Where to invest in Q4 2024? Four experts have their say

Our four asset allocators have turned more positive on emerging markets, but have downgraded their scores for other equity markets. Jim Levi shares the latest views across the main asset classes.

22nd October 2024 10:44

by Jim Levi from interactive investor

There is nothing to quite compare with being the president of China. Apart from all its other attractions, it gives you the power to move stock markets like no one else on the planet.

In mid-September, President Xi Jinping suddenly unveiled a huge monetary stimulus package to revive China’s faltering economy. An estimated £650 billion “bazooka” of effectively free money was to be pumped into China’s stock market and financial system.

- Invest with ii: What is a Managed ISA? | Open a Managed ISA | Transfer an ISA

It was enough to send the market 30% higher in the space of a few days - the biggest gain in 16 years. The Shenzhen Index of Chinese shares surged from 8,000 to 11,477 in the last two weeks of September, but later boiled over to just below the 10,000 level.

The expectation is that Xi has not finished yet. More stimulants to try to revive the country’s depressed property market may soon be on the way.

All eyes on China

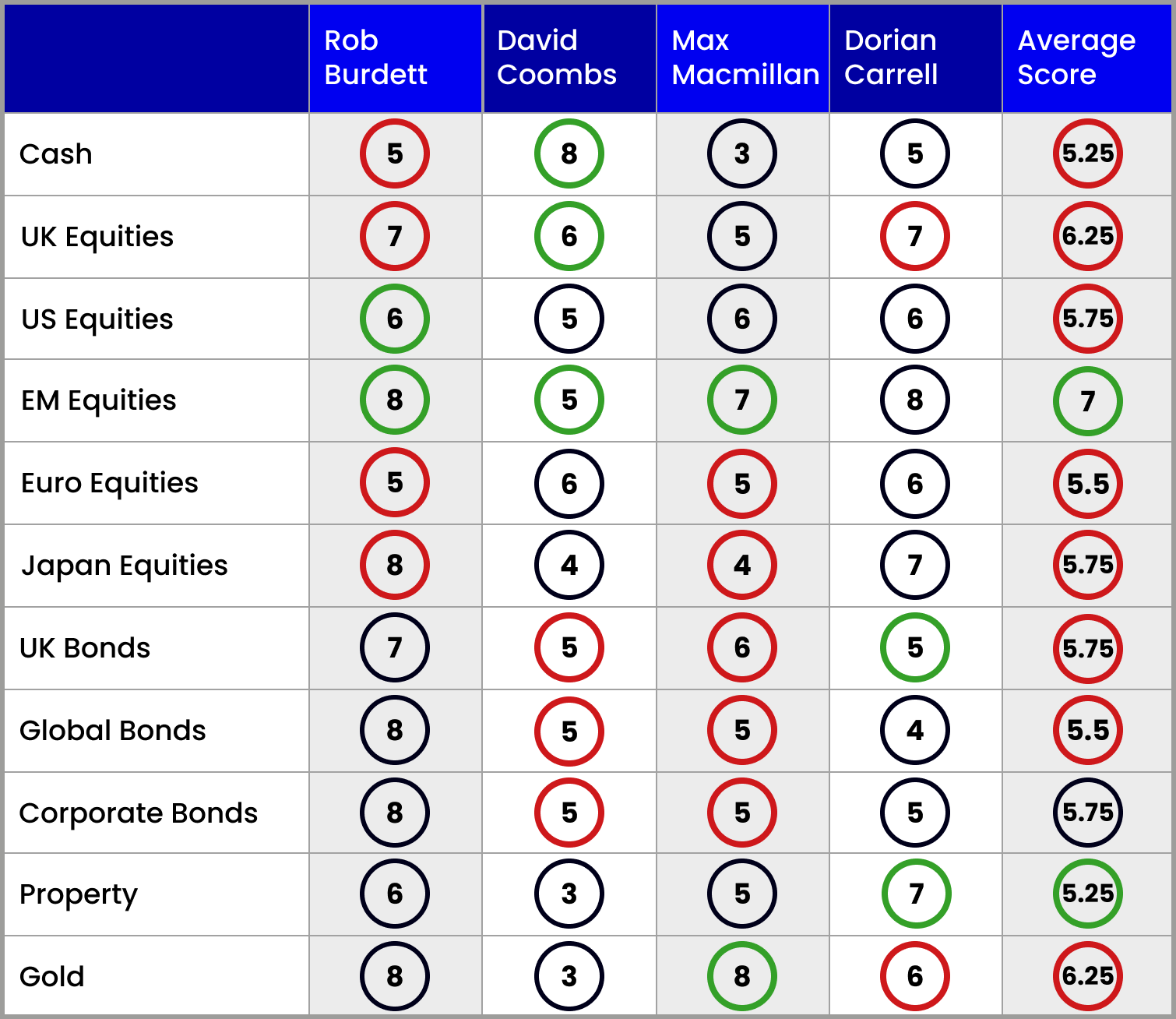

No wonder then that our panel have all eyes on China and other emerging markets as potential sources of future profits. Each one of them has raised the score for the emerging markets equities sector bringing the average score up from six to seven.

It is now the equity region with the highest average score. Both Rob Burdett, head of multi-manager with Nedgroup Investments, and Schroders’ Dorian Carrell score eight for the sector.

Carrell says: “Emerging markets clearly stand out as the sector with the most opportunity. The prospect of a weaker dollar helps these markets. I would be most overweight in China and most underweight in India.”

For longer-term bets, Carrell surprisingly backs some Middle East markets - but places such as Dubai, Qatar and Saudi Arabia rather than Iran, Syria or Lebanon.

Burdett too is not confining himself to Asian markets. “I see opportunities for making money in South American equities,” he says.

David Coombs of Rathbones is no longer bearish on emerging markets, raising his score from three to five, which is a neutral stance.

He explains: “We do own quite a lot of stocks where companies are exposed to emerging markets, if not necessarily listed on those markets.

“We cannot afford to be underweight in these areas if the Chinese plan more stimulants.”

For Coombs, though, there is an element of uncertainty about China’s plans. He claims the market “does not quite know why the Chinese have suddenly embarked on this stimulus package.”

At abrdn, Max Macmillan raises his emerging markets score from six to seven as he is now convinced the Chinese “will be much more proactive in supporting the economy.” He believes too, that the Chinese stock market will continue to perform better as a result.

US strength ahead of election

The Chinese “melt up” in shares has overshadowed the continued strength of Wall Street with both the S&P 500 and the Nasdaq indices hovering close to all-time highs.

Burdett says the continued buoyancy of US markets reflects the growing conviction that the economy is heading for a soft landing and that there will be no recession.

“After a lot of gyrations in interest rates there is now a consensus that rates in the US will settle at above 3% and I think that is realistic,” he says as he raises his US score from four to six to match the scores of both Carrell and Macmillan.

This is in spite of all the uncertainty created by war in the Middle East and Ukraine, as well as Chinese military manoeuvres around Taiwan.

Macmillan notes: “We are not willing to take a punt on the outcome of the US presidential election. We will need to be quick to recalibrate after the result.

“Although the US economy is humming along at trend growth, there are worries about the oil price. Values are high and we think values are already priced into the market.”

- Funds and trusts four pros are buying and selling: Q4 2024

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

However, Macmillan still likes US utilities and healthcare stocks.

Carrell says inflation is going to be a problem for the US regardless of who wins the election, although he thinks inflation is a greater risk under Trump.

Coombs admits that he has no real conviction about where US equities are going. He says: “The outlook is so uncertain and the presidential election too close. So, I am sitting on a neutral score of five as the most realistic approach.”

UK enthusiasm wanes slightly

Turning to the UK, Chancellor Rachel Reeves’ upcoming Budget has led to slightly more caution about UK equities from both Burdett and Carrell, who both trim their scores to seven.

Burdett is worried about what damage will be done to confidence by a tax-raising Budget, while Carrell keeps his UK focus on energy, banking and pharmaceutical stocks.

In contrast, Coombs is raising his score from five to six. “It reflects the UK market’s emphasis on oils and basic materials rather than any confidence about UK growth prospects,” he says.

Enthusiasm for European equities has also waned a little with both Burdett and Macmillan trimming scores back to neutral.

Carrell keeps his score at six, but cautions that a Trump triumph in the election might be a negative for the region. Coombs, on the other hand, believes European manufacturers might benefit from China’s stimulus package.

Both Burdett and Carrell remain firmly overweight in Japanese equities, although the upcoming general election means the market expects higher interest rates from the new government. However, that is enough to prompt Macmillan to cut his score from six to four.

Bond bulls take some profits

Three months ago, Coombs had been neutral or underweight on all equity sectors except Europe where he scored a six. In contrast, he became very bullish on government bonds with scores of nine on both UK bonds and on global bonds.

“During the last quarter, we have been selling bonds as bond yields rallied quite a lot,” he explains.

He continues: “Now our scores are down to five and this neutral stance reflects the fact that the outlook both here and in the US is so uncertain that we have no real conviction about where the market is going.”

- Bond Watch: what 1.7% inflation means for bonds

- Benstead on Bonds: what the Budget will mean for gilts

Macmillan is also trimming back his government bond scores. However, like Carrell he gives slightly higher scores for UK bonds' companies to global bonds. He notes: “The Bank of England needs to make gilts (UK government bonds) more attractive because it has to raise yet more funds from investors.”

Gold proves divisive

A lot of the uncertainty about the US election, Chinese intentions and war in the Middle East and Ukraine continues to be reflected in the buoyant bullion market where the price of gold has risen 30% so far this year.

Macmillan believes the trend is likely to continue and raises his score to eight, matching Burdett, while Carrell has decided to take some profits - lowering his score from eight to six. Meanwhile, Coombs stays firmly on the sidelines with a score of 3.

- Gold: what record highs tell us about geopolitics, markets and economies

- UK commercial property: investing for growth and income

Turning to property, Burdett first went overweight this asset class a year ago. Now he is joined by Carrell, who pushes his score for property up from five to seven.

In the stock market, Real Estate Investment Trusts (REITs) have performed well in recent weeks and leading companies such as British Land Co (LSE:BLND) and Great Portland Estates (LSE:GPE) have been successfully tapping the market for new funds. In British Land’s case, it was the first time it had turned to shareholders for more money in 10 years.

Carrell says: “The property market is definitely on the recovery road. The housing market is going well and the government seems intent on engineering a shortage of rented property. In a lot of sectors of the property market there is a shortage of supply.”

Note: the scorecard is a snapshot of views for the fourth quarter of 2024. How the panellists’ views have changed since the second quarter of 2024: red circle = less positive, green circle = more positive. Key to scorecard: EM equities = emerging market equities. 1 = poor, 5 = neutral and 9 = excellent.

Panellist profiles

Rob Burdett is head of multi-manager with Nedgroup Investments.

Dorian Carrell is head of multi-asset income at Schroders.

David Coombs is head of multi-asset investments at Rathbones.

Max Macmillan is head of strategic asset allocation at abrdn.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.