Why I’d still buy this popular tech stock

It’s already been a hugely successful tip for Rodney Hobson, but the overseas investing expert thinks there’s more upside at this company. Elsewhere, there’s another warning about a business with problems.

19th June 2024 08:47

by Rodney Hobson from interactive investor

One of the most popular American stocks among users of the interactive investor site is IT giant Broadcom Inc (NASDAQ:AVGO). The future is bright but the rating is pricey.

Broadcom is a bit of a hotchpotch, having been created through several amalgamations of companies specializing in computer chips and in software to become the sixth-largest semiconductor company in the world.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

These amalgamations are a mixed blessing, injecting a range of products and a range of customers that are a protection against a downturn in any one specialization but meaning a possible lack of focus. There are 17 semiconductor lines that it regards as core products spread across supplying telecoms, cloud computing and industrial markets. Software products are similarly spread wide. Some manufacturing is carried out in-house but most sales are generated by the company doing its own designs and contracting out manufacturing.

Broadcom stands to gain from the big move towards artificial intelligence, and it delighted Wall Street by revealing that it has made strong gains in AI-related business in its second quarter to 5 May. Revenue soared 43% to $12.5 billion, with a quarter of sales coming from AI business. The group’s software also chipped in with extra sales to enterprises seeking to build their own private clouds.

Guidance for revenue for the full year has been raised slightly from $50 billion to $51 billion. It is likely to be raised again as the year progresses.

Somewhat less cheering was a 39% fall in net income to $2.1 billion, although that did not prevent free cash flow improving 10% to just over $9 billion.

However, the Broadcom board is clearly confident about future prospects, as it has announced a 10-for-1 stock split, with shareholders getting nine free shares for every one held at the market close on 12 July.

This is good news for shareholders. Although technically the share price should fall to a tenth of its current level, in share splits the price actually tends to edge up from its putative new level. So the board must be reasonably confident of the group’s prospects. It will not want to see the share price slide after the share split.

- 10 hottest ISA shares, funds and trusts: week ended 14 June 2024

- These stories will impact your investment portfolio

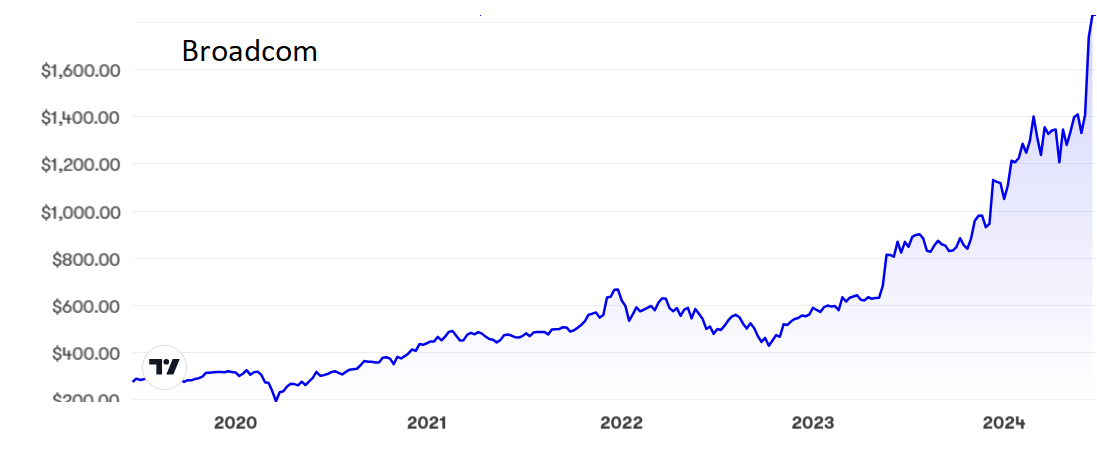

Tech stocks have been leading the upward charge on American exchanges this year and Broadcom is no exception. From $200 less than five years ago the stock had topped $1,000 by the end of 2023 and the revenue upgrade has produced another spike to $1,800. The price/earnings ratio is a really chunky 75 but at least there is the consolation of a safe though low yield at 1.1%

Source: interactive investor. Past performance is not a guide to future performance.

Hobson’s choice: I have tipped Broadcom twice before, firstly in March2019 at under $300 and again three years ago at $477. I hope readers piled in then.

The shares have doubled over the past 12 months so it would take a brave investor to bet against a further rise despite the massive rating. Certainly, shareholders should stay in despite the temptation they must feel to take profits, although it would not be wrong to back your horses both ways by locking in gains on part of your stake. I rate the shares a buy up to $2,000 at this stage.

Update: Change the record! No doubt Boeing Co (NYSE:BA) shareholders wish that I would play another tune, but problems persist. Since I last wrote on the aircraft manufacturer on 29 May there has been a further report of panels from a supplier arriving with the wrong rivets and news of a probe by US air regulators into possible false documentation for titanium used in aircraft built between 2019 and 2013. Despite the flow of adverse news, Boeing shares inexplicably shot up to $191 before sliding back below $180. I repeat that there is no merit in holding the shares. The record is still stuck on sell.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.