Why I said goodbye to one share, and doubled my investment in another

Our Share Sleuth Richard Beddard sells an old holding and doubles his investment in an existing one.

25th June 2020 14:11

by Richard Beddard from interactive investor

Our Share Sleuth Richard Beddard sells an old holding and doubles his investment in an existing one.

This month, I stopped sitting on my hands, jolted into action by an email from a reader wondering why, since I had deemed some shares good long-term investments, I had not added them to the Share Sleuth portfolio. He wanted to know whether I believed share prices would fall again – whether I was waiting to pounce on bargains.

Falling prices are an occupational hazard, and if I worried about them I would probably never trade at all. Perhaps the simplest reason for my trading reticence on this occasion is that I am not afraid of rising prices either. Less than 5% of the portfolio was in cash, so, even if the stock market takes off, Share Sleuth will not be harshly penalised by a large cash allocation earning nothing.

Cliff-hanger

When I am investigating a company, I always have in mind the next one or two. Last month, this column finished on a cliff-hanger. Animal feed additive manufacturer Anpario was the pick of the shares available, but Share Sleuth already held a small holding. A larger holding requires more commitment and since 4Imprint and Quartix were coming down the pipe (see Share Watch), I played for time. Other shares, at an earlier stage of research, might tempt me too. Top of the list is D4T4, a company that sells software that captures data about our behaviour as we use websites. When your next trade is likely to be your last one for a while, it is quite precious.

I have also been a reluctant relinquisher of shares, and here Alumasc must hold the record. It was an orphaned holding in Share Sleuth, too small to be significant. The portfolio acquired it over 11 years ago in November 2009 and I never had the confidence to add to it. In last December’s Money Observer, I questioned whether Alumasc would ever turn its high returns on capital into growth, but I have clung on to it regardless, always wanting to give the underdog one more chance, and not wanting to write off the sunk cost of 10 years of research.

On 1 June, I finally ejected all 938 Alumasc shares. The actual price quoted by a broker was just under 77p per share, and after a £10 charge in lieu of broker fees the portfolio gained about £708 in cash. Although Share Sleuth made a loss compared to the purchase cost of nearly £1,000, thanks to dividends the holding made us a profit overall. The annualised total return was just under 3%. When I think of the time wasted analysing Alumasc, and the opportunity cost of better investments foregone, I recognise that it was a failed trade.

Doubling up

Deciding whether to add a share was easy. I went with the Decision Engine, my scoring system. The top three shares are unavailable to Share Sleuth because it already has sizeable holdings in them. But, as we know, the portfolio had a relatively modest 2.5% holding in the fourth, Anpario, which I’ve doubled to 5%, adding 937 Anpario shares at a price of just under 365p. Including a £10 charge in lieu of broker fees, the transaction cost about £3,425.

Share Sleuth has one less member now, with 26 constituents. It also has little more than £2,000 in cash, insufficient for a purchase of meaningful size. Further funds will come slowly from dividends (very slowly in the current climate of cancellations and deferrals) and when I reject or reduce holdings as a consequence of reviewing them annually.

Thanks for the nudge, Fred.

Anpario boosted by Alumasc sale

| Portfolio | Cost (£) | Value (£) | Return (%) | ||

|---|---|---|---|---|---|

| Cash | 2,175 | ||||

| Shares | 137,249 | ||||

| Since 9 September 2009 | 30,000 | 139,424 | 365 | ||

| Companies | Shares | Cost (£) | Value (£) | Return (%) | |

| ANP | Anpario | 1,874 | 6,593 | 6,840 | 4 |

| AVON | Avon Rubber | 192 | 2,510 | 6,355 | 153 |

| BMY | Bloomsbury | 1,256 | 3,274 | 2,826 | -14 |

| BOWL | Hollywood Bowl | 1,615 | 3,628 | 2,826 | -22 |

| CGS | Castings | 1,109 | 3,110 | 3,859 | 24 |

| CHH | Churchill China | 341 | 3,751 | 4,177 | 11 |

| CHRT | Cohort | 1,600 | 3,747 | 8,912 | 138 |

| DTG | Dart | 456 | 250 | 4,086 | 1,534 |

| DWHT | Dewhurst | 735 | 2,244 | 6,248 | 178 |

| GAW | Games Workshop | 113 | 324 | 8,882 | 2,640 |

| GDWN | Goodwin | 266 | 6,646 | 6,025 | -9 |

| HWDN | Howden Joinery | 748 | 3,228 | 4,370 | 35 |

| JDG | Judges Scientific | 159 | 3,825 | 8,681 | 127 |

| NXT | Next | 45 | 2,199 | 2,431 | 11 |

| PMP | Portmeirion | 349 | 3,212 | 1,466 | -54 |

| PZC | PZ Cussons | 1,870 | 3,878 | 3,336 | -14 |

| QTX | Quartix | 1,085 | 2,798 | 4,069 | 45 |

| RM. | RM | 1,275 | 3,038 | 2,894 | -5 |

| RSW | Renishaw | 92 | 1,739 | 3,676 | 111 |

| SOLI | Solid State | 1,546 | 4,523 | 7,885 | 74 |

| TET | Treatt | 1,222 | 1,734 | 6,599 | 281 |

| TFW | Thorpe (F W) | 2,000 | 2,207 | 6,740 | 205 |

| TRI | Trifast | 2,261 | 3,357 | 2,578 | -23 |

| TSTL | Tristel | 750 | 268 | 3,900 | 1,354 |

| VCT | Victrex | 323 | 6,254 | 6,538 | 5 |

| XPP | XP Power | 339 | 6,287 | 11,051 | 76 |

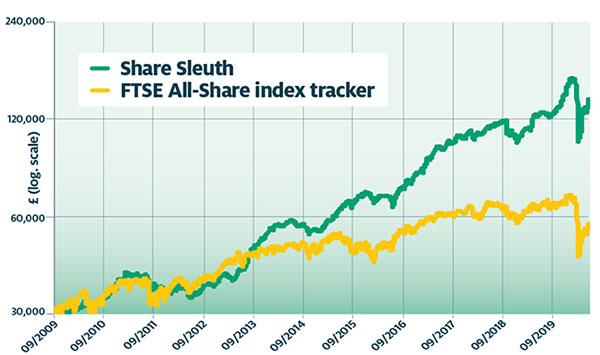

Notes: Augmented existing holding. Transaction costs include £10 broker fee, and 0.5% stamp duty where appropriate. Cash earns no interest. Dividends and sale proceeds are credited to the cash balance. £30,000 invested on 9 September 2009 would be worth £139,424 today; £30,000 invested in FTSE All-Share index tracker accumulation units would be worth £57,053 today. Objective: To beat the index tracker handsomely over five-year periods. Source: SharePad, 2 June 2020.

Low cash allocation captures upside

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.