Want to be an ISA millionaire?

A flat-fee investment platform could get you there quicker.

1st February 2021 16:30

by Jemma Jackson from interactive investor

A flat-fee investment platform could get you there quicker.

Most of us would be happy to treat a friend to lunch or subsidise someone who really needs it, at our discretion. But, when it comes to investing, is it reasonable to pay more than someone else for the same service, because you are wealthier?

The odd approach of charging people based on their wealth has been standard practice for years in the investment industry, and many investment platforms, pension providers, wealth managers and financial advisers have been dining out on the proceeds for years – at customers’ expense.

Research from interactive investor, the UK’s second-largest DIY investment platform and number one flat-fee provider, suggests that percentage fee charging structures can significantly compromise your wealth and aspirations compared to flat-fee charging structures.

The research suggests that percentage fees can even erode diligent long-term investors’ chances of hitting ISA millionaire status – even with realistic starting points. The research was conducted by financial consultancy the lang cat comparing the UK’s best-known investment platforms.

Not just the super wealthy

Assuming a starting value of £50,000 in a stocks and shares ISA – which is lower than the UK average stocks and shares ISA value of £61,707*, the research then assumed an annual ISA investment of £10,000 (not insignificant, but a long way short of the £20,000 annual allowance). The research then imagined a portfolio split equally between funds and shares, with an annual return of 5%, with a 0.66% ongoing charge for the funds element of the portfolio. See notes to editors for full methodology.

There’s no question that anyone putting this amount of money away is very fortunate – but they are far from super-wealthy. Yet over time, the differences between the percentage fee and fixed fee charging structure is striking.

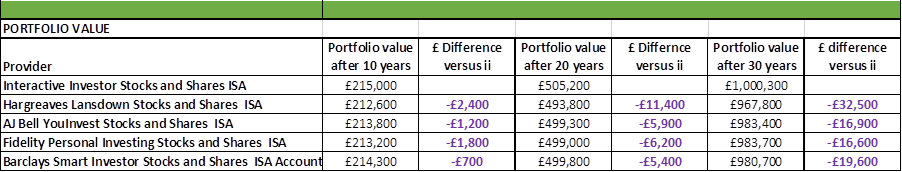

In the first 10 years, the differences might not seem so great to some. But it is still the value of a decent family holiday (if only they were allowed!). Using the scenario above, customers with ii’s largest competitor (which charges a percentage fee), would have investment pots worth £2,400 less than ii customers – even though they had invested the same amount in the same way.

But fast forward to 20 years, and there’s more of a sting: customers with ii’s largest competitor have £11,500 less in their ISA. That’s the value of a small family car.

Over 30 years, the difference is going to hurt. The ii customer, using this scenario, has become an ISA millionaire, with a portfolio value of £1,000,300. The same amount squirrelled away using the same scenario but with ii’s largest competitor, is £32,500 short of the target. That could be the same value for a year travelling the world (just as soon as restrictions are relaxed) or a used camper van, or you could spend it on home improvements such as a garden room, new conservatory and kitchen.

See tables below for the independent comparisons.

Moira O’Neill, Head of Personal Finance, interactive investor, says: “Compound interest was allegedly described by Albert Einstein as the eighth wonder of the world. But when it comes to percentage fees, it is a drag, taking more of your wealth as it grows.

“This research shows that diligent long-term investors can make life-changing returns even from relatively ‘normal’ starting points – and this is encouraging. But it also lifts the lid on a percentage fee pricing gambit that has gone unchecked for too long.

“In fairness, percentage fee platforms enable people who invest relatively modest amounts to pay low fees, while those with large amounts pay much more for exactly the same product and service. But everyone is penalised for building up their savings as, if their investment grows in value, they pay more in charges - losing some of the benefit of that growth in the process.

“There is no question that percentage fees are more competitive for smaller pots – investors just need to regularly review their portfolios to make sure their platform is still the right place for their hard-earned money.”

Portfolio value over time** assuming portfolio split 50/50 equities and funds, with 5% annual return, a 0.66% annual fund charge on the equities proportion of the portfolio and with a £50,000 starting balance and £10,000 annual contributions.

**These are scenarios only. See notes to editors for full methodology

Notes to editors

*Source: HMRC

**The research assumed a starting value of £50,000 in a stocks and shares ISA – which is lower than the UK average ISA value of £61,707*. The research then assumed an annual ISA investment of £10,000. The research imagined a portfolio split equally between funds and shares, with an annual return of 5%, and with a 0.66% ongoing fund charge (OCF) for the fund proportion of the portfolio. The research assumed one buy and one sell trade in each year, with associated dealing charges included. Equal split in funds (Open Ended Investment Companies) and shares.

The investment returns reflect the following charges:

Administration fees

Dealing costs (assuming online transactions only)

Fund manager charges, known as the Ongoing Charges Figure.

All competitor charges were taken from their published fees correct as at 1 January 2021. In the summary tables above, charges and portfolio values have been rounded to the nearest £100 for illustration purposes.

Ongoing Charges Figure (OCF)

The analysis assumes a typical portfolio of active funds, with an average OCF of 0.66%.

This OCF is taken from the investment each year, not from your ISA.

The typical OCF used is the average fee charged by the active funds (not investment trusts) making up the ii Super 60 range, as published in their Key Investor Information Documents in October 2020. Each provider shown may offer a different range of investments.

Investment returns

For all comparisons shown, the Lang Cat assumed:

Future investment growth will be at 5%. This is for illustration only and is not guaranteed. Investment returns can go down as well as up. An inflation rate of 2.00% throughout the period. Inflation is applied to regular contributions and to instances of fixed fees, but not used to adjust final projected values.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.