to what you might think, this chart suggests they may be. Profitability has halved to 15%, but that is still a decent return, and if RWS is right in believing the group will be more profitable together than apart, it should be able to extract higher returns over time as it fulfils this vision.

I do not get too hung up on which is the right measure of return on capital, 15% or 75%. They measure different things. The good news is they indicate RWS is highly profitable and probably a good acquirer.

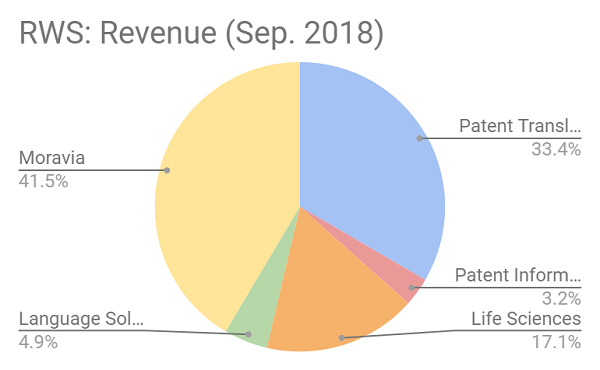

Not only have the acquisitions transformed the company’s performance, they have fundamentally changed what it is. In 2013, RWS was focused on patent translation, with a small but highly profitable sideline in other patent services. Today Patent translation and services account for little more than a third of revenue:

The acquisition of CTi in 2015, described by RWS at the time as the market leader in pharmaceutical and biotech translation, created the Life Sciences division. It was joined by LUZ in 2017. The acquisition of Moravia later in 2017 added the company's biggest revenue spinner, even though RWS only owned Moravia for 11 months of the financial year to Sept 2018. Moravia localises products, websites, and marketing for global companies, including many US technology giants.

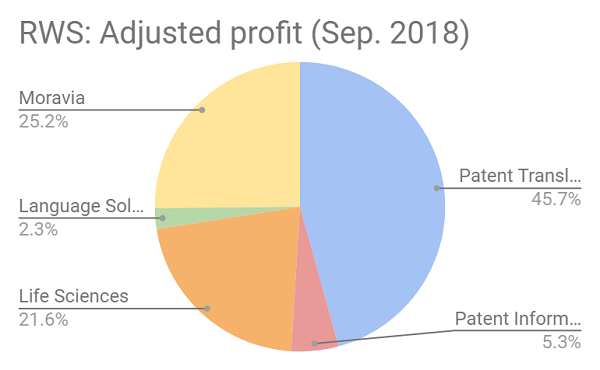

The acquisitions contribute well over half RWS’ revenue, although the split is more even in terms of profit:

Patent Translation, Patent Information and Life Sciences earn RWS incredible operating profit margins (30%, 37%, and 28% respectively) but Moravia, which achieved 13%, seems to be in a more competitive market.

The size of the acquisitions is unnerving, as is the degree of change, but there is logic to the strategy. RWS is now a market leader in a gaggle of specialisms. Specialisation probably earns RWS high profit margins. Being good at one thing, languages, is valuable, but being good at two, languages and life sciences, or languages and patents, is more so. Companies are probably willing to pay handsomely for good quality translations when their fortunes and people's health are at stake.

RWS has more services to sell and more customers to sell them to. It is selling patent services to Moravia customers, and although Moravia is, perhaps, less specialised, it brings the group something else. Moravia is a heavy user of machine translation, and it is sharing its expertise.

Rise of the machines

RWS already uses Translation Memory, pre-translated text segments, but machine translation is both a threat and an opportunity. It is an opportunity to reduce the work of human translators and, therefore, costs. But it is not clear, to me at least, who will benefit, companies doing the translation, customers if competitors drive down the cost of translation, or software companies providing the translation engines. RWS' customers are working out how machine translation fits into their workflows. Some do the machine translation and send it to RWS to proofread.

RWS' instincts are probably right: To position itself in growing markets where exacting quality requirements require human involvement, and to use technology wherever it improves efficiency. But I have no idea whether that will be enough to maintain profitability in the machine age. The much-delayed European Unitary Patent, which will use machine translation, illustrates the risk.

RWS doesn't say much about its translators in its annual report, but the staff reviews on online recruitment websites can be negative, especially in the UK. They complain of boring routine work, inefficient processes, and little opportunity for career progression. It makes me question whether skilled translators are RWS’ secret sauce, and if they are, the march of the machines makes me wonder whether they will continue to be.

Scoring RWS

As usual, I have scored RWS to determine whether it is profitable, adaptable, resilient, equitable, and cheap. Each criterion can achieve a maximum score of 2, and a minimum score of zero except the last one. The lowest score for companies trading at very high valuations is -2.

Profitable: Does it make good money?

Yes. RWS is highly profitable in accounting and cash terms.

Score: 2

Adaptable: How will it make more money?

The company has developed and acquired market-leading positions enabling it to cross-sell services globally. RWS is earning sufficient returns to justify the purchases, which have also brought it machine translation expertise.

Score: 2

Resilient: What could go wrong?

I fear machine translation will disrupt the industry. RWS' focus on markets that demand the highest quality translations and its acquisition of machine translation expertise addresses this risk, to a degree.

Score: 1

Equitable: Will we all benefit?

An experienced board of directors is chaired by Andrew Brode, who acquired the company in 1995, floated it in 2003 and remains a majority shareholder. But I am wary of the low reviews staff give the company on recruitment sites.

Score: 1

Cheap: Is the firm's valuation modest?

At 475p RWS is valued at about 25 times adjusted profit in 2018. The company is confident in its organic growth prospects and Moravia will contribute a full year of revenue in the year September 2019 instead of 11 months.

Even so, I am flummoxed by RWS' valuation. There appear to be palpable risks.

Score: -1.4

A total score of 4.6/10 means I cannot recommend RWS for long-term investment. The financials suggest it is a great business, but it pains me to say I have not worked out the source of its secret sauce.

I hope to receive a postbag politely pointing out what I have missed.

* If my French host is there with the keys when we arrive, we will know for sure.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation, and is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Members of ii staff may hold shares in companies included in these portfolios, which could create a conflict of interests. Any member of staff intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. We will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, staff involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.