What I’d do with these two hugely successful stocks

It’s never wrong to take a profit, but investors who kept these stock tips would have been rewarded handsomely. Analyst Rodney Hobson reveals what he’d do with them now.

4th September 2024 09:14

by Rodney Hobson from interactive investor

Retail sales are holding up really well in the United States. So it is not surprising that Walmart Inc (NYSE:WMT), the country’s pre-eminent retailer, is doing particularly well. The problem is that continued strong sales are more than fully reflected in a share price that assumes the good times will continue to roll.

US retail sales rose 1% in July, the latest available figure, more than making up for a 0.2% decline in June. It was the biggest monthly rise for 18 months and took the annual increase up to 2.7%. With jobless claims staying low and inflation remaining under control, albeit at above target levels, consumer spending seems likely to persist for at least the third quarter, while a bumper Christmas is in the offing.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

Even if the Federal Reserve Bank sticks with its customary reluctance to act in haste in cutting interest rates, it does seem highly likely that the US economy is in for a soft landing.

Arkansas-based retailer Walmart saw revenue rise 4.8% in the second quarter compared with the same three months last year despite a slightly adverse exchange rate movement. In constant currency terms the improvement was 5%, ahead of the 3.5-4.5% target that Walmart set only three months earlier.

Much of the improvement was driven by online sales that are running 22% ahead, with customers taking full advantage of the option to pick up orders in-store.

Walmart is putting the accent on value, yet it is mostly reeling in households with above-average income, meaning it is winning all round.

Net sales are expected to rise 3.25-4.25% in the third quarter at constant currencies. That implies a slowdown – but not if sales growth once again comes in ahead of the company’s own forecast, which is highly likely.

- Stockwatch: time to worry over Warren Buffett’s rapid sales?

- Sign up to our free newsletter for share, fund and trust ideas, and the latest news and analysis

Walmart has already raised its annual guidance for sales growth, upping its earlier 3-4% forecast by three-quarters of a percentage point.

So all is going well with the top line. Alas, things are not so rosy at the other end of the accounts. Net profits slumped 43% to $4.5 billion in the second quarter. This sharp decline was admittedly caused by a large one-off credit last year being replaced by a write-off this time, but even so profits are set to slip for the rest of this year.

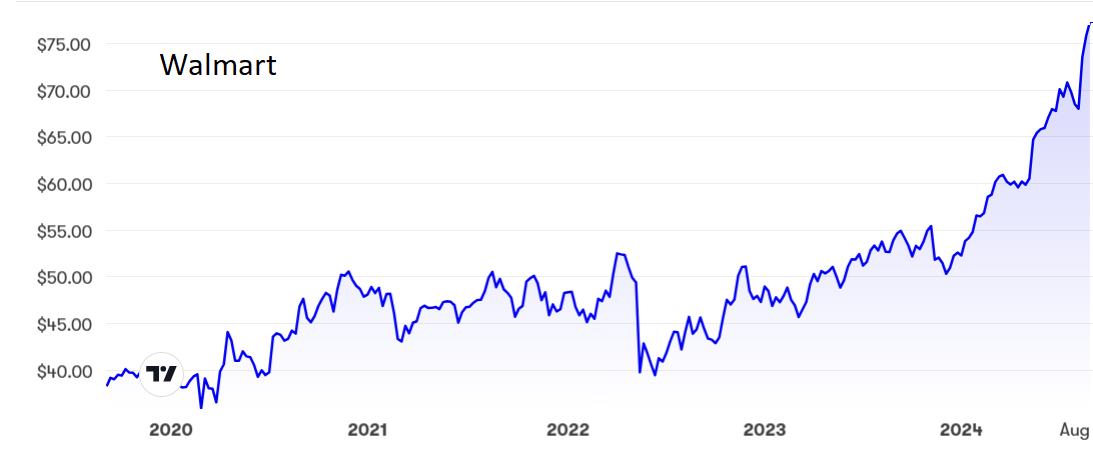

Source: interactive investor. Past performance is not a guide to future performance.

Walmart shares dropped below $40 just over two years ago (adjusted to allow for a share split earlier this year) as the pandemic took its toll, but they have recovered strongly since and have doubled to the current $78, pushing the price/earnings (PE) ratio to an uncomfortably high 40 and the yield down to little more than 1%.

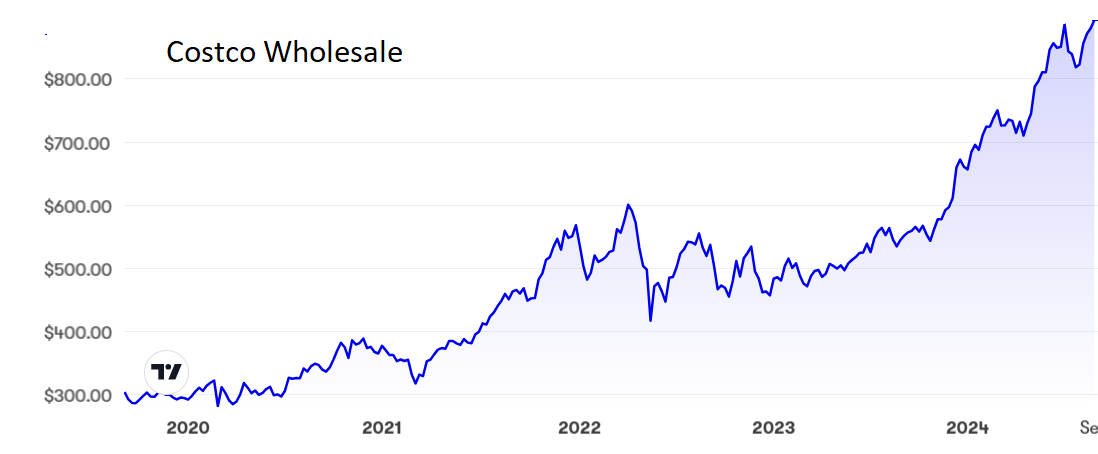

Source: interactive investor. Past performance is not a guide to future performance.

Sales have also been rising at retail chain Costco Wholesale Corp (NASDAQ:COST), but again there is a lot of good news factored into the share price. Costco stock has tripled from below $300 to $880 in just four years to give a whopping PE of 55 while the yield is a miserly 0.5%.

Hobson’s choice: After tipping Walmart shares at $51, I turned prematurely cautious when $60 was breached, little realizing that the upward surge would run towards $80. At least I advised earlier buyers to hold on. I cannot shake off the nagging feeling that the shares have run well ahead of themselves so I cannot bring myself to recommend buying at these elevated levels. My view is to hold, although those who bought below $50 could consider cashing in part of their holdings to lock in some profits.

I first drew attention to Costco in October 2022, when my buy recommendation at $480 worked really well. Again, I turned cautious too soon, downgrading to hold at $680, but as at Walmart I feel the share price has run up too far too soon. Hold, but consider taking some profits to hedge your position.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.