Why I like this cheap AIM share

This high-scoring AIM company may be complicated, but it could well be a good long-term investment.

30th August 2019 14:59

by Richard Beddard from interactive investor

This high-scoring AIM company may be complicated, but it could well be a good long-term investment.

I see you have updated your Cohort spreadsheet Richard...

Yes, it is that time of year again. Cohort (LSE:CHRT) has just published its annual report.

How many businesses is Cohort this year, I forget?

We're back up to five, after the closure of Cohort's original business, SCS, in the year to March 2017 and the acquisition of Chess last December.

Just to remind you, Cohort is the home of the Three and the Four Letter Acronym. The Jewel in the crown is MASS, Cohort's most profitable business. MASS specialises in data and analysis, particular hard-to come by data used in electronic warfare (colloquially "jamming" and "anti-jamming").

MASS was Cohort's founding acquisition in 2006. SEA, a maritime system's specialist followed in 2007, MCL in 2014 and EID in 2016.

MCL is a distributor and customiser of defence technology, principally for security and special forces. EID, which unlike the other four business is headquartered overseas in Portugal, specialises in tactical and naval communications systems.

That's quite a gaggle of businesses, how do they all slot together?

They all have the same customers, mainly the UK Ministry of Defence, and they all supply technology or technology services.

The companies sometimes work together, but Cohort is not hell-bent on welding a tightly integrated ship. It operates the businesses at arms length, giving them the financial support they need to win large contracts from governments and contractors.

This way, Cohort says its businesses are more entrepreneurial and quicker to respond to customers.

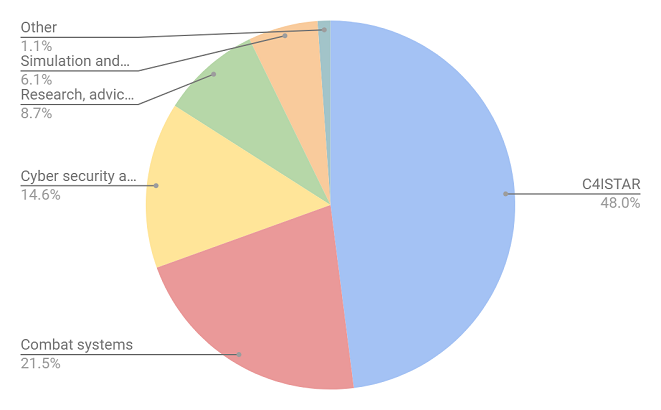

Here's a chart from the annual report that cuts through the acronyms to show Cohort's most important activities:

OK, there is one acronym left, and it is an abominable one. C4ISTAR stands for Command, Control, Communications, Computers, Intelligence, Surveillance, Target Acquisition and Reconnaissance.

The other categories are Combat systems, Cyber-security and secure networks, Research advice and support, and Simulation and training.

SCS, the original business, was a training consultancy, but the MOD has brought much of its training in-house in response to budget constraints.

That precipitated SCS's closure and the distribution of its remaining contracts between MASS and SEA, technology companies that supply software and hardware as well as training, research, and people.

The more recent acquisitions supply technology products, which should be resilient and scalable because the MoD is unlikely to start manufacturing equipment and products are easier to sell abroad than consultancy.

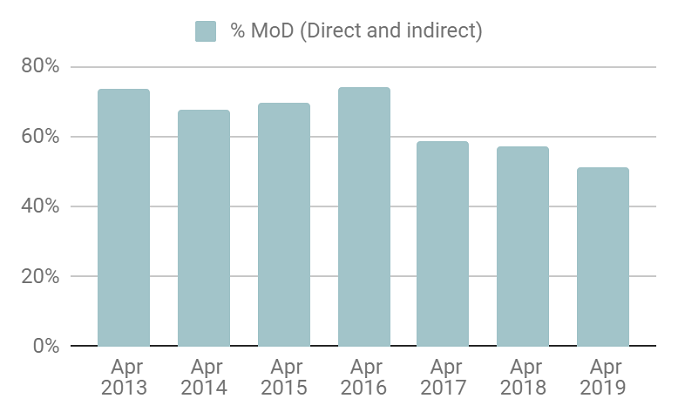

The strategy appears to be working. Although in 2019 Cohort earned more from the Ministry of Defence directly and indirectly through contractors working than ever before, its dependence on revenue ultimately from the MoD has come down from 74% of total revenue six years ago to 51% today.

So Cohort is growing then?

Good question. It can be difficult to tell if a serial acquirer is actually growing the businesses it owns, or whether it is just buying growth. As well as the demise of SCS, revenue has declined 25% at SEA over the last three years due to reductions in consultancy work and delays to big projects like the Dreadnaught class submarine, which SEA will eventually supply with an external communications system.

In 2019, though, SEA returned to growth. MASS and MCL grew revenue and profit too. But just as the older businesses are returning to form, the younger ones are misfiring.

What's wrong with EID then?

There's been a sudden decline in revenue. In 2019 EID earned £11.5 million revenue. The year before it made £19 million. The decline was enough to wipe out all the growth in the other three businesses Cohort owned at the beginning of the financial year.

Were it not for the acquisition of Chess, Cohort would have shrunk very slightly in 2019. In the annual report, Cohort says EID endured a slump in naval activity and a slippage in deliveries of a major tactical land communications equipment order. Cohort believes EID will bounce back in 2020, due to new orders and the fulfillment of delayed ones.

One bad year then, perhaps, what about Chess?

Perhaps... The main concern about Chess is the price Cohort paid, which I wrote about at the time of the acquisition. Chess must grow to justify the outlay. There are good reasons to suppose it will. It fits Cohort's product and export focused strategy and already has international customers including the US Department of Defence, which may open doors for the other Cohort businesses.

Chess makes fire-control systems, which track and target all manner of threats including drones, a capability which made the headlines last year when drone flights brought Gatwick Airport to a halt.

Chess's Counter Unmanned Air Vehicle system, made in collaboration with two other businesses, was installed at the airport (and another unnamed UK airport) in response to the crisis. The installation contributed to higher than expected revenue in Chess' first five months with Cohort.

While Cohort expects Chess to grow in 2020, its first full year as part of the group, it says those first five months were exceptional. Cohort says it has also discovered deficiencies in Chess' project control process, which it is remedying. I'm just a bit nervous it bought EID and Chess while they were going through purple patches and the growth may not be sustainable.

You think Cohort might be overpaying?

No, but it's possible. We will have to see how these acquisitions perform over the long-term,

Over the last nine years, Cohort has increased revenue at a compound annual growth rate of 7% and adjusted profit at 15%. Since it hasn't issued any shares, it hasn't borrowed excessively, and its return on total invested capital including acquired goodwill and intangible assets at cost is a reasonable 10% (after tax), I think it's probably a decent acquirer.

I see cash conversion was 59%. Bit low isn't it?

Yes. Free cash flow has averaged 76% over the last nine years. Cohort invested more than usual in 2019, but the main culprit was working capital. The company says it is building up stock for large programmes at EID and SEA, and that the working capital situation is unlikely to improve until it gets paid later in the year. Seems reasonable. Shareholders are used to variable cash flows.

OK, let's put it through the algorithm. How does it score?

I like Cohort. It is quietly adapting to a difficult market. The acronyms, the acquisitions, the esoteric nature of military technology, and the lumpiness of contract renewals and cash flows complicate the story, but I think it is adapting to a difficult market.

Does Cohort make good money?

Yes. Cohort earned a return on operating capital of 35% in 2019, which is pretty typical.

Score: 2

What could prevent it from growing profitably?

Continued pressure on defence budgets has stymied growth at SEA, brought about the end of SCS, and are probably weighing on Cohort's other businesses. Cohort's acquisitive strategy could backfire if its judgements about the price and prospects of targets are unfounded.

Score: 1

How will it overcome these challenges?

Cohort's strategy is allowing it to develop export markets and reduce its dependence on the UK MoD. The focus on technology keeps it relevant to the changing needs of armed forces, and civilian law enforcement.

It seeks acquisitions with sustainable competitive advantages. Such companies rarely come cheaply, and the performance of SEA and EID raises the question of just how sustainable the advantages are.

Score: 1

Will we all benefit?

Cohort explains itself well in the annual report, providing detailed financials for each of its five businesses. The board is very experienced (it includes the company's two founders), and modestly remunerated. Cohort emphasises training and invites all staff to join share schemes.

Score: 2

Are the shares cheap?

Probably. A share price of 450p values the enterprise at about £200 million, which is about 15 times adjusted profit in 2019. Cohort's earnings yield is 7%.

Score: 7.7

A score of 7.7 out of 10 indicates Cohort may well be a good long-term investment.

Richard owns shares in Cohort.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.