Where to invest in Q3 2024? Four experts have their say

Our panellists are turning more positive on the ‘unloved’ UK equity market. Jim Levi runs through the latest views across the main asset classes.

17th July 2024 11:26

by Jim Levi from interactive investor

We are in an era of obviously increasing geopolitical turbulence. If anything, things have got worse since our panel of asset allocators last pontificated in April. Yet the stock markets, particularly on Wall Street, power on. How much longer can the good times last?

Perhaps not much longer according to David Coombs of Rathbones. He says: “We are at a very pivotal point and if central banks don’t act soon we could very quickly go over the precipice into a recession. We are seeing evidence of a slowdown in lots of sectors and there are signs the consumer is losing confidence.”

- Invest with ii: What is a Managed ISA? | Open a Managed ISA | Transfer an ISA

When will rate cuts materialise?

Coombs feels we need an interest rate cut in the US by October at the latest. For so long enthusiastic on US equities, he now cuts his score from seven to five (which is neutral).

Others are not quite so gloomy. Dorian Carrrell at Schroders expects two rate cuts – one in September and another in December. “But they will not be quite so big as the markets hope for,” he predicts. He holds his score for US equities at six as does abrdn’s Max Macmillan who, three months ago, doubled his score from three to six. It was a well-timed late entry to Wall Street still dominated by technology and growth stocks. And Macmillan admits: “The concentration on growth stocks like Amazon.com Inc (NASDAQ:AMZN), Microsoft Corp (NASDAQ:MSFT) and NVIDIA Corp (NASDAQ:NVDA) makes you wonder about the medium-term sustainability of US equities.”

Rob Burdett agrees, he points out: “Wall Street has had the best-performing equities market in the second quarter of 2024 but the risks are increasing [and] the rewards look diminished.” He keeps an underweight score of four.

- Funds and trusts four pros are buying and selling: Q3 2024

- Top-performing fund, investment trust and ETF data: July 2024

Coombs’ fears about recession next year are far from isolated. But he has decided now is the time to go underweight equities generally, as well as raising his cash score to seven and maintaining near maximum scores of nine for UK and global government bonds. In equities, he is overweight only in Europe.

Europe downgraded, but UK scores lifted

Three months ago, the panel all seemed to favour European stocks. They all remain overweight but only just. Carrell has cut his score from eight to six. He warns: “A Trump presidency would not be good for Europe. Macmillan has lowered his score from seven to six, but thinks a hung parliament in France will bring the kind of political stalemate that could help equities to recover.

Astonishing though it may seem, the panel have produced the highest average score in equities for UK stocks. Carrell has raised his score from seven to eight. He says: “We now have a stable political backdrop in Britain, shares are still on attractive valuations while merger and acquisitions activity is stepping up.” He stresses his score reflects his view of shares in the FTSE 250 index rather than the global players in the FTSE 100.

Burdett keeps his UK score at nine. “After the US, the UK equity market was on some measures the best-performing sector, so I am glad I boosted the score back in April,” he says.

Even the cautious Coombs has edged up his UK score from four to five, while Macmillan goes from three to five. He explains: “The new government is already moving closer to the EU and that seems to be helping sentiment, but I still find it hard to find high-quality businesses to buy in the UK.”

Emerging market scores edge higher

Elsewhere, Coombs continues to steer clear of emerging markets, pointing out: “We are still seeing a strong US dollar and that makes it very difficult for me to favour the sector.”

In contrast, both Burdett and Macmillan have edged their scores higher. Carrell also remains an enthusiast. “Geopolitical risks are rising,” he says. “So, I have shaved my score from nine to eight.” But even now he is prepared to invest in regions such as the Middle East.

Burdett points out that the Asian element of the sprawling emerging markets sector performed just about as well as Wall Street in the April to June quarter with India, Taiwan, South Korea, and Singapore approaching peaks. This was in spite of a continuing lacklustre performance by Chinese shares.

- Sign up to our free newsletter for share, fund and trust ideas, and the latest news and analysis

- Q2 2024: key investment trends and why they matter

Macmillan thinks the current weakness of the Japanese yen - caused by the yawning gap between US 10-year bond yields and their Japanese equivalents - can be helpful to the stock market. He remains overweight the region as do Burdett and Carrell. Long-time supporter Burdett thinks the recent pause in the market’s performance is just a pause and that the growth pattern will soon re-emerge. “We will have to wait to see the floor in the yen, but I am quite happy to back Japan because the economy will always trump the currency,” he says.

Bullish on bonds

For some time, the global government bond markets have been signalling the risk of a recession and three of the panel have taken this on board by keeping scores well overweight. The hope is central banks will stave off the risk by appropriately timed interest rate cuts. Either way, government bonds should benefit. The average score for global bonds is now seven even though Carrell remains on four. He comments: “We see the recession risk is already priced into markets. We think the risk for the UK is one of persistent inflation.”

Burdett believes the pattern of interest rates is far from clear. “The assumption is we are in for a period of interest rate cuts but I don’t think it will be that clear cut. Rather, I think we are in for a period of variable interest rates and variable inflation,” he says.

- Is there a perfect number of stocks for a portfolio?

- Bond Watch: US rate cut in September ‘close to 100%’

The property sector is very hesitantly coming in from the cold. Only Coombs remains underweight the sector, although he has edged up his score from two to three. In April, both Burdett and Carrell had raised their scores. Now Macmillan has raised his score from three to five. “The pain still being suffered by the sector is already reflected in valuations,” he says. Coombs stresses that there is still plenty to worry about, particularly the need to upgrade offices to meet net-zero targets.

And finally, the outlook for gold has improved, with the commodity being elevated to the second-highest average score. Carrell has become a wholehearted bull of the precious metal - doubling his score from four to eight. It reflects his concerns about rising geopolitical tensions, which many fear may override all the other factors affecting financial markets.

Coombs remains the odd man out, cutting his gold score from four to three. He explains: “I would rather hold government bonds than gold at this point. If interest rates are going to come down over the next 18 months, it is not usually a great background for the gold price.”

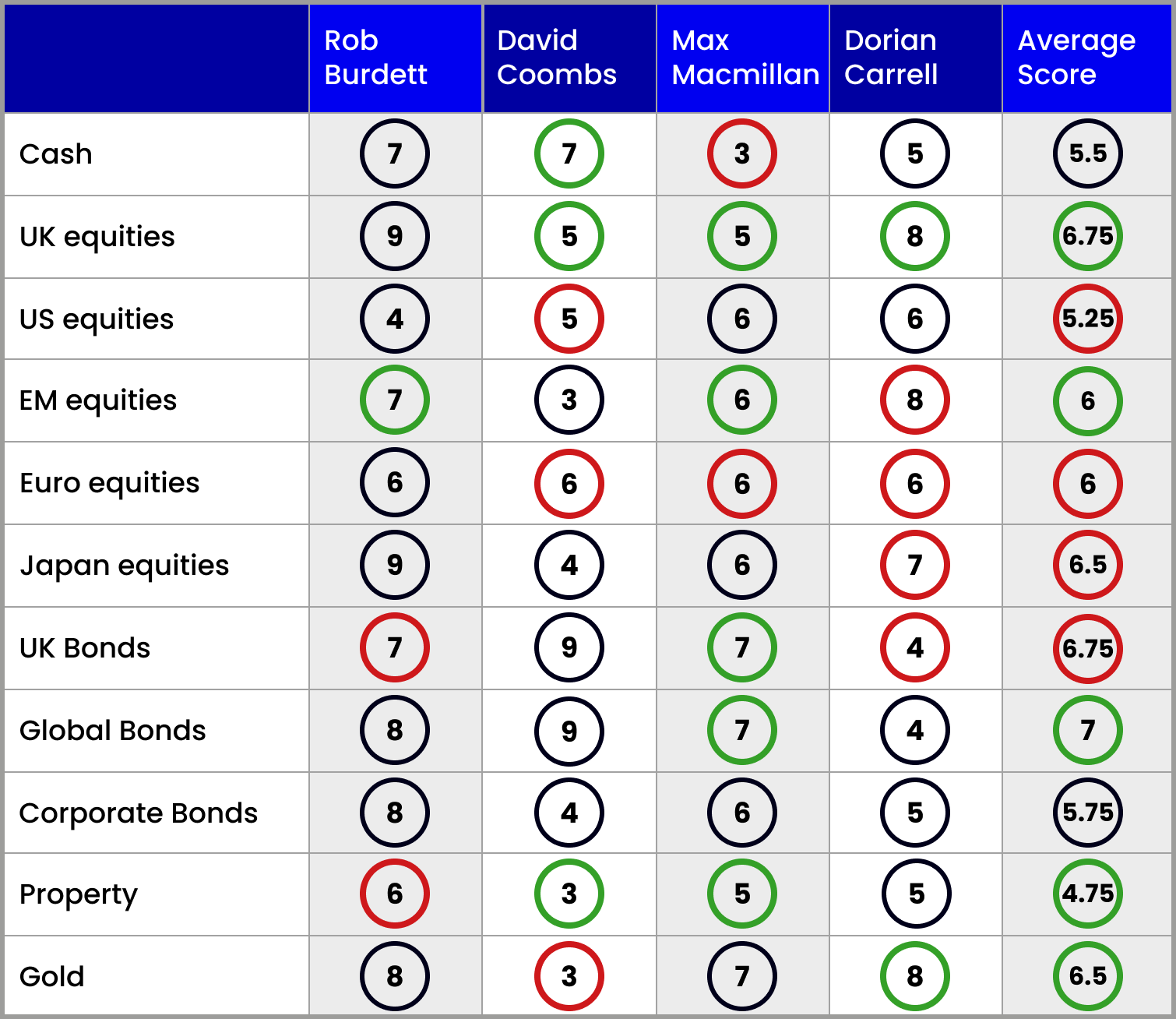

Note: the scorecard is a snapshot of views for the third quarter of 2024. How the panellists’ views have changed since the second quarter of 2024: red circle = less positive, green circle = more positive. Key to scorecard: EM equities = emerging market equities. 1 = poor, 5 = neutral and 9 = excellent.

Panellist profiles

Rob Burdett has been a professional fund buyer for more than three decades.

Dorian Carrell is head of multi-asset income at Schroders.

David Coombs is head of multi-asset investments at Rathbones.

Max Macmillan is head of strategic asset allocation at abrdn.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.