Why we’re selling one of our UK funds

Saltydog explains how it is playing the UK stock market, and why the decision has been taken to sell one of its three UK funds.

9th September 2024 14:12

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

There are three Investment Association (IA) sectors for funds that invest predominantly in UK companies: UK All Companies, UK Smaller Companies, and UK Equity Income.

At the beginning of the year, our demonstration portfolios were holding only one fund from these three sectors - Ninety One UK Special Situations from the UK All Companies sector.

- Invest with ii: Buy Global Funds | Top Investment Funds | Open a Trading Account

In 2023, the UK All Companies and UK Equity Income sectors both went up by more than 7%. Not bad, but sectors focusing on other regions had done considerably better. Europe, excluding UK, gained 14.3%, and the North America sector rose by 16.7%. Meanwhile, the UK Smaller Companies sector grew by a mere 0.4%.

So far, this year has been more promising. At the end of August, the UK All Companies sector was showing a year-to-date gain of 10.8%, UK Equity Income had made 11.7%, and UK Smaller Companies was up 12.4%.

During the course of the year, our demonstration portfolios have increased the amount invested in the Ninety One UK Special Situations fund, and added funds from the UK Equity Income and UK Smaller Companies sectors. However, last week we changed tack and sold the Schroder UK Smaller Companies fund.

The UK Smaller Companies sector had a disappointing start to the year. It went down in January and February, but picked up in March, rising by 2.9% and ending the quarter up 1.3%. It gained a further 2.9% in April when it was only beaten by two sectors, India/Indian Subcontinent and China/Greater China. It did even better in May. It was the best-performing sector with a one-month gain of 6.1%.

The UK economy had briefly gone into recession at the end of 2023, but in May the Office for National Statistics (ONS) released data showing that in the first quarter of this year the UK economy had grown by 0.6%. That was the fastest rate for two years.

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

- 10 hottest ISA shares, funds and trusts: week ended 6 September 2024

At the same time, inflation was heading back towards the government’s target, and speculators were predicting an interest rate cut in the summer. We hoped that perhaps the UK sectors might be in for a good run. There were concerns that the early July election could rock the boat, but the polls were suggesting it would not be a close contest, with Labour expected to secure a clear working majority.

On 10 May 2024, we invested in the Schroder UK Smaller Companies fund.

The UK Smaller Companies sector did not have a great June, falling by 1.8%, but recovering strongly in July. It went up by 4.5%, and was only outperformed by the North American sector’s 5.8% return. Last month, most of the sectors investing in equities had a fairly quiet month. The UK All Companies and UK Equity Income sectors made a small gain, but the UK Smaller Companies sector fell by 1.0%.

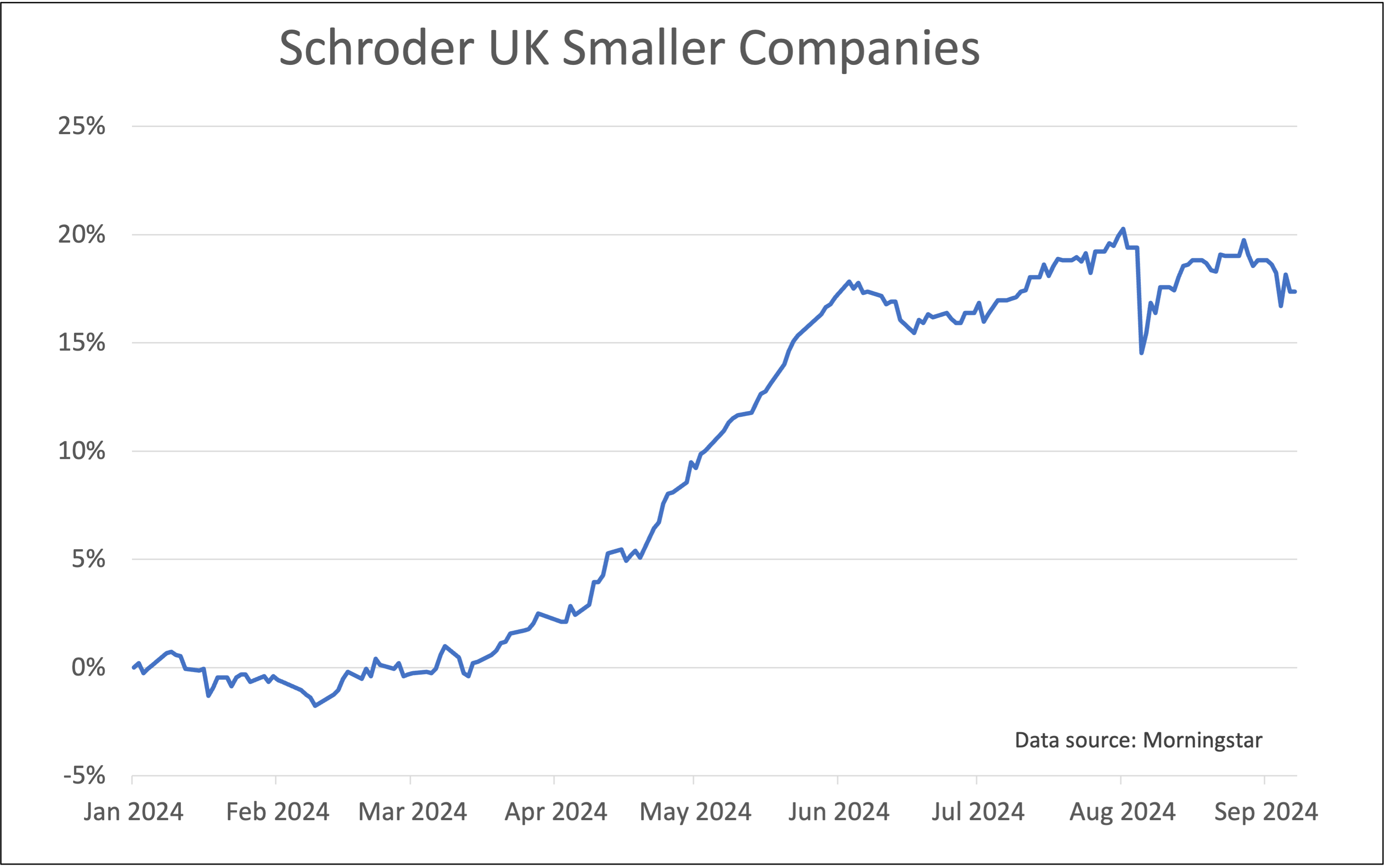

If you look at the graph of the Schroder UK Smaller Companies fund since the start of the year, you can see that it was basically flat until the middle of March. It then went steadily up until early June. Since then, it has become more volatile with little overall movement. It peaked at the beginning of August.

Past performance is not a guide to future performance.

Our Ocean Liner portfolio bought this fund in May and sold it last week. In just under four months the price had gone up by 5.8%. A reasonable result, but we were hoping that the upward momentum would continue for a little bit longer.

We are still holding the Ninety One UK Special Situations and JOHCM UK Equity Income funds, but their performance has also tailed off in the past couple of months. We will be monitoring them closely, and if we see any further falls then their days will also be numbered.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.