Why income investors should buy America

A Kepler Trust Intelligence analyst explains how one income strategy allows investment trust investors to still enjoy the return potential of US equities.

5th July 2024 14:11

by Alan Ray from Kepler Trust Intelligence

This content is provided by Kepler Trust Intelligence, an investment trust focused website for private and professional investors. Kepler Trust Intelligence is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Material produced by Kepler Trust Intelligence should be considered a marketing communication, and is not independent research.

We'll let you into a secret. It's a pretty safe bet, even without the advantage of privileged information, that by the fall, we will all have read, or at least will have been invited to read, some comments about what the US election means for markets.

It's a rather enjoyable internet rabbit hole, if one has a few minutes to spare, to search for something like “how does the S&P 500 index perform under different presidents” and we expect there will be at least one cut-and-paste of this topic sent to our inboxes before November.

- Invest with ii: Trade Investment Trusts | Cashback Offers | Open a Trading Account

On the Thursday before the first presidential debate, we drafted something to the effect that we are in the relatively unusual position of both the main candidates having already served a term and both having seen the S&P 500 index rise under their tenure, although obviously we accept that the incumbent has a few months to go.

By the Friday after the debate, it seems possible that a third scenario, or candidate, could emerge, and all we can say to anyone thinking of writing the above-mentioned article then is “good luck with all that”.

We Britons probably need a break from politics right now, so let's park that thought and just for fun make some polarising statements about investment instead. The trouble with US equities, for a UK investor, is that there is a very limited “equity income” opportunity, and as we know equity income is a big priority for many investors.

Dividend yields are much lower in the US, and companies prefer to either invest excess cash, or return it via share buybacks. Thus, while UK investors are probably well aware that the US equity market generally provides a better engine for capital growth, they favour the home team, as it pays a regular dividend.

On the other hand, the trouble with UK equities is that by far the largest group of funds that invest in it are equity income funds, that keep a tight leash on the companies they own, rewarding them for paying out profits as dividends and punishing them if they dare to drop the dividend, even if it's for good long-term investment reasons.

In writing these two paragraphs, the writer is deliberately setting out two opposing views in simple terms, because the longer, more nuanced version might take a while, and in this era of instant reactions, no one has time for that, right?

Suffice to say that a) there are plenty of exceptions to both sides of this argument and b) no one should feel any guilt about investing in companies that pay dividends. Some businesses really are better as dividend machines and investors should be very happy to own them.

That said, readers of the financial press will have found it virtually impossible to avoid the existential angst playing out in the press around the London Stock Exchange's inability to attract or retain high-growth companies. It would be wrong to say that “equity income culture” has not been discussed as one factor, but it seems to be playing a much smaller role in the discussion than various other “solutions” such as incentivising or compelling investors to invest in the UK. If the answer is “let's force institutions to own UK equities, and that extra capital is bound to attract companies they actually want to own” then we think the wrong question is being asked.

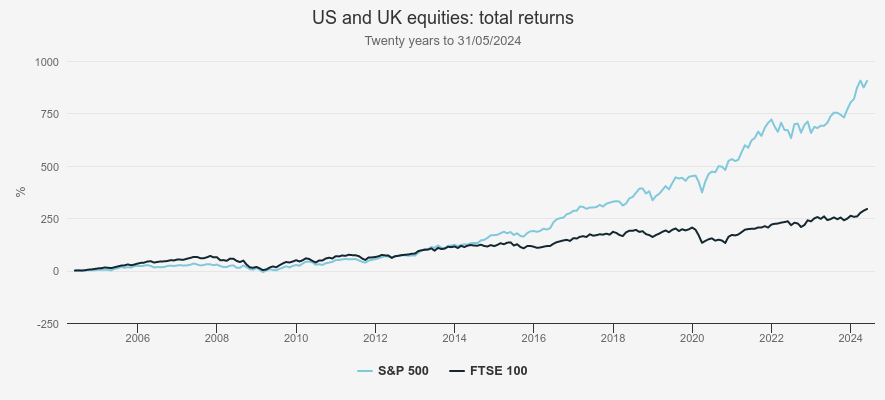

Stick with us, this is a piece about US, or North American, equities we promise. The reason for this preamble is that it is possible that investment trust investors, many of whom are underweight US equities, are in that position not because they don’t follow the above argument, and they have seen versions of the chart below before, but because they want and need dividends.

The evidence of this has played out across the investment trust sector over many years, with huge amounts of money raised for income strategies, and many investment trusts with little or no underlying income opting to pay dividends from capital profits. In recent days we have seen two further trusts, Schroder Japan Trust Ord (LSE:SJG) and Invesco Global Equity Income Trust (LSE:IGET), both announce they will be making a contribution or a larger contribution to their dividends from capital.

There is though, another pretty simple way an investor can derive an income from owning an investment trust. One can just sell a few shares at the appropriate interval. We, of course, know that's a massive behavioural shift for many investors, but is it so different from accepting dividends from capital profits, which is the path that so many investment trusts have gone down over the last decade?

It would allow investors to draw their income while enjoying the return potential which has seen the US soar away from the UK indices in recent decades.

US AND UK EQUITIES OVER TWENTY YEARS

Source: Morningstar. Past performance is not a reliable indicator of future results.

In fact, there are some subtle differences between selling shares and receiving a capital dividend. One of the less-well discussed features of paying dividends from capital is that, should an investment trust trade at or above asset value, then the case for paying those dividends begins to weaken, as shareholders are better off if they sell their shares in the market for a higher price than if they receive capital at NAV through a dividend.

On the other hand, when an investment trust is trading at a discount, paying a capital dividend is, from a mathematical point of view, the equivalent of the investor being able to sell some shares at net asset value rather than at the share price, which is a very good thing. Thinking of it like that can quickly help the reader see that when shares are at a premium, a capital dividend may not be the best way to receive a distribution.

Of course, generally speaking the percentage differences are tiny and may not matter compared to the convenience, but still, geeks like us feel compelled to point it out. But investors thinking about selling shares versus a capital dividend shouldn't really get too hung up on the differences if considering investment trusts on relatively small discounts or premiums.

For geeks like us though, it's good to know that the investment trust we consider to be the essential “core” active holding for US equities, JPMorgan American (LSE:JAM), doesn't pay dividends from capital as it invariably trades close to, or above asset value, being on a circa 2% discount at time of writing after a period earlier in 2024 of trading at a premium.

JAM also provides the case study that seems to contradict our statement that investment trust investors are underweight the US, since it is a FTSE 250 index investment trust with total assets of circa £1.9 billion, with little or no discount. Then again, the UK equity income sector has total assets of over £12 billion, which doesn’t really square with the US's 70% weight in the MSCI World Index compared to the UK's circa 4%. Hence our “underweight” contention.

JAM has built an excellent track record of outperformance balanced with that “core” holding status. It has achieved this by marrying two sets of fund managers with biases to value and growth stocks respectively, meeting on the common ground of “quality” to create a 40 or so large-cap portfolio that tends to grow a little faster and trade a little cheaper than the market.

What we like about this is that it gives the trust the flexibility to adapt to different phases of the market but emphasising one or the other style, without ever straying too far into deep value or blue-sky growth. The results have been excellent and the fact that JAM has recently returned to a premium rating, during a period when the investment trust sector is experiencing persistent discounts across many areas, says that we aren’t the only ones to have noticed this.

A very good track record of buying shares in when JAM strays to even a small discount should give investors confidence that this trust's board understands that to maintain its reputation as an essential holding in any portfolio requires that the share price reliably tracks the net asset value.

Finally, to provide the full “core” equity experience, JAM allocates a small portion of the portfolio, less than 10% and currently circa 7%, to small caps, which is managed in a similar way with a growth and a value manager working together to build a blended portfolio. Thus in the scenario outlined below, JAM still has the potential to outperform.

While large-cap US equities, notably technology and the “Mag 7s”, have put US equities firmly in the spotlight over the last year or two, smaller-cap equities have lagged and the managers of both investment trust specialists in this area, Brown Advisory US Smaller Companies Ord (LSE:BASC)and JPMorgan US Smaller Companies (LSE:JUSC)continue to highlight the valuation disparity between small- and large-cap equities.

We've seen the same phenomenon in the UK and the rest of Europe, and the disparity is partly explained by higher rates, which can be more challenging for smaller companies themselves but also tend to make equity investors more risk averse, but there's also the reality that with passive investing playing such an important role in the US in particular, money flowing into equities will tend to hit the large well-known ETFs first.

But let’s not forget that a domestic-facing smaller company in the US is addressing a continental-sized market, slightly bigger in GDP terms than Europe, including the UK, and so very often these are large well-established businesses able to survive a downturn.

Neither of these trusts pays the kind of dividend that an income investor would be attracted to, but again, there is more than one way to take an income. While every small-cap recovery in history is a bit different, falling interest rates and inflation are linking themes. We would though say that interest rate cuts are sometimes driven by the need to stimulate an economy, which means rate cuts aren't always immediately “good news” and so the path to a small-cap recovery may be more complex than “rates go down, small caps go up”. But with the valuation gaps both managers identify being so large, we might expect to see a confirmatory wave of M&A in the US small-cap world presaging an improvement in valuation.

As ever, it's important not to forget the US's neighbour Canada, which provides a very different set of opportunities to the US equity market, and for investors unconvinced by our “just sell some shares regularly” argument, has an equity income culture more akin to the UK than the US. Middlefield Canadian Income (LSE:MCT)yields circa 5% through a traditional income-based dividend policy and gives investors exposure to Canada's REIT sector, the trust's biggest position, alongside the country's important energy and pipeline infrastructure sectors and Canada's conservatively managed banking sector.

Canada was the first G7 country to cut interest rates earlier this year, and with a circa 25% exposure to interest-rate sensitive REITs, MCT could benefit from a strong recovery in this sector, which like the UK equivalents trades at a very wide discount currently.

Finally, BlackRock Sustainable American Income (LSE:BRSA)does pay a yield that is at a level an equity income investor would be interested in. It does this using a mix of current revenue and capital reserves, and over recent years has held the dividend at a constant level, which at time of writing equates to a yield of 4%.

BRSA has a long-standing value investment style which has been a performance headwind, but investors who worry about the high valuations that more growth-orientated stocks in the US market trade at might find this value style appealing.

There are, of course, many other ways to invest into the US through investment trusts, and so again we can chip away a little at our own claim that investors are “underweight”. The widely owned group of Global trusts will be familiar to all readers, and often the US is the largest single country exposure.

We would highlight a couple of other specialist trusts that, notwithstanding global mandates, derive most of their returns from companies listed in the US. Allianz Technology Trust Ord (LSE:ATT)provides specialist exposure to the technology sector, and generally has about 90% of the portfolio invested in the US, which is a measure of where much of the technology growth stocks in the world are listed rather than a comment on the manager's particular preferences.

Clearly a sector specialist such as this comes with potentially higher volatility and cyclicality risks than a generalist core trust such as JAM, highlighted above, but there is of course also the potential for higher returns given the nature of the sector ATT specialises in.

In a similar vein, International Biotechnology (LSE:IBT)provides exposure to the adjacent healthcare and biotechnology space and again the circa 85% exposure to the US is an expression of the US's importance in this area rather than a management bias. Highlighting these two specialists also helps to highlight that to be diversified across all the important sectors, is not so easy to do without placing the US at the centre of a portfolio.

IBT also, income investors will be pleased to know, does pay dividends using capital profits, paying 4% of NAV in four quarterly instalments, which means at its current 11% discount the yield is circa 4.4%. We could obviously reel off a long list of other trusts that also predominantly invest in the US, but these two serve to highlight two of the largest sectors that help set the US apart from other markets.

Conclusion

Eagle-eyed readers may have spotted our choice of 'fall' rather than 'autumn' in the opening paragraph, and apart from the fact that we just quite like the sound of it, its origins, in old English, are a reminder of the ties that still bind us to the US, however shaky they might appear sometimes.

'Invest in what you know and understand' is very good advice and investors shouldn’t feel worried if their comfort zone is UK equity income; it's a fine way to invest for the long term, and as we've discussed before, certainly beats inflation. There's also no particular reason why an investor needs to care at all what the MSCI World Index, or any other index says about the relative importance of different markets.

But given the extraordinary potential of the US's continental economy to generate equity returns over the long term, discussed a little while ago here, we think it would be a shame if all that was holding investors back was a little thing like dividends.

Kepler Partners is a third-party supplier and not part of interactive investor. Neither Kepler Partners or interactive investor will be responsible for any losses that may be incurred as a result of a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important Information

Kepler Partners is not authorised to make recommendations to Retail Clients. This report is based on factual information only, and is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

This report has been issued by Kepler Partners LLP solely for information purposes only and the views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment. If you are unclear about any of the information on this website or its suitability for you, please contact your financial or tax adviser, or an independent financial or tax adviser before making any investment or financial decisions.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. Persons who access this information are required to inform themselves and to comply with any such restrictions. In particular, this website is exclusively for non-US Persons. The information in this website is not for distribution to and does not constitute an offer to sell or the solicitation of any offer to buy any securities in the United States of America to or for the benefit of US Persons.

This is a marketing document, should be considered non-independent research and is subject to the rules in COBS 12.3 relating to such research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research.

No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not to be taken as advice to take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm's internal rules. A copy of the firm's conflict of interest policy is available on request.

Past performance is not necessarily a guide to the future. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is a limited liability partnership registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771.

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority.