Why’s the Magnificent 7 getting all the attention?

The economic reality for European growth shares is more positive than the common narrative, argues a Kepler Trust Intelligence analyst, who says that firms are already benefiting from trends such as artificial intelligence, and the energy transition.

17th May 2024 13:36

by Alan Ray from Kepler Trust Intelligence

This content is provided by Kepler Trust Intelligence, an investment trust focused website for private and professional investors. Kepler Trust Intelligence is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Material produced by Kepler Trust Intelligence should be considered a marketing communication, and is not independent research.

The sentence 'Don't worry about the macro, it's all about the companies' is a particular favourite of investors in European equities. Indeed, to list the largest, best-performing stocks in Europe is to list a group of companies with global revenues.

Pharmaceutical company Novo Nordisk A/S ADR (NYSE:NVO), with a market capitalisation larger than the GDP of its home country, Denmark, is one example, generating only about 20% of sales in Europe.

Semiconductor equipment manufacturing ASML Holding NV (EURONEXT:ASML) is the leading supplier in its space to semiconductor manufacturers wherever they are based, and of course, we all know the story of how luxury goods manufacturers such as LVMH (EURONEXT:MC) have been seen as proxies for emerging markets growth, which perhaps explains why its share price performance, impressive over the long term, has been more muted in the last year.

It's not hard to see then how easy it has become to establish the narrative that Europe's macroeconomic outlook shouldn’t therefore be a primary concern for investors.

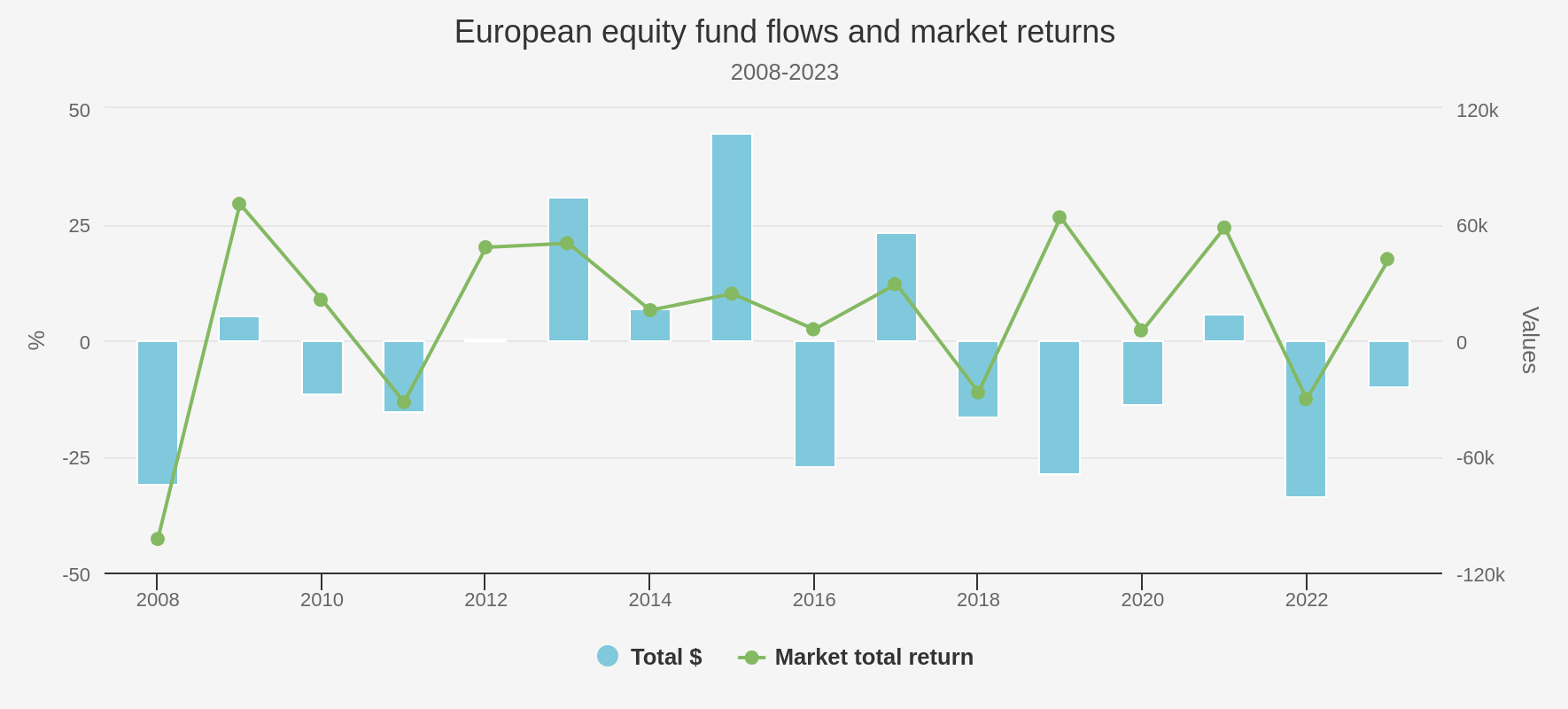

The chart below is one we've used a few times in various forms but bears repeating simply because it's empirical evidence of our claim that investors are ignoring European equities. It tracks the fund flows in and out of all the European equity funds on Morningstar's database, a group of funds with a total assets under management (AuM) of almost £700 billion and therefore, we think, a statistically significant sample size we can use as a proxy for overall investor sentiment.

The blue bars are the total inflow or outflow for each calendar year since 2008, and the line shows the corresponding performance for the European market index that many of our own European investment trusts choose as their benchmark. To help read the chart, we note that 2022's outflow was over $80 billion.

Over the years, one can see that there does seem to be a correlation between fund flows and market direction, which perhaps isn't the most startling insight, but it's notable that the same was not true in 2023 when European equities put on a very good show. Perhaps, as the chart could suggest if you wanted it to, it's just become a bit of a habit to be underweight Europe.

It may also be the case that the 'never mind the macro' message isn’t landing with investors, as one could hardly be blamed for feeling that the macroeconomic outlook for Europe in the last few years is, at best, very difficult to decipher.

EUROPEAN FUND FLOWS AND MARKET PERFORMANCE

Source: Morningstar. Past performance is not a reliable indicator of future results

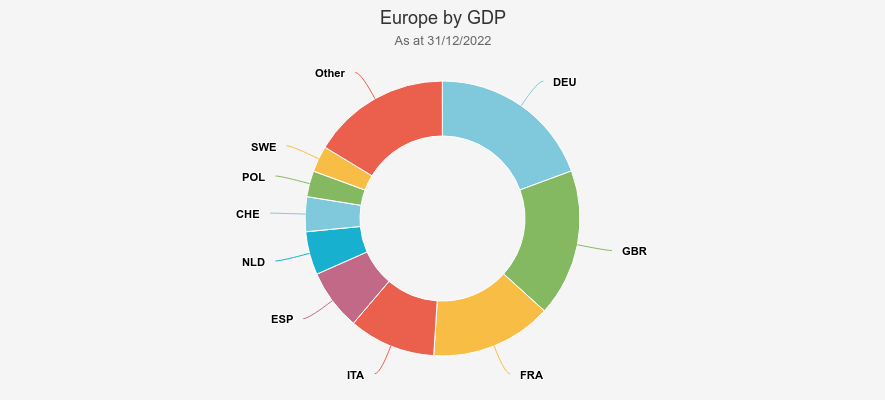

Let's begin to dissect that by looking at what, in macroeconomic terms, Europe actually is. The chart below will be a familiar roster of countries ranked by GDP, taken from World Bank data to the end of 2022. There are no real surprises in this chart. This is the landscape of the aforementioned 'Don’t worry about the macro' Europe.

Since UK investors generally expect Europe in the context of investment to mean 'Europe ex UK' the only possible surprise is our inclusion of the UK, but as some of the European trusts do choose to include some UK stocks, we've included it here. To put the whole into context, the sum of the parts GDP is approximately the same size as the US.

EUROPE DEFINED BY GDP

Source: World Bank as of 31/12/2022

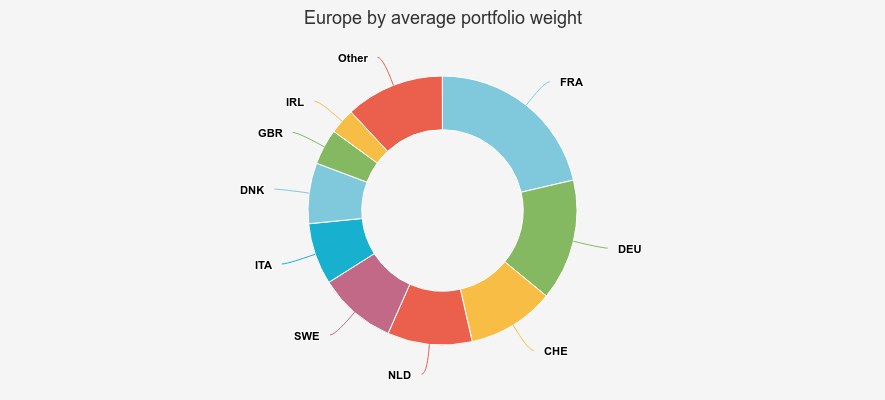

Now let's look at Europe as defined by fund managers. The chart below takes the average geographical weighting for all the European trusts, both large- and small-cap. Not unexpectedly, the UK's percentage falls significantly simply because most trusts do not include it in their portfolios.

EUROPE DEFINED BY PORTFOLIO WEIGHTING

Source: Morningstar

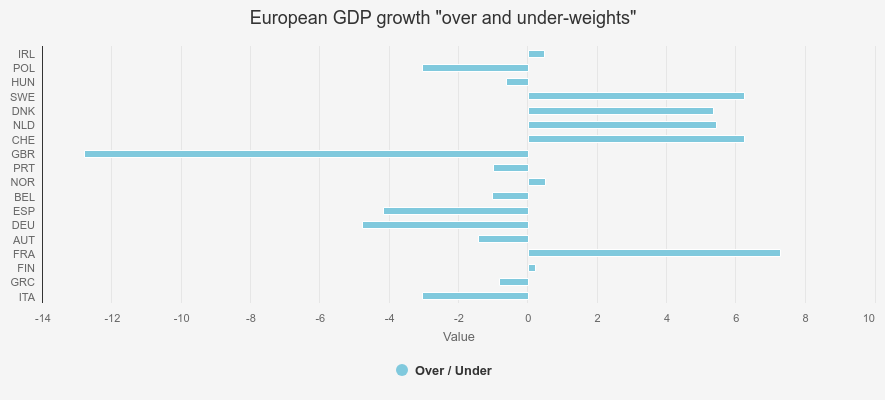

Now we've established a simple way of looking at how European fund managers define Europe, let's chop up the data in a different way. Readers are probably familiar with charts that show how fund managers are over or underweight different sectors or geographies compared to an index. Let's first make the 'index' weights the size of each European economy by GDP, i.e., the data from the first of our two charts above. Then let's see how each country is over or underweighted by the average fund manager from our second chart above. This we show in the chart below, which is also sorted from top to bottom in terms of GDP growth over the last decade. Again, we've left the UK in as it is part of the sample although only in a small number of European investment trust portfolios. With the main exception to the pattern being France, which sits fairly low down the GDP growth rank, the chart shows that portfolios tend to be 'overweight' European countries with faster GDP growth. Just to deal with a couple of other outliers, many of the samples will not include Hungary or Poland in their benchmark, so the underweight here is more technical than an investment decision, but again we include them in the data just for transparency.

EUROPEAN GDP GROWTH OVER AND UNDERWEIGHTS

Source: World Bank, Morningstar

And again, to give the chart some context, if we inserted the US in the GDP growth ranking, it would be right there in that block of overweight countries that have experienced faster GDP growth over the last ten years. And for what it's worth, the same chart re-cast with data over 20 years looks much the same.

There's obviously a temptation to run this data through some further analysis and try to come up with a composite GDP growth figure for countries that fund managers tend to favour, and perhaps that would be an interesting exercise. But the simple conclusion we were reaching is already apparent, i.e. the faster-growing economies of Europe tend to be favoured by fund managers .

Despite what the statistics suggest, we don't think our European investment trust managers are, on a conscious level at least, selecting countries with faster GDP growth. There are a host of factors one could think about that might be cause, effect, or both. For example, could a country that has a well-ordered stock market experience faster GDP growth because that stock market is indicative of a pro-business culture? Or could faster GDP growth cause a stock market to function better? Either could be true simultaneously and we aren’t really trying to go that deep. Our simple conclusion is that, consciously or not, European trusts tend to be overweight faster-growing economies. France is the very conspicuous exception to this, and with both France and Germany, the heavyweights in GDP terms in continental Europe, seeing slower growth over the last decade or two, one can see how we've developed this habit of repeating that 'never mind the macro, feel the quality of the companies' trope. We can't help wondering if one broke down the US into smaller regional economic units, whether the same range of outcomes would be apparent. The US is obviously a more cohesive block than continental Europe, but it's certainly big enough for there to be sizeable regional differences.

European fund managers, as a group, are much wiser than us of course, and generally steer away from the argument above. What does come across loud and clear from many of them though is that European equity markets feature many world-leading companies that are already benefitting from longer-term trends such as deglobalisation, artificial intelligence, the energy transition and, soberingly, rising defence spending. Europe also possesses more than its fair share of the luxury consumer brands beloved by aspirants all around the world. Alexander Fitzalan-Howard, manager of JPMorgan European Growth & Income Ord (LSE:JEGI)for over 18 years, recently reflected on how the European index has changed out of all recognition over the years, with financials and oil companies being superseded by higher growth technology, pharmaceutical and healthcare, and consumer discretionary companies such as the above-mentioned luxury brands.

This thought is echoed by Tom O'Hara, co-manager of Henderson European Focus Trust Ord (LSE:HEFT) who succinctly puts it this way "Europe is good at making stuff." Fidelity European Trust Ord (LSE:FEV)'s co-manager Marcel Stötzel takes this one step further and notes that while many of the big US-listed success stories of the last decade are business-to-consumer companies, and thus naturally higher-profile, many of Europe's biggest success stories, such as semiconductor equipment manufacturer ASML, as the business-to-business enablers that work behind the scenes. One's laptop may well have an 'Intel' and a 'Nvidia' sticker on it, but the chances are high that ASML's kit helped make it all happen in the background. And of course, many investors will more recently be familiar with the hugely successful pharmaceutical company Novo Nordisk, but as Luca Emo, co-manager of European Opportunities Trust (LSE:EOT)reminded us recently, the trust has owned it for well over 20 years, collecting some extraordinary returns along the way.

The same excitement for a Europe that makes stuff pervades down to the smaller companies fund managers, who also collectively point out the extremely low valuations of many European smaller companies, a phenomenon shared by the US and elsewhere but one which may not persist once inflation and interest rates abate. Like many small-cap managers, the team at JPMorgan European Discovery Ord (LSE:JEDT)have found opportunities further down the market cap spectrum to participate in the semiconductor industry, with such companies as Melexis providing technology to the conventional and EV automotive industries. Demonstrating the breadth of opportunity, the same trust owns glass manufacturer Verallia (EURONEXT:VRLA), an ESG leader in an industry that is highly energy intensive. Ollie Becket, manager of The European Smaller Companies Trust PLC (LSE:ESCT)has among many other holdings two companies involved in the Liquefied Natural Gas business, which as many readers will know has seen an extraordinarily rapid expansion in Europe since Russia's invasion of Ukraine. In fact, for those who are still thinking of Europe as a ponderous place, it's interesting to note that Germany took just 10 months to construct Europe's first floating LNG terminal in Wilhelmshaven.

A couple of paragraphs can’t really capture the whole opportunity set of course, but we've picked out some examples that also go to demonstrate that European equity markets are made up of different elements to other markets, and so our old friend diversification should also be a consideration for any investor sitting on the sidelines. We also note that there is a consistent message from European fund managers that European equities, when compared to the US, are at attractive valuations in absolute and historical relative terms. Figures from JPMorgan's JEGI, and its sister trust JPMorgan American Ord (LSE:JAM), show 12-month forward P/E ratios for their respective benchmarks of just under 13x for Europe and almost 17x for the US.

Conclusion

What this piece isn't trying to do is cast any economic forecasts for European countries, and in truth, it's not hard to find plenty of negatives to talk about if one wants to.

At the heart of things, we are just intrigued by the fact that last year European stock markets performed well, driven by good operational performance by many of its largest companies, rather than by a valuation recovery from the lows reached in 2022, but at the same time investors continued to shun the region.

And as it turns out the Europe that fund managers invest into has a brighter economic track record than the Europe we think of when we just look at the sizes of the economies that make up the whole.

We've been asked a fair bit this year whether very strong fund flows into US equities are a signal that it's time to jump ship, and our view is that when one is dealing with explosively growing companies, it can become complicated to answer such a question.

What seems less complicated to us is that Europe has shown it has some great, world-leading companies in which investors have shown limited interest by comparison to the Magnificent Seven, and yet the economic reality for many countries is much more positive than the common narrative.

This seems to us to be a convergence of things that could lead to very strong performance once investors fully grasp the situation.

Kepler Partners is a third-party supplier and not part of interactive investor. Neither Kepler Partners or interactive investor will be responsible for any losses that may be incurred as a result of a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important Information

Kepler Partners is not authorised to make recommendations to Retail Clients. This report is based on factual information only, and is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

This report has been issued by Kepler Partners LLP solely for information purposes only and the views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment. If you are unclear about any of the information on this website or its suitability for you, please contact your financial or tax adviser, or an independent financial or tax adviser before making any investment or financial decisions.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. Persons who access this information are required to inform themselves and to comply with any such restrictions. In particular, this website is exclusively for non-US Persons. The information in this website is not for distribution to and does not constitute an offer to sell or the solicitation of any offer to buy any securities in the United States of America to or for the benefit of US Persons.

This is a marketing document, should be considered non-independent research and is subject to the rules in COBS 12.3 relating to such research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research.

No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not to be taken as advice to take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm's internal rules. A copy of the firm's conflict of interest policy is available on request.

Past performance is not necessarily a guide to the future. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is a limited liability partnership registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771.

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority.